- Smart Options Trader

- Posts

- Copper’s Next Shortage Isn’t Hype — It’s Structural

Copper’s Next Shortage Isn’t Hype — It’s Structural

AI, electrification, and green energy are colliding with limited supply.

Why Most Traders Stay Stuck (And How to Fix It)

*New Weekly Show*

After nearly 30 years in the markets, Rob Roy has seen what actually leads to consistency—and what doesn’t. This series breaks down real technical setups, risk control, and decision-making without the fluff most traders get stuck in.

Missed last week’s first show?

🕒 Market Overview: Copper’s trend, its supply-demand deficit, and increasing demand for the nonferrous metal are likely to push prices higher in 2026, benefiting SCCO and other copper producers. In 2025, LME and COMEX copper prices rose by over 41%.

📈 Sector Insight: If copper prices continue to rise in 2026, expect SCCO shares to outperform copper on a percentage basis.

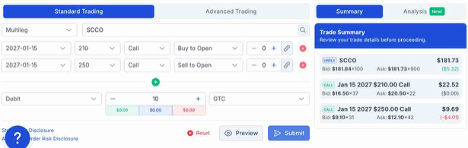

💡 Today's Trade Idea: Bull Call Spread on SCCO.

SMART TRADE IDEA 💡

Bull Call Spread on SCCO

Trade Setup: Buy $210 Call / Sell $250 Call, January 15, 2027, expiration.

Cost: $10.50

Max Profit: $29.50

Breakeven: $220.50

Risk-reward: 1:2.8

Management Plan: Exit at 50% loss, take profits, or roll up if SCCO’s price reaches $225 before January 15, 2027.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Smart AnalysisA Wall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

Why the World Is Running Out of Copper

Copper is the leading base metal and is a critical infrastructure building block. Meanwhile, copper’s applications in green and traditional energy initiatives have increased the demand side of its fundamental equation. While EVs, wind turbines, and other green energy innovations require increasing amounts of copper, the acceleration of electrification driven by AI will only put more strain on copper supplies. In a December 17, 2025, article on Mining.com, the author explained that copper’s next short is “structural, not hype.” The article started with, “Copper is heading into a structural deficit in 2026 as demand from electrification accelerates faster than new supply.”

A bull market since the turn of this century

Source: Barchart

After reaching a bottom of 60.40 cents per pound in late 2021, copper futures have made higher lows and higher highs, without violating the significant downside support levels, reaching a new high of $6.1540 per pound in January 2026. At the $5.94 level on January 23, copper futures remain in a long-term bullish trend.

Tariffs distorted prices in 2025- The bullish trend remains intact

In 2025, the Trump administration’s tariff policy caused substantial price distortions between COMEX copper futures and the London Metals Exchange three-month copper forwards prices. The futures moved to a significant premium to the forwards in 2025, pushing the futures to a record high while the forwards remained below the all-time 2024 peak. However, in late 2025, the LME forwards caught up with the futures prices, rising to new record highs in Q4 2025 and rising to an even higher high in January 2025.

In late January 2025, LME copper forward and COMEX copper future prices have realigned and are in bullish trends.

Copper mining shares leverage copper’s price action

Mining companies that extract copper from the Earth’s crust often deliver leveraged returns relative to copper prices during bullish trends. Meanwhile, copper is the leading base metal trading on the LME, and aluminum, nickel, lead, zinc, and tin prices tend to follow copper’s price trend. In 2025, the nonferrous metals sector posted across-the-board gains, with prices above the 2025 closing level in late January 2026.

Most of the leading copper mining companies also produce other ores, metals, and minerals.

