- Smart Options Trader

- Posts

- Central Bank Unity Crumbles While Precious Metals Surge Higher

Central Bank Unity Crumbles While Precious Metals Surge Higher

Fed unity crumbles as Waller demands immediate cuts. Silver breaks out while traders scramble to position for currency chaos.

Fed unity crumbles as Waller demands immediate cuts. Silver breaks out while traders scramble to position for currency chaos.

🕒 Market Overview: Fed Governor Waller's surprise rate cut demand shattered central bank unity

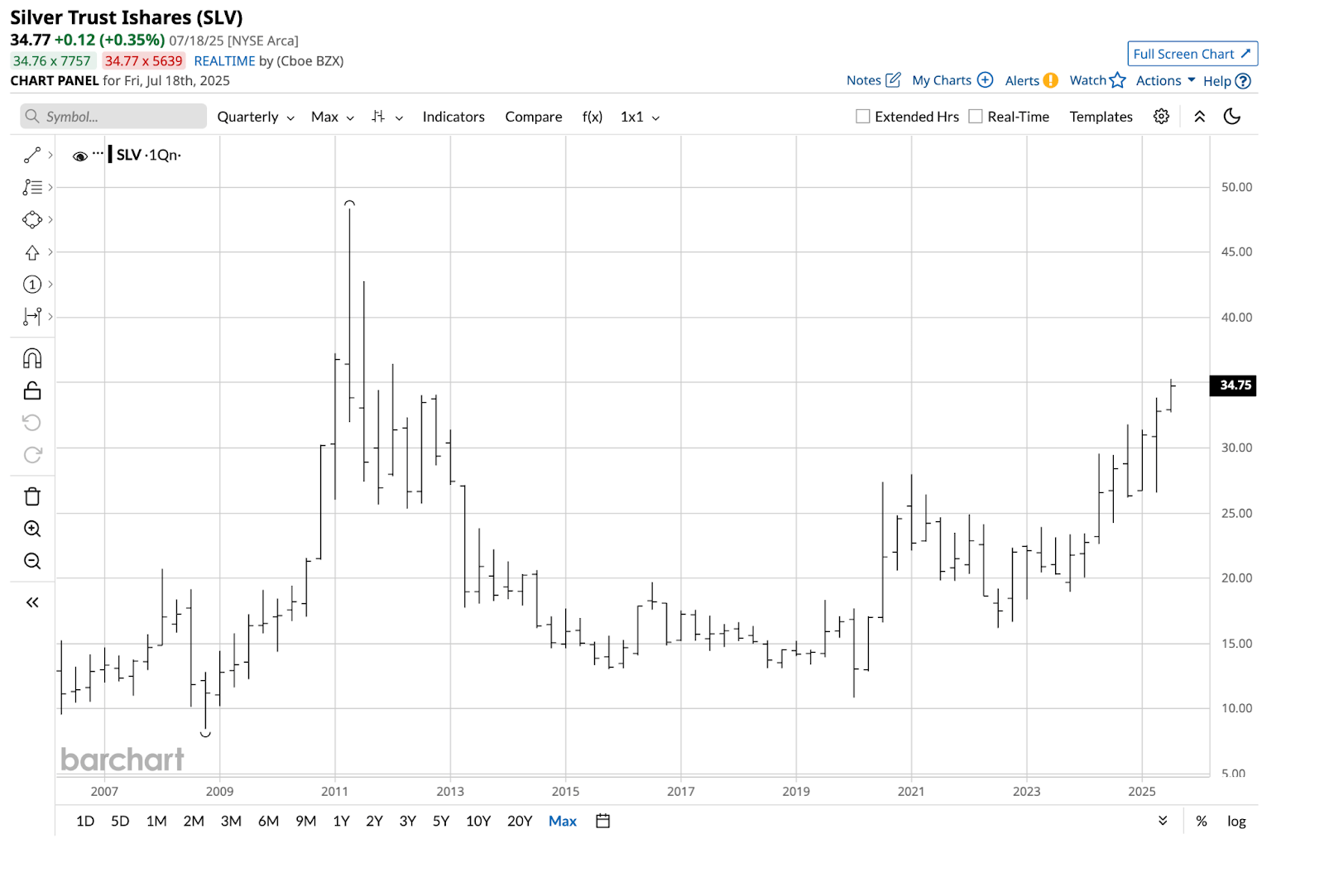

🔄 Sector Insight: Silver ETF hits highest level since 2011 amid dollar weakness expectations

💰 Today's Trade Idea: Bull Call Spread on SLV targets precious metals breakout momentum

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

Fed Governor Christopher Waller demolished the central bank's carefully orchestrated messaging Thursday afternoon, demanding immediate rate cuts despite colleagues favoring a wait-and-see approach. This public fracture represents the most significant split in Fed communication since the early 2000s, creating uncertainty that extends far beyond interest rate policy.

