- Smart Options Trader

- Posts

- CDNS Soars to All Time Highs as AI Demand Proves Real

CDNS Soars to All Time Highs as AI Demand Proves Real

Cadence Design Systems shattered expectations and hit all-time highs, but technical patterns suggest a potential pullback ahead.

Cadence Design Systems shattered expectations and hit all-time highs, but technical patterns suggest a potential pullback ahead.

🕒 Market Overview: CDNS surged 10% to record highs after beating Q2 expectations by wide margins.

🔄 Sector Insight: AI chip design demand proves structural as export restrictions lifted, boosting EDA sector confidence.

💰 Today's Trade Idea: Bear Put Spread on CDNS targeting gap-fill correction opportunity.

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

The artificial intelligence infrastructure story continues to evolve beyond speculative hype into measurable demand. Export restrictions that previously constrained Electronic Design Automation companies have been partially lifted as part of broader U.S.-China trade negotiations, creating a catalyst for companies like Cadence Design Systems.

The AI chip design market trajectory from $3.46 billion in 2025 to $11.4 billion by 2029 represents a 34.7% compound annual growth rate, driving unprecedented demand for sophisticated design tools. This structural shift occurs against a backdrop of regulatory complexity, with companies navigating compliance requirements while capitalizing on renewed market access.

Trade tensions remain fluid, with August tariff deadlines potentially imposing rates as high as 50% on imports, creating both opportunities and risks for technology companies with global exposure.

Sector and Stock Watch – Identifying Key Movers

Cadence Design Systems delivered a masterclass in beating expectations under pressure. The company reported adjusted earnings of $1.65 per share against $1.56 consensus, while revenue jumped 20.2% to $1.28 billion. More significantly, management raised full-year guidance despite operating under temporary export restrictions that cost weeks of China sales.

Options activity exploded with the August 15th $360 call becoming the highest volume contract at 1,941 contracts. The call-to-put ratio of approximately 5:2 revealed overwhelming bullish sentiment extending beyond retail enthusiasm into institutional positioning.

