- Smart Options Trader

- Posts

- Goldman's Billion Dollar Beat Triggers Massive Vol Crush Across Markets

Goldman's Billion Dollar Beat Triggers Massive Vol Crush Across Markets

Bank earnings triggered predictable vol crush patterns while rate cut speculation builds toward September FOMC meeting.

Bank earnings triggered predictable vol crush patterns while rate cut speculation builds toward September FOMC meeting.

🕒 Market Overview: Goldman's billion-dollar earnings beat triggers predictable vol crush across financials

🔄 Sector Insight: VIX drops to one-month low as front-month implied volatility collapses post-earnings

💰 Today's Trade Idea: Bull Call Spread on TLT targets Fed rate uncertainty ahead of September meeting

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

Markets continue processing mixed signals from Washington as President Trump's Fed criticism intensifies pressure for rate cuts. The administration's public stance on Chairman Powell creates policy uncertainty while tariff implementation remains fluid. June inflation data shows contained price pressures with PPI flat month-over-month, supporting the case for potential September rate cuts. Fed officials remain split between two or three cuts this year, with some advocating for aggressive 50-basis-point moves if labor data weaken. The VIX term structure maintains modest elevation compared to spot levels, indicating unresolved uncertainty despite current calm.

Sector and Stock Watch – Identifying Key Movers

Financial sector earnings created textbook post-earnings volatility dynamics. Goldman Sachs obliterated expectations with record equities-trading revenue, while Bank of America posted solid gains despite net-interest income disappointment. The market had priced these stocks for ±4% post-earnings moves, but actual moves landed at modest 2-3% gains. This disconnect triggered rapid implied volatility compression, with Goldman's front-month IV collapsing from 28% to 22% within hours. Bank of America's at-the-money straddles lost one-third of their value in the first trading hour, demonstrating how crowded consensus trades create premium-selling opportunities.

Trading Strategy in Focus – How to Play the Market

The current environment favors volatility sellers over buyers, particularly in post-earnings scenarios. Retail traders concentrating flow in zero-DTE contracts are creating predictable vol crush patterns that sophisticated traders can exploit. However, longer-dated volatility remains elevated due to Fed policy uncertainty and tariff risks. The TLT ETF presents a compelling setup as bond futures trade near critical support levels while rate cut expectations build toward September. With the 10-year trading range intact and administration pressure mounting, Treasury bonds could experience significant moves as Fed policy shifts.