Money-market futures jumped from pricing a 3% chance of July cuts to 60% odds for September action. The VIX compressed from 17.16 to 16.52 overnight as traders initially embraced the dovish pivot. However, 2-year Treasury yields fell six basis points, signaling deeper structural shifts in monetary policy expectations.

The backdrop intensifies with June PCE data arriving July 26, followed by the July 30 FOMC meeting. Any core PCE reading above 0.3% could reverse the entire dovish narrative, creating whipsaw conditions across asset classes. Historical precedent suggests Fed factional splits persist, adding event risk to every future policy meeting.

Sector and Stock Watch – Identifying Key Movers

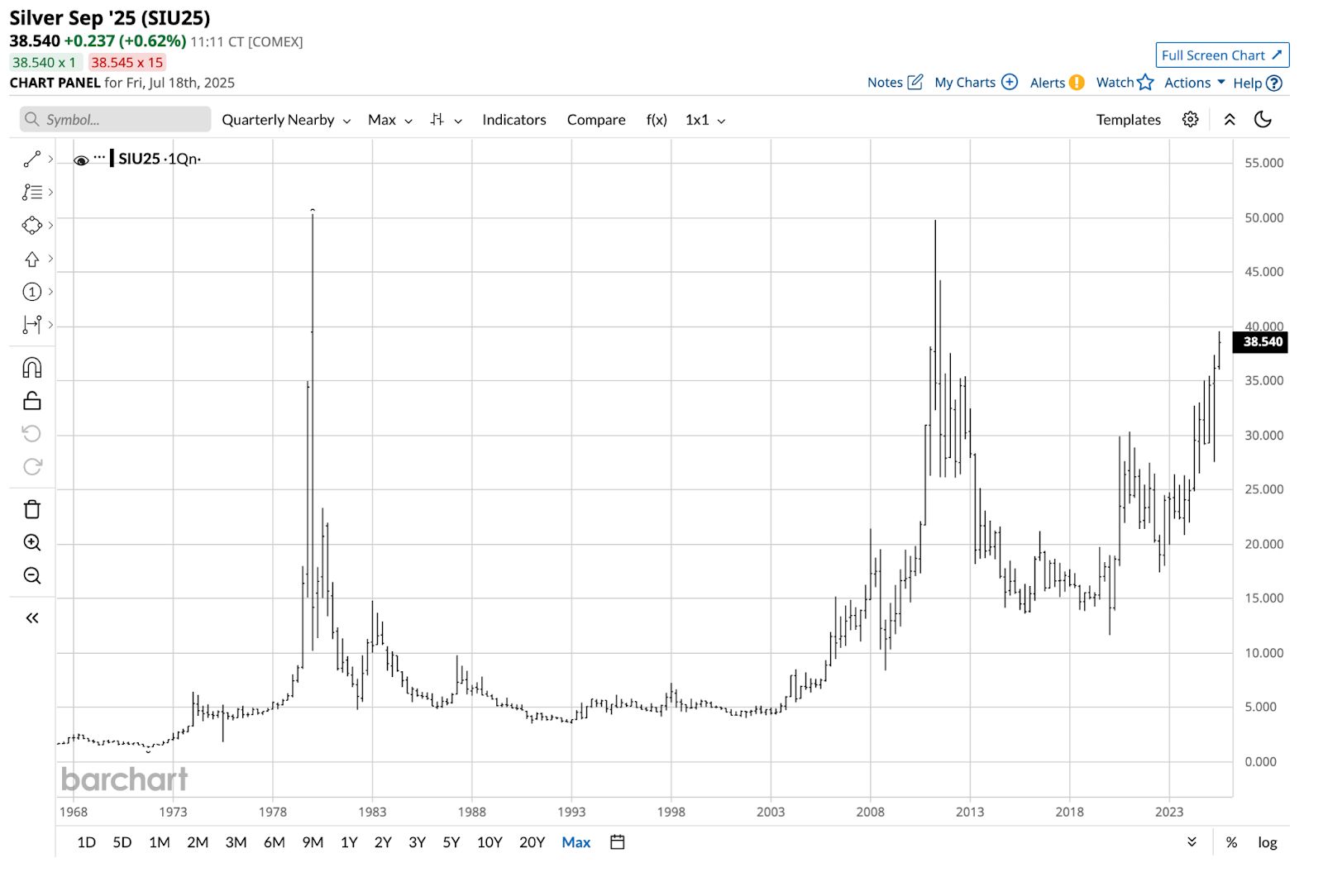

Silver markets exploded higher following Waller's comments, with the iShares Silver Trust ETF (SLV) breaking through key resistance levels to reach multi-year highs. The precious metal formed a bullish key reversal pattern in Q2 2025, falling below Q1 lows before closing above Q1 highs.

