- Smart Options Trader

- Posts

- AMD's OpenAI Megadeal Sends Shockwaves Through Semiconductor Markets

AMD's OpenAI Megadeal Sends Shockwaves Through Semiconductor Markets

A weekend announcement changed everything for AMD traders. Options markets exploded as OpenAI's massive chip order—with warrant sweeteners—signals a seismic shift in AI infrastructure competition.

A weekend announcement changed everything for AMD traders. Options markets exploded as OpenAI's massive chip order—with warrant sweeteners—signals a seismic shift in AI infrastructure competition.

🕒 Market Overview: AMD surged on a multi-year AI chip supply deal with OpenAI worth tens of billions annually.

🔄 Sector Insight: Options traders pushed implied volatility over 100% as institutional buyers dominated call activity.

💰 Today's Trade Idea: Bull Call Spread on SMH targets continued semiconductor sector momentum through mid-2026.

SMART TRADE IDEA

Bull Call Spread on SMH

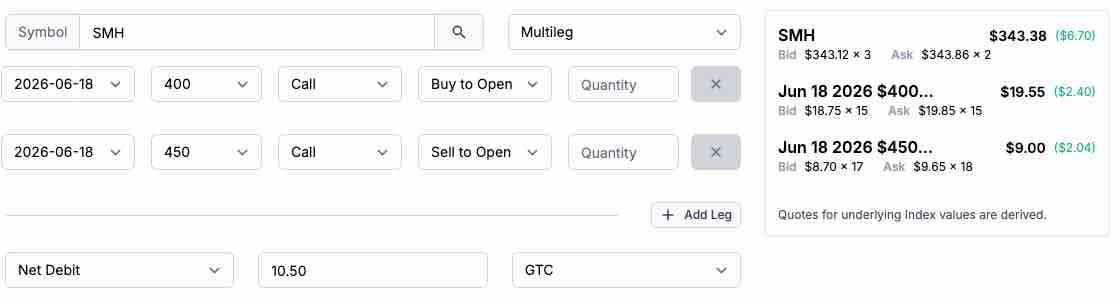

Trade Setup: Buy $400 Call / Sell $450 Call, June 18, 2026, expiration

Cost: $10.50 ($1,050 per spread)

Max Profit: $39.50 ($3,950 per spread)

Breakeven: $410.50 on SMH on June 18, 2026.

Predicting where the next big partnership, acquisition, or deal in semiconductors will originate is pure speculation. However, forecasting more deals on the horizon is a far more prudent approach. The diversified SMH ETF could be the optimal approach to participating in the exciting sector.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

The semiconductor sector continues benefiting from sustained AI infrastructure investment as companies race to secure computing capacity. AMD's partnership with OpenAI represents the latest example of strategic positioning in the AI chip wars, where supply agreements increasingly include equity components that align long-term interests.

The deal structure reveals broader market dynamics: technology leaders are willing to pay premium prices and offer significant equity stakes to secure reliable chip supply chains. This environment creates persistent volatility in semiconductor stocks as each new partnership announcement forces traders to reassess competitive positioning and market share assumptions.

Current trade policy favoring U.S.-based manufacturers adds another layer to semiconductor valuations. AMD's position as the third-largest U.S. semiconductor company places it favorably within this framework, potentially supporting sustained institutional interest.

Sector and Stock Watch: Identifying Key Movers

AMD's Monday session delivered exceptional volatility following weekend news that OpenAI would purchase 6 gigawatts of AI chips over multiple years. The announcement included warrant provisions allowing OpenAI to acquire up to 160 million AMD shares at one penny per share—approximately 10% of the company.

The stock moved over 24% higher from Friday's close of $164.67, approaching its February 2024 high of $227.30. This represented AMD's largest single-day gain since April 2016, adding approximately $60-70 billion in market capitalization.

Options activity reflected the magnitude of the news. The October 10, 2025, 240 call experienced implied volatility expansion from 44.7% to 95.8%, with intraday peaks reaching 109.4%. Total AMD options volume hit 1.9 million contracts—roughly 130% of the stock's average daily volume. Order flow analysis indicated 80.9% buy-side activity, with 80% appearing institutional in size.

Nvidia declined approximately 2% during the same session but avoided collapse, suggesting the market views expanding AI infrastructure demand rather than zero-sum market share transfer.

Trading Strategy in Focus: How to Play the Market

The immediate AMD volatility trade has largely passed, with premiums reflecting the magnitude of Monday's move. However, the broader semiconductor sector thesis remains intact as market participants anticipate additional partnerships and strategic announcements.

