- Smart Options Trader

- Posts

- China Weaponizes Rare Earths as Trump Xi Summit Approaches

China Weaponizes Rare Earths as Trump Xi Summit Approaches

Beijing's export controls spark chaos across mining, automotive, and defense sectors. Chinese equities may benefit from trade deal – here's the setup.

Beijing's export controls spark chaos across mining, automotive, and defense sectors. Chinese equities may benefit from trade deal – here's the setup.

🕒 Market Overview: China expands rare earth export restrictions, triggering volatility across manufacturing-dependent sectors.

🔄 Sector Insight: U.S. rare earth stocks surge while automotive and defense contractors face supply chain disruptions.

💰 Today's Trade Idea: Bull Call Spread on FXI capitalizes on potential U.S.-China trade agreement ahead of APEC summit.

SMART TRADE IDEA

Bull Call Spread on FXI

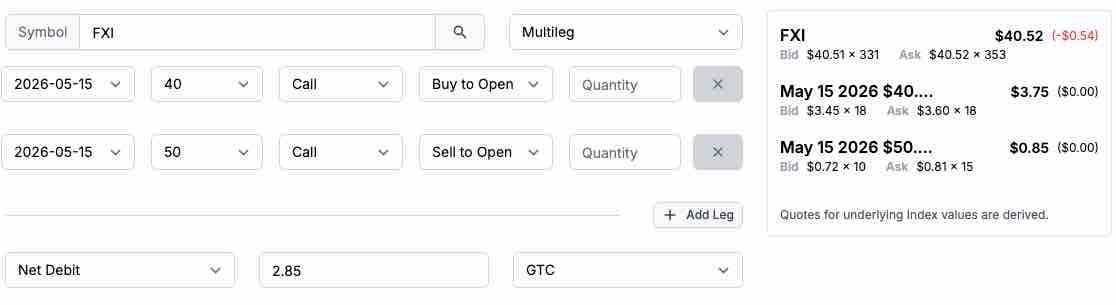

Trade Setup: Buy $40 Call / Sell $50 Call, May 15, 2026 expiration

Cost: $2.85 ($285 per spread)

Max Profit: $7.15 ($715 per spread)

Breakeven: $42.85 on FXI on May 15, 2026.

Management Plan: Exit at 50% loss, roll up, or take profits if FXI’s price reaches $53 per share.

A trade deal between China and the U.S. and better relations could cause a herd of buyers for Chinese equities and the FXI ETF, given the value compared to U.S. stocks.

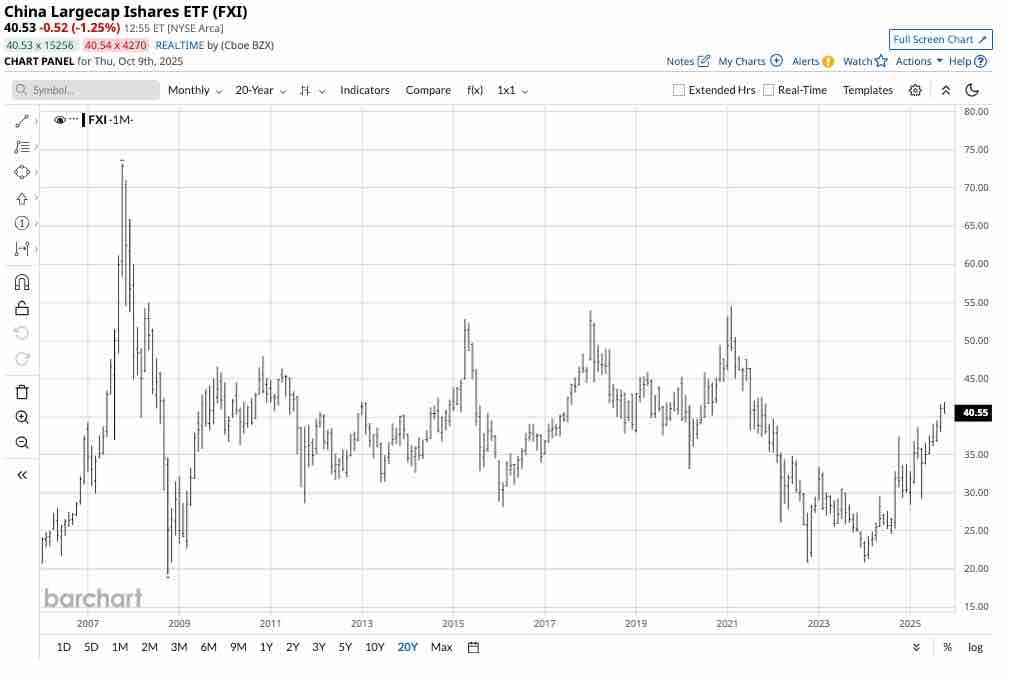

The May 15, 2026 $40-$50 vertical bull call spread on FXI has an attractive risk-reward ratio, and the top strike price remains below the critical technical resistance level, which is the upside target during the current bullish trend.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

