- Smart Options Trader

- Posts

- A Mega Bullish Call on Stocks for 2026

A Mega Bullish Call on Stocks for 2026

Expect investment capital to flood the stock market over the coming months and year as one indictor screams that equities are inexpensive.

**Not-To-Be-Missed LIVE Show this week!**

Traders Workshop – The Santa Claus Rally Edition

Is the Santa Claus Rally real… or market myth?

And more importantly — will it show up this year?

Join us this Thursday, 12/18 @10am ET for a special holiday-themed Traders Workshop as Lex, Mark, and Jayson host Afshim Moshrefi of TradeWave, the data-driven strategist known for turning decades of market behavior into actionable trading signals.

🕒 Market Overview: The U.S. stock market reflects many of the world’s leading companies. If gold’s parabolic rally translates to asset inflation, the U.S. stock market is inexpensive at the current level and could experience a substantial rally in 2026.

📈 Sector Insight: The S&P 500 at 10,000 is a bold call, but so was gold, trading over $4,000 per ounce at the end of 2024, when it was trading at $2,641 per ounce. Meanwhile, the world’s oldest means of exchange, gold, is signaling that fiat money, including the U.S. dollar, is deteriorating.

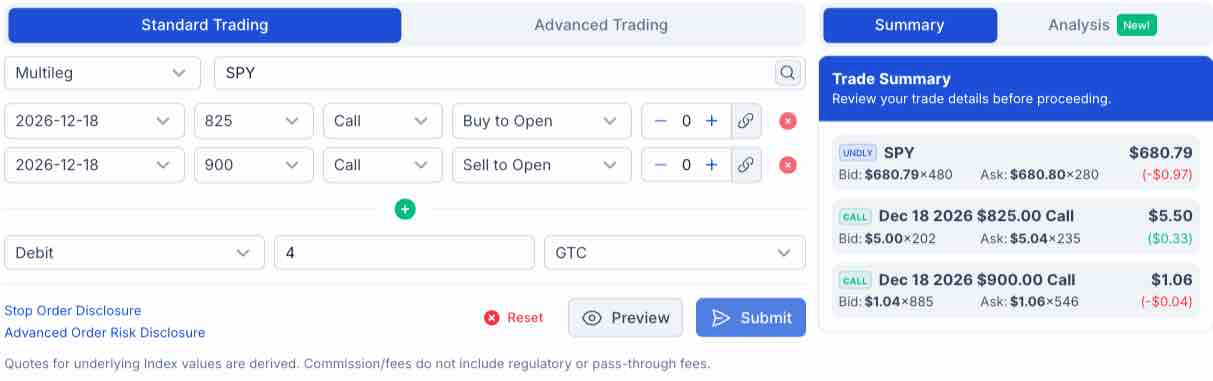

💡 Today's Trade Idea: Bull Call Spread on SPY.

SMART TRADE IDEA 💡

Bull Call Spread on SPY

Trade Setup: Buy $825 Call / Sell $900 Call, December 18, 2026, expiration.

Cost: $4.00 ($400 per spread)

Max Profit: $71.00 ($7,100 per spread)

Breakeven: $829.00

Risk-reward: 1:17.75

Management Plan: Roll up, or take profits if SPY’s price reaches $875.

At $681.40 per share, SPY had over $690.37 billion in assets under management. SPY trades an average of over 81 million shares daily and charges a 0.09% management fee.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Smart AnalysisA Wall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

A Mega Bullish Call on Stocks for 2026- The S&P 500 at 10,000 Next Year

On December 15, the index is around 6,825, which suggests an over 46.5% rally from the current price level in the coming year. The SPY ETF, which tracks the most diversified U.S. stock market index, was near $683 per share.

It is not that I am so bullish on stocks; instead, the value of money, or fiat currency, has declined and will continue to deteriorate over the coming months and years. Moreover, historically high P/E ratios may not matter in the current environment, as a significant indicator is screaming that money’s purchasing power has fallen off a cliff, making the equities in the S&P 500 index downright cheap.