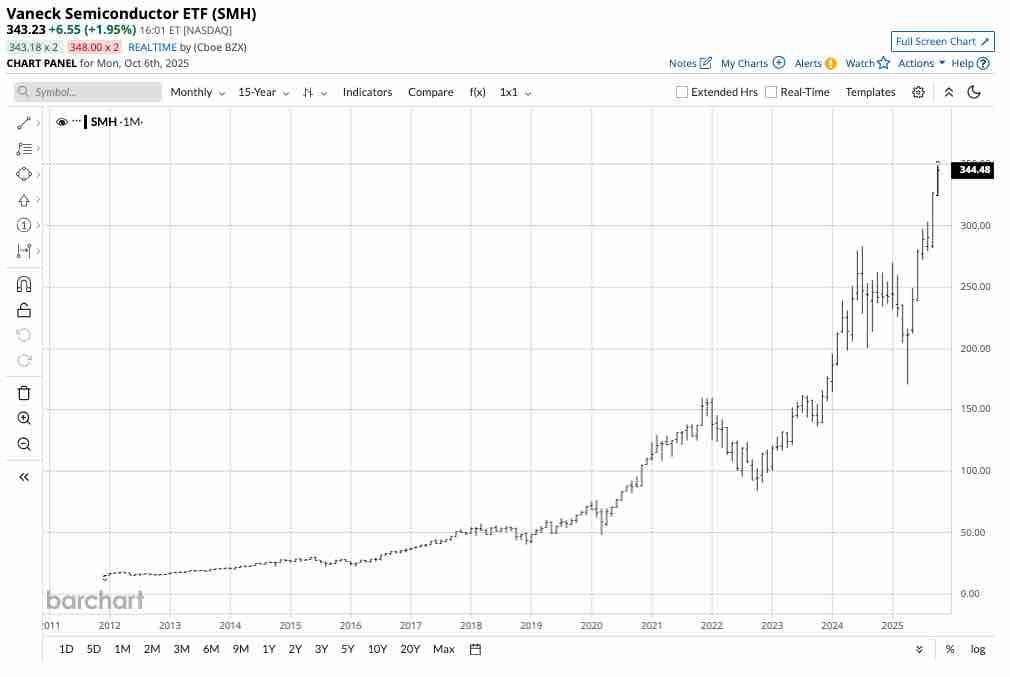

A diversified approach through the VanEck Semiconductor ETF (SMH) provides exposure to sector-wide momentum while reducing single-stock event risk. SMH holds positions across leading semiconductor companies, trading over 8.3 million shares daily with $33.25 billion in assets under management.

The ETF trades at $343.23 and maintains exposure to companies positioned to benefit from ongoing AI infrastructure buildouts. With competition intensifying and companies seeking supply security, additional deals appear likely across the sector.

For traders seeking defined-risk exposure to continued semiconductor strength, vertical spreads allow participation while capping maximum loss. The extended timeframe through mid-2026 accommodates the multi-year nature of AI infrastructure investments and provides room for sector developments to unfold.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

The partnership news sent AMD shares soaring toward a challenge of the February 2024 record high of $227.30, reaching $226.71 on October 6. AMD experienced an explosive rally of over 24% after settling at $164.67 on Friday, October 3. AI investments are fueling the semiconductor sector, which is on fire.

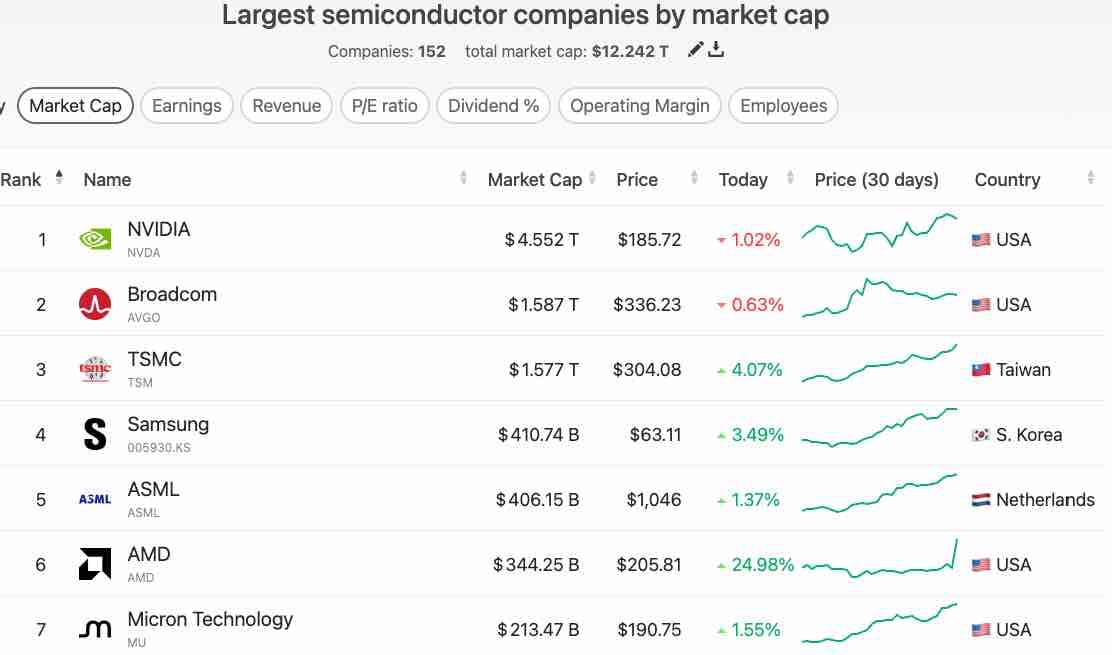

The chart shows that AMD is the sixth-largest semiconductor company, but the third-largest U.S. company in the sector, which is particularly critical in the current environment, given the U.S. "Made in America" trade policy that favors U.S. companies. Market participants are now scouring the sector, trying to determine where and when the next deal will emerge. Competition means the AMD partnership will not be the last. I favor a diversified approach to the sector through the highly liquid VanEck Semiconductor ETF (SMH).

At $343.23 per share, SMH has over $33.25 billion in assets under management. SMH trades an average of over 8.345 million shares daily and charges a 0.35% management fee. SMH owns shares of the leading semiconductor companies.

The chart highlights that SMH is a bullish freight train, and future deals and partnerships could continue to drive the ETF substantially higher.

The June 18, 2026, $400-$450 SMH vertical bull call spread at $10.50 or lower offers an attractive risk-reward ratio of better than 1:3.75.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.