- Smart Options Trader

- Posts

- Disney Trades at Half Netflix Valuation While Streaming Wars Intensify

Disney Trades at Half Netflix Valuation While Streaming Wars Intensify

Technical resistance levels could trigger explosive price action in undervalued media stocks trading at half competitor multiples.

Technical resistance levels could trigger explosive price action in undervalued media stocks trading at half competitor multiples.

🕒 Market Overview: Streaming sector rotation favors diversified content companies over single-vertical plays.

🔄 Sector Insight: Disney's multiple revenue streams provide earnings stability Netflix lacks.

💰 Today's Trade Idea: Bull Call Spread on DIS targets technical breakout above $126.48 resistance.

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

Streaming wars continue reshaping media valuations as investors weigh growth versus profitability metrics. Netflix's Q2 2025 earnings validated the advertising-supported tier model, pushing the stock above $1,300 with a 59.50 P/E ratio. However, market participants increasingly favor companies with diversified revenue streams over single-vertical plays, especially during periods of Fed uncertainty and policy volatility.

The VIX spike to 18.67 during recent earnings season highlighted investor preference for defensive positioning in growth stocks. Disney's multiple business segments provide natural hedging against streaming market volatility, making it attractive during uncertain market conditions.

Sector and Stock Watch – Identifying Key Movers

Disney represents compelling value in the streaming space trading at $121.25 with a 20.73 P/E ratio—less than half Netflix's valuation multiple. The company's diverse revenue portfolio includes movie studios, network ownership, animation, theme parks, resorts, streaming services, and highly profitable merchandise divisions.

Technical analysis reveals DIS shares have been rangebound between $80 and $125 since the October 2023 low of $78.73. The monthly chart shows consolidation following the decline from March 2021 highs of $203.02, with key resistance at the August 2022 high of $126.48.

Trading Strategy in Focus – How to Play the Market

Current market conditions favor defined-risk strategies on undervalued media companies with technical breakout potential. Disney's rangebound price action creates attractive risk-reward profiles for bull call spreads targeting moves above resistance levels.

The streaming sector's maturation phase rewards companies with multiple revenue verticals over pure-play competitors. Disney's merchandise business alone generates substantial margins, with strong consumer brand loyalty providing recurring revenue streams independent of streaming subscriber metrics.

SMART TRADE IDEA

Bull Call Spread on DIS

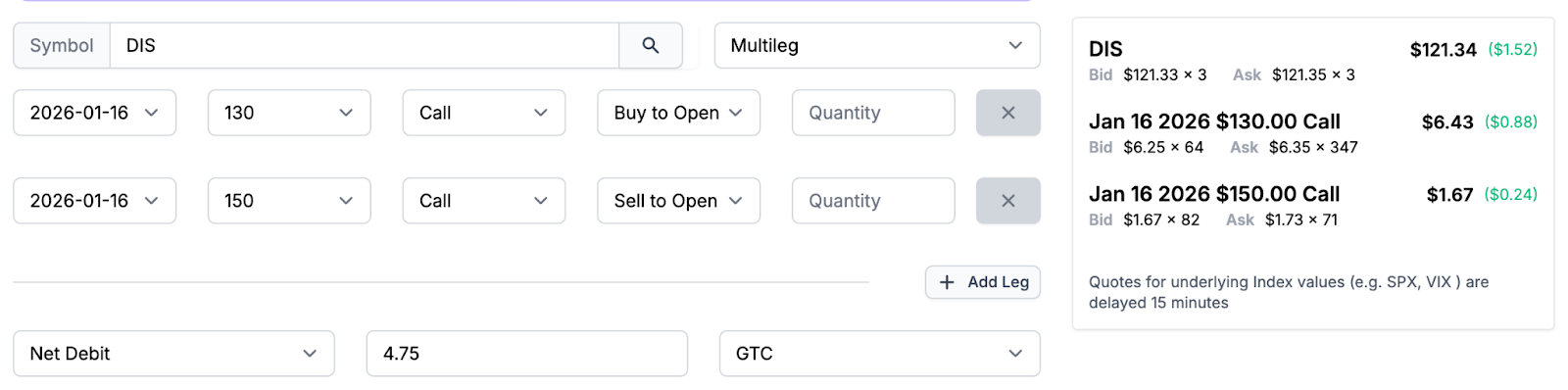

Trade Setup: Buy $130 Call / Sell $150 Call, January 16, 2026 expiration

Cost: $4.75 ($475 per spread)

Max Profit: $15.25 ($1,525 per spread)

Breakeven: $134.75.

Risk-reward ratio: 1:3.21

Management Plan:

Exit at 50 percent loss, roll up if DIS share price reaches $150.

DIS is an inexpensive stock, compared to Netflix, and it offers investors far more segments that can provide earnings diversification. DIS has been in a trading range. If the stock breaks out above the $126.48 technical resistance level, the price action could become explosive.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

Netflix has been an incredible story, and the market has rewarded shareholders. Streaming, the continuous delivery of multimedia content, enables users to access and consume content without first downloading it, and has significantly changed the media landscape. Netflix's business model has been a beneficiary, and the stock has probed above the $1,300 per share level. However, the stock has become expensive. At around $1,250, Netflix's price-to-earnings ratio was over 59.50. One of the company's drawbacks is its single earnings vertical.

Disney (DIS) is also a streaming company through its Disney+ service. However, DIS has other earnings verticals, including its movie studios, network ownership, animation, theme parks, resorts, streaming service, and merchandise. I have two nearly four-year-old granddaughters, and each owns at least twenty princess dresses. The merchandising business is highly profitable, and DIS trades at a P/E ratio that is less than half of Netflix's, at around $121.25 per share. DIS's P/E is approximately 20.73 times earnings.

The monthly chart shows that DIS shares declined from the March 2021 high of $203.02 to the October 2023 low of $78.73 per share. Since the low, DIS shares have been rangebound between $80 and $125. Technical resistance is at the August 2022 high of $126.48 per share.

At the current valuation, DIS could be a bargain, given its diverse business model and its position in the content streaming industry.

A DIS $130-$150 vertical bull call spread at $4.75 or lower for expiration on January 16, 2026, has a better than 1:32 risk-reward ratio.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.

LATEST MARKET BREAKDOWN

Watch on Youtube

That's it for today!Before you go we'd love to know what you thought of today's newsletter to help us improve the experience for you. |