This breakout carries significant technical weight. Silver remains substantially below its 2011 and 1980 peak levels, suggesting considerable upside potential if the dollar weakening thesis plays out. The quarterly chart structure indicates early-stage momentum that could extend through multiple quarters.

Currency dynamics drive this move. Lower Fed funds rates historically pressure dollar strength, creating tailwinds for dollar-denominated commodities. With gold already achieving record highs across seven consecutive quarters, silver's relative underperformance suggests catch-up potential.

Trading Strategy in Focus – How to Play the Market

Vertical call spreads capture directional moves while managing risk in volatile environments. The SLV setup benefits from multiple catalysts: Fed policy shifts, dollar weakness, and technical breakout momentum. January 2026 expiration provides sufficient time for the precious metals thesis to develop.

Risk management remains paramount given Fed communication uncertainty. The 50% loss exit rule protects against thesis invalidation, while the roll-up provision allows participation in extended moves. Current implied volatility levels support premium collection strategies that benefit from time decay.

SMART TRADE IDEA

Bull Vertical Call Spread on SLV

Trade Setup: Buy $35 Call / Sell $45 Call, January 16, 2026 expiration.

Cost: Cost: $2.00 ($200 per spread)

Max Profit: $8.00 ($800 per spread)

Breakeven: $37.00 per share on SLV

Management Plan:

Exit at 50% loss, roll up, or take profits if the SLV share price reaches $45.

It may not be a question of if, but when, short-term U.S. rates begin to fall, and how quickly they will come down. Lower rates could weigh on the U.S. dollar, which supports higher silver prices. Silver has already broken out to the upside, but it also has plenty of room to rally before challenging its 2011 and 1980 highs. The $35-$45 SLV call spread, expiring on January 16, 2026, offers a 1:4 risk-reward ratio.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

Short-term interest rates will fall; it is just a question of when they will begin to decline and how low they will go. If President Trump's comments provide a clue, the Fed Fund rate could quickly drop from 4.375% to 2.375% when the guard changes at the Fed. The Fed controls the short-term Fed Funds Rate, which is the central bank's primary monetary policy tool to aid in its mandate of full employment and stable prices. While short-term rate changes do not guarantee long-term rate changes, a significant decline in the Fed Funds Rate could filter through to the long-term U.S. government bond market, which has concentrated on the 2025 Moody's downgrade and debt of over $37 trillion and rising.

Christopher Waller is a voting member of the FOMC and a candidate to replace Chairman Powell when his term expires in May 2026. Governor Waller argued that the Fed Funds Rate should be at the 3% level and stated that it should move lower at the July meeting, adding he would likely dissent if his colleagues leave rates unchanged.

The bottom line is that rates are going to decline, which is bullish for bonds and commodities and bearish for the U.S. dollar's value if historical relationships hold. Rising bonds that cause lower interest rates and a falling dollar could ignite another upside leg in the precious metals sector, which is already in a bullish trend. Gold is already near a record high, having reached a new all-time high in seven consecutive quarters. Silver prices have broken out to the upside and are trading at the highest level since 2011. However, silver remains well below its 2011 and 1980 highs.

The quarterly chart indicates that silver formed a bullish key reversal pattern in Q2 2025, as the price fell to a level lower than the Q1 2025 low and closed above the Q1 2025 high. Silver is already higher in early Q3, and has lots of room to rally.

The iShares Silver Trust ETF (SLV) tracks silver prices as the ETF owns physical allocated and unallocated silver. Lower interest rates and a declining U.S. dollar tend to support higher precious metals prices, and silver is no exception. A bullish vertical call spread for early 2026 expiration is attractive in the current environment.

The SLV ETF is trading around the $34.75 per share level on July 18.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.

LATEST MARKET BREAKDOWN

Watch on Youtube

That's it for today!Before you go we'd love to know what you thought of today's newsletter to help us improve the experience for you. |