SMART TRADE IDEA

Bull Call Spread on TLT

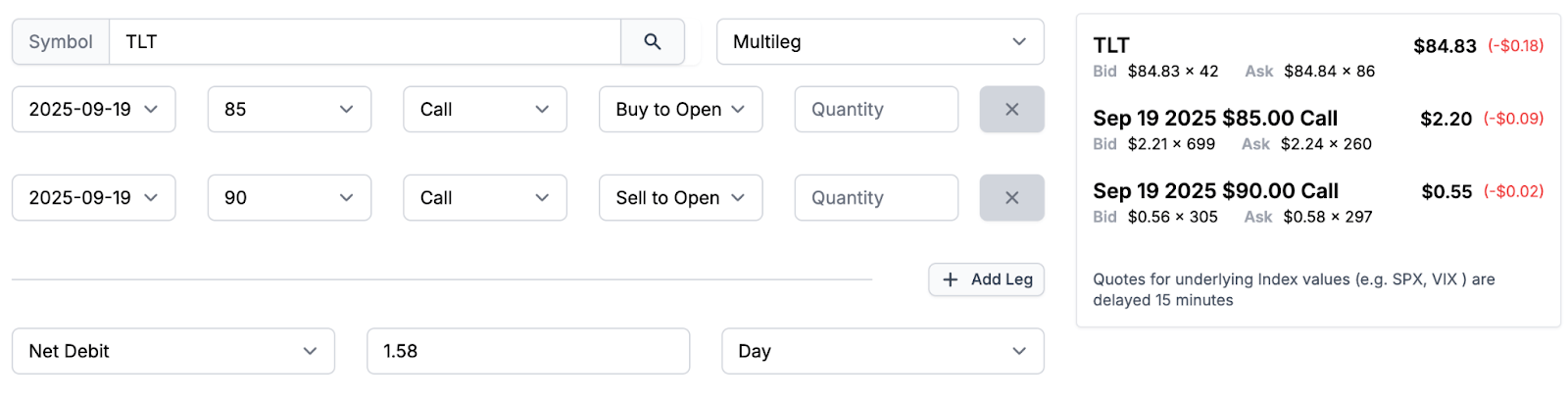

Trade Setup: Buy $85 Call / Sell $90 Call, September 19, 2025 expiration.

Cost: $1.58 ($158 per spread)

Max Profit: $3.42 ($342 per spread) at over $90 per share

Breakeven: $86.58

Management Plan:

Exit at 50% loss, roll up, or take profits if TLT's price reaches $90

While the Fed and the administration are at odds under President Trump, inflation has not spiked, and the jury is still out regarding the ultimate impact of the tariffs. TLT and the long bond futures are near the bottom end of their trading ranges, and the potential for a bounce is high, given the market's propensity for volatility and knee-jerk reactions to daily events. The call spread with a better than 1:2 risk-reward ratio could be a high-odds risk position for those looking for rates to move lower as the spread expires after the September FOMC meeting.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

The latest sign of the market's fickle nature was the rumor that President Trump was prepared to fire Fed Chairman Jerome Powell. The dollar index and bonds fell, stocks backed off, and other markets reacted to the "rumor" until the President said, in a televised moment that while he has some support for firing Chairman Powell because he is consistently "too late," he will not likely take that path, unless there is reason, such as fraud, for the overruning costs of the Federal Reserve's headquarters. Markets quickly stabilized.

There is no question that the pressure from 1600 Pennsylvania Avenue for lower interest rates is rising, as the administration believes the Fed is responsible for wasting billions in debt servicing for funding the $37 trillion deficit. However, the bottom line is that markets across all asset classes will continue to experience elevated volatility due to the President's style, which allows markets insight into his thinking, uses the press to float potential actions, and makes public statements to influence negotiations. Thinner liquidity during the summer vacation period only exacerbates the market's reaction and price volatility.

The move toward very short-term option trading reflects the market's uncertainty and the U.S. administration's impact on financial assets. Meanwhile, since taking office in January, President Trump has passed his economic package, and oil prices have declined. Although still elevated, inflation appears to be under control. The June CPI was slightly higher, but in line with expectations, and the June PPI remained unchanged. Tariff impacts may not have filtered through to the inflation data yet, but the tariff levels remain in flux as negotiations could alter the trade barriers at any moment.

The long bond futures have been trading in a range in 2024 and 2025, and while the bonds have a bearish bias, they have held above the critical support level. The inflation data and President Trump's pressure on the central bank may increase the odds of a 25 basis point rate cut, or even a surprise 50 basis point reduction by the September 17, 2025, FOMC meeting.

The TLT ETF tracks longer-term U.S. government interest rates. While the Fed controls short-term rates, the market determines rates further on the yield curve. While the $37 trillion debt level will climb, inflation is under control.

The chart shows that critical technical support for TLT is at the October 2023 low of $82.42, with technical resistance at the September 2024 high of $101.64 per share. At the $84.82 level, the trend has a bearish bias. Still, the administration's desire for lower rates and the inflation data could mean short-term rates will move lower by the September FOMC meeting. Longer-term rates may decline and move from the bottom to the top end of the trading range that has been in place since the October 2023 low.

A vertical bullish call spread on the TLT ETF for September 19, 2025, expiration would benefit from lower interest rates over the coming weeks. The $85-$90 TLT bull call spread is trading around the $1.58 per spread level, providing a better-than-1:2 risk-reward ratio if TLT moves to $90 per share or higher by September 19, 2025.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.

LATEST MARKET BREAKDOWN

Watch on Youtube

That's it for today!Before you go we'd love to know what you thought of today's newsletter to help us improve the experience for you. |