- Smart Options Trader

- Posts

- Bitcoin and Ethereum on the Correction

Bitcoin and Ethereum on the Correction

Bitcoin’s value has exploded from 5 cents in 2010 to its October 2025 high of $126,184.05.

🕒 Market Overview: If the current bust turns into a boom, COIN shares could explode. Moreover, COIN is moving into prediction markets, which could increase earnings.

📈 Sector Insight: COIN began trading in April 2021, and the shares have been as volatile and correlated with Bitcoin and Ethereum prices, trading from a January 2023 low of $31.55 to a July 2025 high of $444.64 per share. At around $226 in late December 2025, COIN shares were near the midpoint of the trading range.

💡 Today's Trade Idea: Bull Call Spread on COIN.

SMART TRADE IDEA 💡

Bull Call Spread on COIN

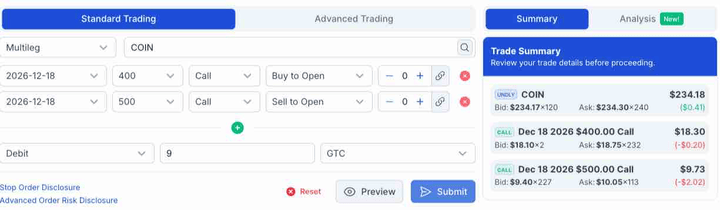

Trade Setup: Buy $400 Call / Sell $500 Call, December 18, 2026, expiration.

Cost: $9.00 ($900 per spread)

Max Profit: $91.00 ($9,100 per spread)

Breakeven: $409.00 on COIN on December 18. 2026.

Risk-reward: 1:10

Management Plan: Exit at 50% loss, roll up, or take profits if the price of COIN reaches $440 per share.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Smart AnalysisA Wall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

Bitcoin and Ethereum on the Correction

Bitcoin reached a new record high of $126,184.05 in October 2025, where the leading cryptocurrency ran out of upside steam. After falling 36% to a low of $80,742.05 in November, the price stabilized above $87,000 per token.

Ethereum reached a new record high of $4,953.929 in August 2025, only to turn lower. After falling 46.9% to a low of $2,629.903 in November, the price stabilized above $2,900 per token in late December.

Explosive and implosive price action is nothing new for the leading cryptocurrencies. As the asset class enters 2026, the odds remain in favor of new highs, with the current correction establishing bottoms.

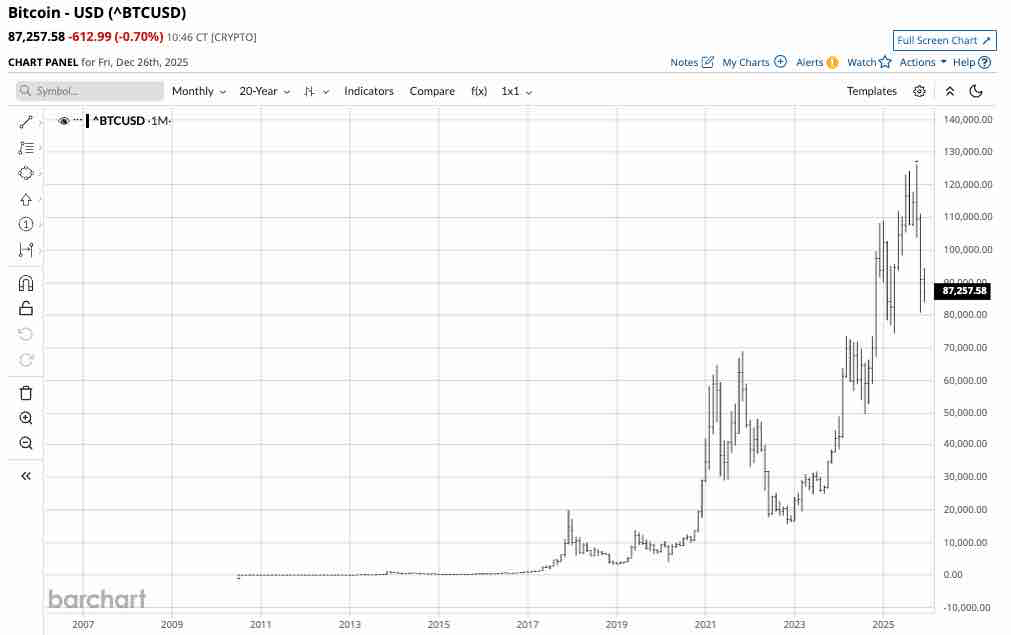

Bitcoin has a history of extreme volatility

Source: Barchart

Bitcoin’s value has exploded from 5 cents in 2010 to its October 2025 high of $126,184.05. Bitcoin has a decade-and-a-half history of explosive and implosive price behavior. Bitcoin has corrected from the October high to below $88,000 per token.

Ethereum can be more volatile than Bitcoin

Source: Barchart

Ethereum’s value has exploded from $6.07 in 2016 to the most recent August 2025 high of $4,953.919. Ethereum has a decade-long history of explosive and implosive price behavior. Ethereum has corrected from the August high to below $3,000 per token.

The factors that support higher prices in 2026

The debate over cryptocurrencies’ future continues, but acceptance has increased.

Many of the leading financial institutions now allow their customers allocations to cryptocurrencies as part of their overall investment and savings portfolios.

The United States, under the Trump administration, has removed many cryptocurrency restrictions.

Today, major banks, including BNY Mellon, JPMorgan Chase, and Standard Chartered, offer digital asset custody services for institutional investors.

Investment banks, including Goldman Sachs and Morgan Stanley, provide clients with access to crypto trading services and investment funds, including Bitcoin and Ether ETFs.

The bottom line is that regulatory changes for banks and other financial institutions increase the addressable market for the cryptocurrency asset class.

The issues that could send prices substantially lower

Detractors believe that cryptocurrencies have no intrinsic value and can be used for nefarious purposes.

Governments survive and thrive on the power of the purse, or controlling the money supply.

Cryptocurrencies could threaten government influence, increasing the risk of bans or regulations that reduce their value or availability.

A trade recommendation in a pick-and-shovel asset that moves higher and lower with Bitcoin and Ethereum prices

Coinbase is a leading cryptocurrency exchange that provides storage and brokerage services for a host of leading cryptocurrencies, including Bitcoin and Ethereum. At just over $236 per share, COIN had a market capitalization of over $64.64 billion. COIN is a liquid stock with an average daily volume of over 7.8 million shares. COIN is also moving into prediction markets, which could turbocharge its revenues.

Source: Barchart

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.