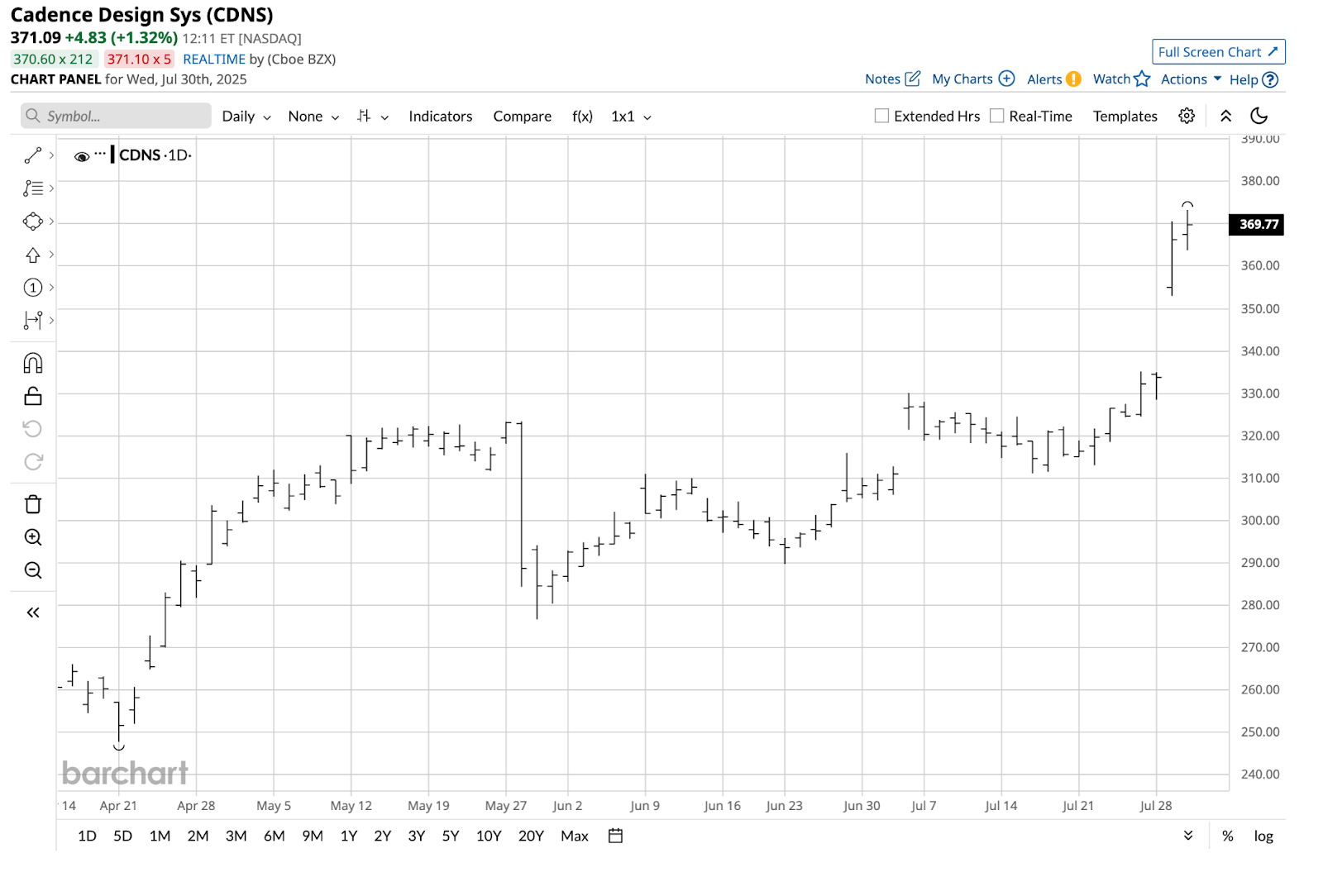

The technical picture shows CDNS gapping from $335 to open at $355, reaching $373.27 - a pattern that historically precedes either continuation or corrective moves.

Trading Strategy in Focus – How to Play the Market

Gap-fill strategies capitalize on the market tendency for explosive moves to retrace toward previous resistance levels. CDNS shares gapped significantly higher on earnings, creating a technical void between current levels and the $330-340 support zone.

The current price-to-earnings ratio has expanded to substantially above twice the QQQ ETF level, raising valuation concerns even amid strong fundamental performance. Bear put spreads allow traders to position for corrective moves while maintaining defined risk parameters.

This contrarian approach acknowledges the strong underlying AI demand story while recognizing that aggressive bull markets rarely move in straight lines without corrections.

SMART TRADE IDEA

Bear Put Spread on CDNS

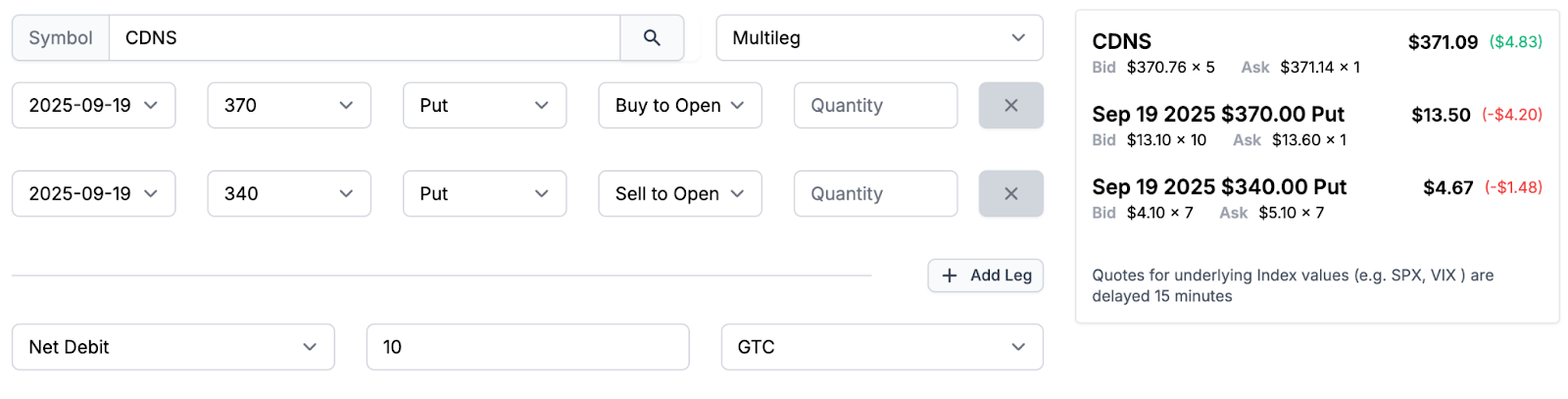

Trade Setup: Buy $370 Put / Sell $340 Put, September 19, 2025, expiration.

Cost: $10 ($1,000 per spread)

Max Profit: $20 ($2,000 per spread)

Breakeven: $360 on CDNS shares on September 19, 2025.

Management Plan: Exit at 50 percent loss, roll down, or take profits if CDNS shares reach $350.

The $370-$340 bear put spread is a contrarian trade that will profit if the stock moves to fill the gap on the daily chart. Even the most aggressive bull markets suffer corrections. The gap, profit-taking, and CDNS's current P/E ratio suggest that the 1:2 risk-reward ratio creates an opportunity.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

Cadence Design Systems (CDNS) shares soared after the better-than-expected Q2 earnings report that delivered stellar EPS and revenue results. The shares gapped higher on July 28.

As the daily chart shows, CDNS shares gapped higher from a high of $335.00 on July 28 to open at $355.00 on July 29, rising to a high of $373.27 per share on July 30.