China implemented sweeping rare earth export controls requiring licensing for materials containing even trace amounts of Chinese rare earth technology. The Ministry of Commerce's October announcement goes beyond raw material restrictions, extending to processing technologies and intellectual property. These measures take full effect December 1st, coinciding with the scheduled Trump-Xi meeting at the APEC summit in South Korea.

Beijing controls the global rare earth supply chain with overwhelming dominance: processing capacity, magnet manufacturing concentration, and mining operations. This positioning transforms rare earths from a trade issue into a geopolitical leverage tool. The timing suggests strategic positioning ahead of bilateral negotiations, echoing China's territorial dispute tactics from years past.

Gold breaking through recent highs while rare earth stocks rally simultaneously signals investor concerns about supply chain stability and deglobalization trends. The dual movement across precious metals and critical materials indicates a broader shift in how markets price geopolitical risk.

Sector and Stock Watch – Identifying Key Movers

U.S.-listed rare earth producers experienced sharp gains following China's announcement. MP Materials advanced, USA Rare Earth climbed higher, Ramaco Resources gained double digits, and Critical Metals posted the strongest movement. Chinese rare earth companies also rallied as domestic producers benefited from tighter export policies.

Options activity reveals heightened trader positioning. USA Rare Earth processed significant contract volume with heavy call concentration. Implied volatility levels across the sector remain elevated, with USA Rare Earth showing triple-digit IV percentages and MP Materials running near annual highs. These readings indicate traders expect continued price swings and supply chain uncertainty.

The automotive and defense sectors face material constraints. Ford previously closed production facilities due to rare earth shortages. Electric vehicle manufacturers depend on permanent magnet motors requiring specific rare earth elements. Defense contractors now confront explicit license denials for military applications, affecting precision systems and advanced aircraft production.

Trading Strategy in Focus – How to Play the Market

The rare earth situation creates trading opportunities across multiple timeframes. Short-term volatility plays capture immediate price movements as earnings reports quantify supply chain impacts. Medium-term positioning targets merger activity as companies acquire alternative suppliers at premium valuations. Long-term infrastructure investments focus on domestic processing capacity and recycling operations.

Chinese equities present a contrarian angle. The iShares China Large Cap ETF trades at significantly lower valuation multiples compared to U.S. equity benchmarks. A successful trade agreement between the U.S. and China could trigger repricing of Chinese assets as tensions ease and market access stabilizes.

Technical analysis on FXI shows trend reversal from early lows, with prices approaching double from trough levels. The next resistance target sits at previous peak levels, suggesting room for continued appreciation if fundamental catalysts materialize. The valuation discount combined with technical momentum creates conditions for tactical positioning ahead of bilateral negotiations.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

China’s move on rare earths is likely a page from U.S. President Trump’s playbook. As the two leaders meet, trade will be the primary item on the agenda. In many ways, a deal between China and the United States is the only logical outcome as China relies on the U.S. consumer market, and the U.S. relies on natural resources and the power of the world’s second-largest economy. Therefore, the odds favor that the latest news on rare earths is posturing with a capital P.

Any successful negotiation requires both sides to leave the table with a deal that makes both sides unhappy. I expect that outcome when Presidents Trump and Xi sit down, a deal where both sides give something but can claim a victory. For the U.S. President, even a slight shift in trade favoring the U.S. will be a success, while the Chinese leader will succeed if access to the U.S. market at a reasonable cost remains intact.

The big winner of a China-U.S. agreement could be Chinese stocks trading on U.S. and foreign exchanges. The iShares China Large Cap ETF (FXI) has a blended price-to-earnings ratio of around 10.62 times earnings compared to the SPY’s P/E of 17.86. The bottom line is that in a U.S. stock market that is at the highs, less expensive alternatives become highly attractive.

The long-term monthly chart highlights that FXI’s trend has turned higher since the January 2024 low of $20.86, and has nearly doubled at over $40 per share on October 9. Moreover, from a technical perspective, FXI has lots of upside potential with the first upside technical resistance target at the February 2021 high of $54.52 per share.

The May 15, 2026, FXI $40-$50 vertical bull call spread at $2.85 has a risk-reward ratio of better than 1:2.5.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.