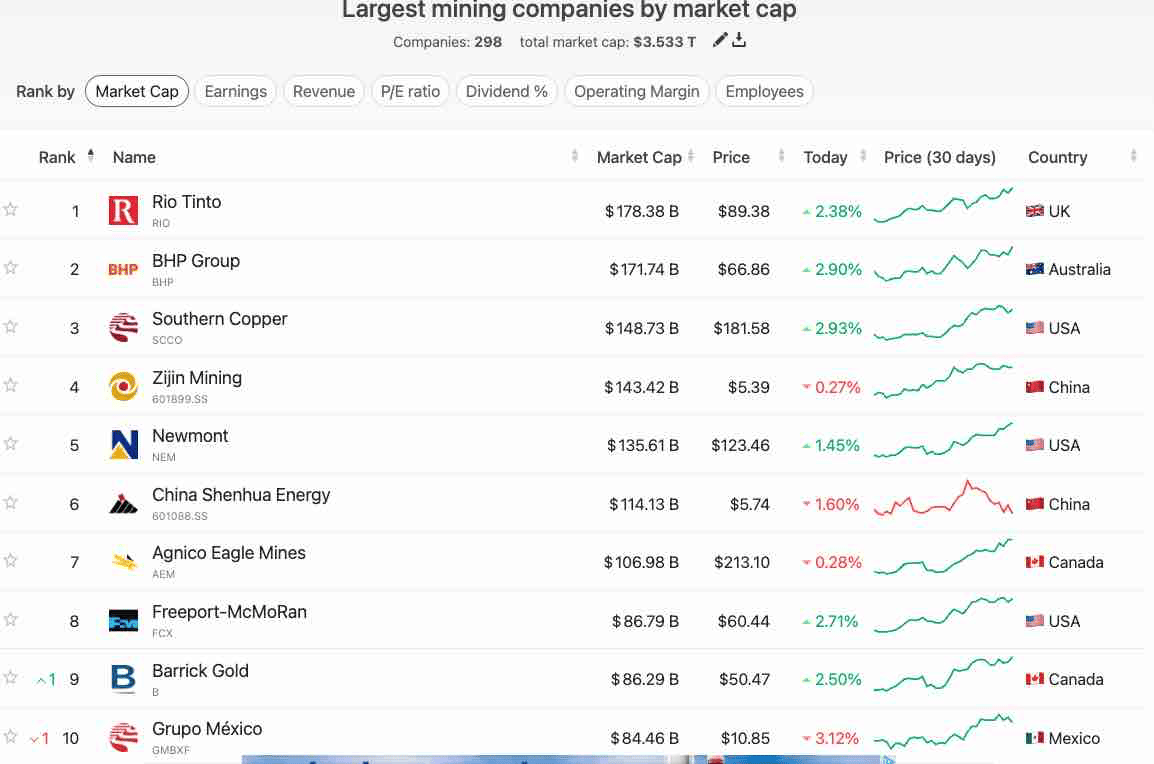

The leading copper-producing companies

Source: companiesmarketcap.com

While many of the leading mining companies produce a wide range of metals, ores, and minerals, Southern Copper (SCCO) primarily focuses on the red nonferrous metal. At $181.24 per share, SCCO had a market cap of $143.278 billion. SCCO is a highly liquid stock that trades an average of over 1.828 million shares per day. SCCO’s $3.60 annual dividend translates to a 1.99% yield.

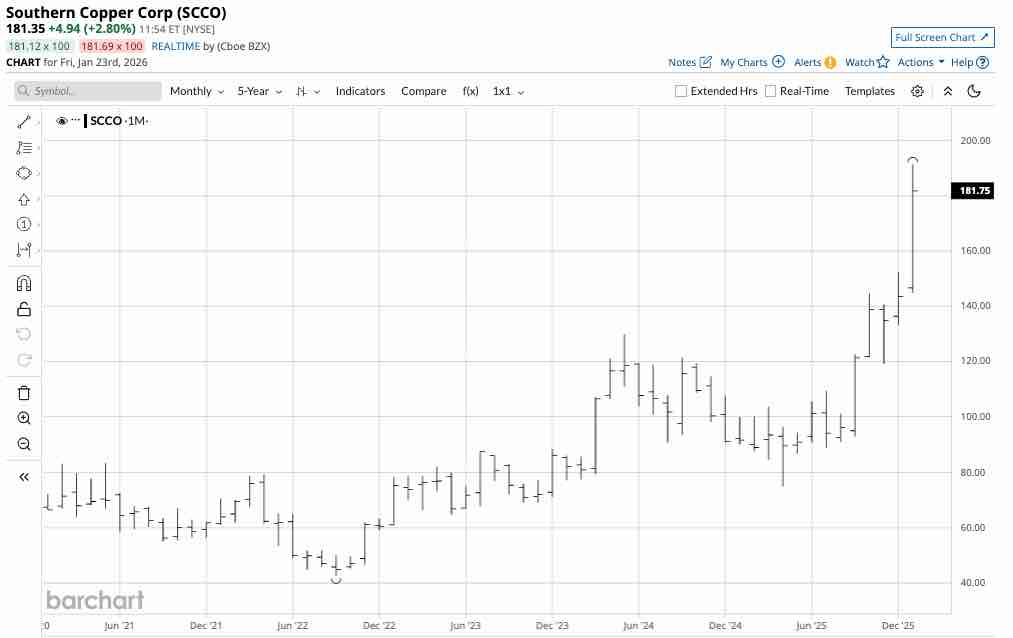

Source: Barchart

SCCO outperformed copper prices, rising 57.4% from $91.13 at the end of 2024 to $143.47 per share on December 31, 2025. If copper prices continue to rise in 2026, expect SCCO shares to outperform copper on a percentage basis.

AD - TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.