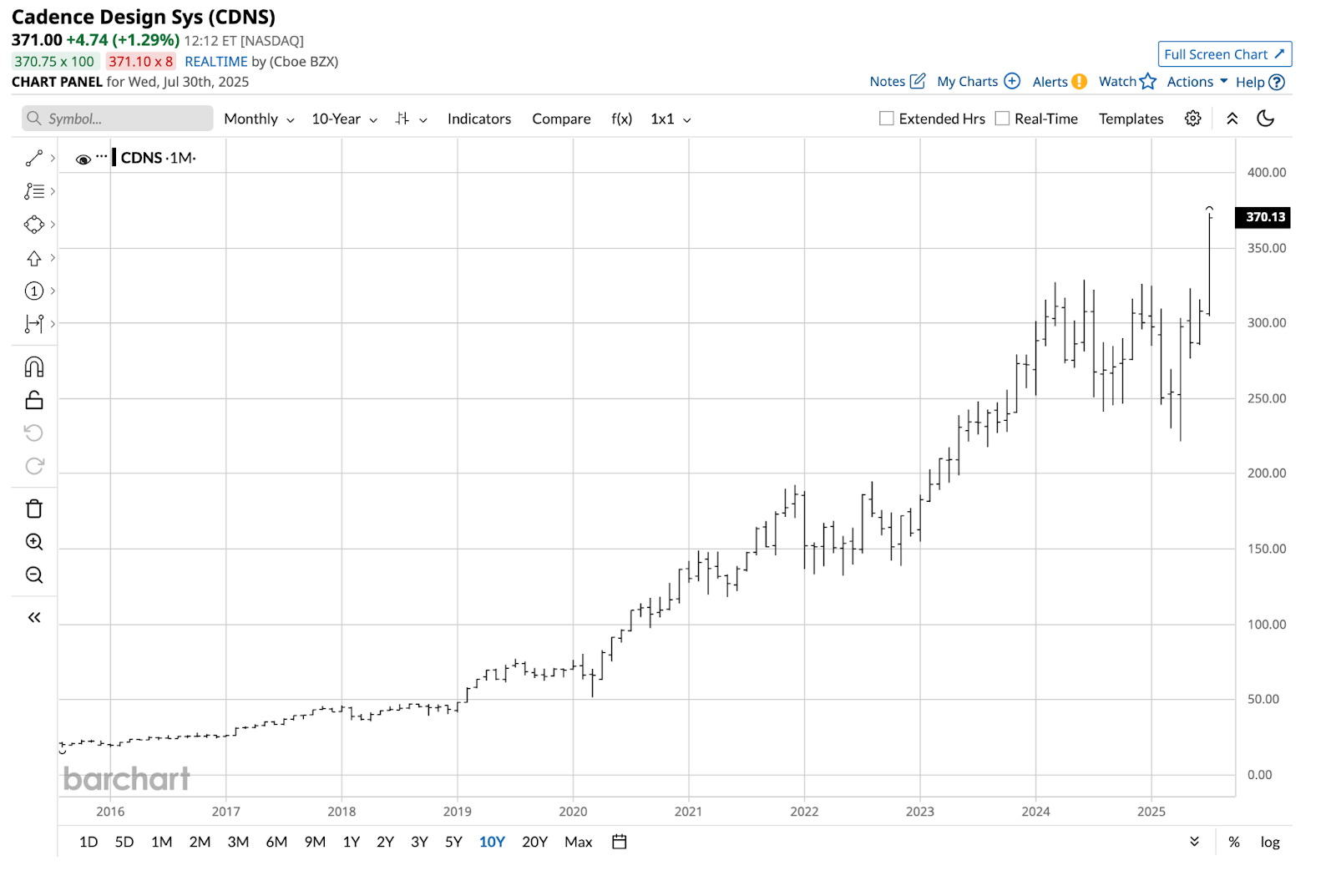

The long-term monthly chart shows that CDNS shares rose above the previous record June 2024 high of $328.99, which has become technical support. While the Q2 earnings ignited a bullish fuse, and analysts have raised their targets to around the $400 per share level, even the most aggressive bull markets rarely move in straight lines. Profit-taking selling often causes corrections that fill the gaps on short-term charts. Meanwhile, there is no doubt that AI and companies like CDNS will continue to outperform many other companies; the current price-to-earnings ratio has risen to substantially over twice the level of the QQQ ETF, which tracks the technology-heavy NASDAQ, raising some red valuation warning flags.

A CDNS $370-$340 vertical bear put spread at the $10 level for September 19, 2025, expiration will benefit from a correction that takes the shares back to above its critical technical support level at around $330 per share. The put spread that should profit from filling the chart gap has a 1:2 risk-reward ratio.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.

LATEST MARKET BREAKDOWN

Watch on Youtube

That's it for today!Before you go we'd love to know what you thought of today's newsletter to help us improve the experience for you. |