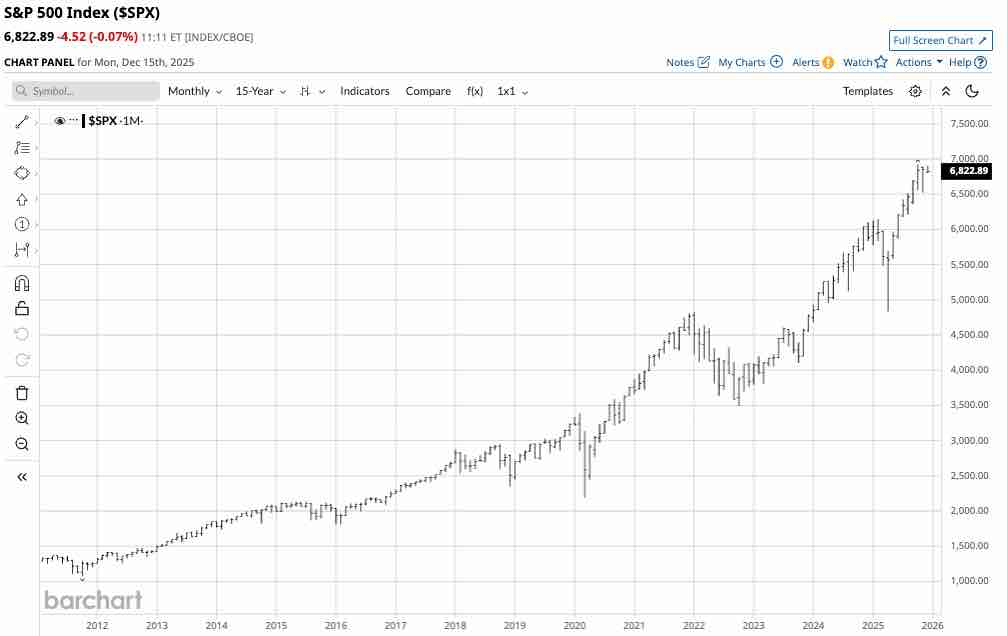

The S&P 500’s trend is higher

Source: Barchart

The S&P 500 has posted double-digit percentage gains in eight of the past ten years. As of December 15, the index was over 16% higher in 2025.

2025 was a unique year- Gold, the world’s oldest currency, reached record highs in a parabolic rally

Source: Barchart

COMEX gold futures have posted gains in eight of the past ten years. As of mid-December, gold was over 64% higher in 2025.

Rising gold signals the decline of fiat money’s purchasing power

Gold is a commodity, but it is also the world’s oldest means of exchange and a store of value. Value is the amount of money that something is worth, an equivalent in goods, services, or money for something exchanged, the relative worth, utility, or importance, something that can be purchased for a fair price, something intrinsically valuable or desirable, and a numerical quantity that is assigned or is determined by calculation or measurement.

Over the past years, central banks have been accumulating gold, making it one of the leading reserve assets. The world’s central banks and governments validate gold’s role in the global financial system, which has grown to regain its historical position as the ultimate currency asset. Gold’s ascent is more than a commentary on fiat currency values, as the precious metal has appreciated versus all of them. Gold’s price suggests that fiat currencies’ purchasing power has declined at an accelerated pace, with fascinating implications for the value of companies in the S&P 500 index.

The S&P 500 is cheap at its record high

Source: Barchart

This ten-year monthly chart highlights reflect the S&P 500 index divided by the price of nearby continuous COMEX gold futures. Interestingly, the SPX in gold terms has fallen by more than 17% from the start of 2016 through December 15, 2025. The average over the past 10 years has been around 2 SPX units for each ounce of gold. The bottom line is that stocks are cheap.

A November 28, 2025, CNBC article quoted a Goldman Sachs survey of 900 institutional investor clients, in which 36% of respondents, a plurality, “expect gold to maintain its momentum and exceed $5,000 per troy ounce by the end of next year.” In this case, a return to the average relationship between the precious metal and the leading U.S. benchmark equity index at 2:1 would put the S&P 500 at 10,000. An over 46% rally in the index would ignite the highly liquid SPY ETF.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.