- Smart Options Trader

- Posts

- EA's $55 Billion Buyout Just Triggered a Sector Wide Repricing

EA's $55 Billion Buyout Just Triggered a Sector Wide Repricing

The largest LBO in history just reset valuations across gaming. While everyone chases the obvious plays, one sports betting giant sits at a technical inflection point that institutional money may already be eyeing.

The largest LBO in history just reset valuations across gaming. While everyone chases the obvious plays, one sports betting giant sits at a technical inflection point that institutional money may already be eyeing.

🕒 Market Overview: EA's $55B leveraged buyout marks the largest LBO in corporate history, surpassing the 2007 TXU deal.

🔄 Sector Insight: Call option volume on EA surged 493% as private equity signals gaming sector maturation.

💰 Today's Trade Idea: Long call on DKNG captures potential M&A speculation with defined downside risk.

SMART TRADE IDEA

Long Call Option on DKNG

Trade Setup: Buy $60 Call, March 20, 2026 expiration.

Cost: $0.90 or lower

Max Profit: Unlimited

Breakeven: $60.90 per share on DKNG

Management Plan: Roll up, or take profits if DKNG’s price reaches $60 before expiration.

DKNG is a dominant company in the sector. The interest in professional sports-related businesses, fantasy sports, and gaming could make DKNG an attractive takeover candidate or a stock that attracts substantial speculative investment capital over the coming months.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

Private equity is reshaping the gaming landscape with unprecedented aggression. A consortium led by Saudi Arabia's Public Investment Fund, Silver Lake Partners, and Affinity Partners acquired Electronic Arts at $210 per share—a premium that reflects the sector's evolution from speculative entertainment to predictable cash flow generators.

Since 2018, private equity has deployed over $21B across gaming deals, with the majority targeting content developers and publishers. The strategic shift is clear: institutional capital recognizes that franchises like Madden and FIFA function as annuities rather than volatile hit-or-miss releases. Goldman Sachs projects M&A activity to accelerate through 2026, suggesting EA represents the beginning of a consolidation wave rather than an isolated event.

Falling interest rates have improved financing conditions for leveraged transactions, while public market volatility has created entry points at valuations that justify substantial debt loads. The gaming industry now exceeds $200B globally with over 3B players, providing scale and stability that attract long-term capital.

Sector and Stock Watch – Identifying Key Movers

EA's deal triggered volatility expansion across gaming equities as traders repriced merger probability into related names. Options markets reflect heightened speculation—implied volatility spiked on Take-Two, Activision, and Ubisoft as market participants positioned for potential follow-on transactions.

The critical consideration: not every gaming company fits the LBO profile that justified EA's premium. Buyers seek businesses with irreplaceable intellectual property, recurring revenue streams, and operational leverage. Companies lacking these characteristics face inflated valuations based on speculation rather than fundamental merit.

Sports entertainment represents a parallel opportunity with similar characteristics. DraftKings controls the only U.S.-based vertically integrated sports betting platform, holding official partnerships with the NFL, MLB, PGA, NBA, and PGA Tour. Fantasy sports continues expanding while franchise valuations accelerate—Robert Kraft recently valued the New England Patriots at $9B in a partial stake sale. The NFL's pending media contract renegotiations position owners for significant revenue increases, potentially directing institutional attention toward sports-adjacent investment opportunities.

Trading Strategy in Focus – How to Play the Market

The immediate post-announcement period typically generates FOMO-driven speculation into marginal gaming stocks, creating situations where retail capital chases merger scenarios unlikely to materialize. Institutional buyers operate methodically, screening for companies with strong cash generation, defensible IP, and operational improvement potential.

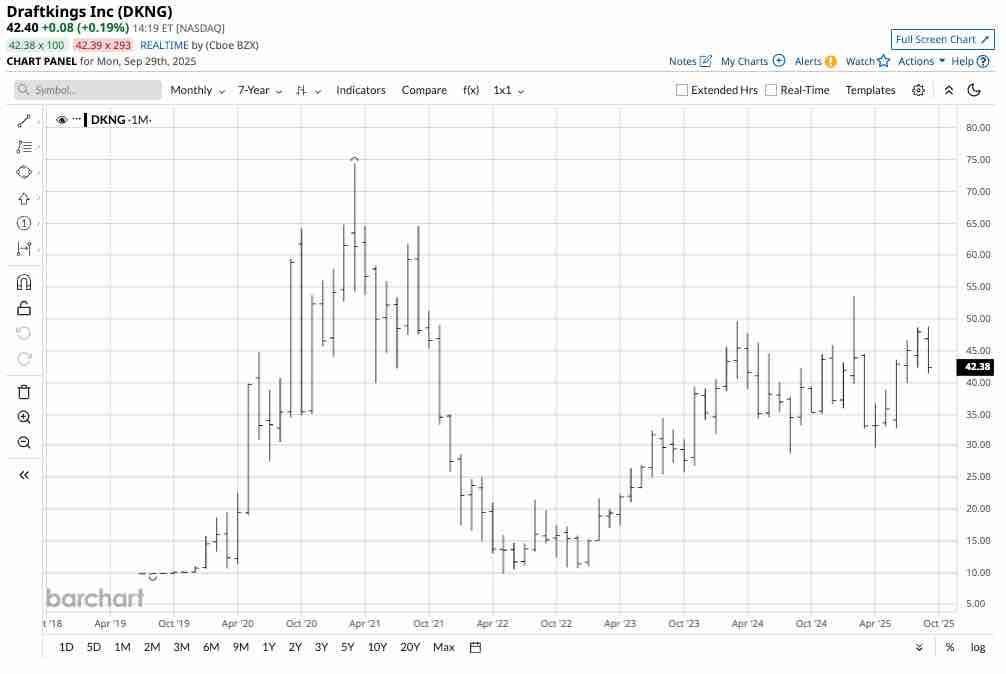

DraftKings trades substantially below its 2021 high while establishing a pattern of higher lows and higher highs since early 2023. The stock approaches technical resistance at February 2025 levels, positioning below the $74.38 all-time peak. If investment capital rotates toward sports entertainment and gaming infrastructure, DKNG presents asymmetric risk-reward characteristics through options rather than equity exposure.

Regulatory approval of EA's transaction becomes a critical catalyst. The Committee on Foreign Investment in the United States reviews deals involving foreign capital in American technology and entertainment assets. Expedited approval could accelerate LBO activity across the sector, while delays or restrictions may temper enthusiasm. Either scenario creates directional opportunities for positioned traders.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

EA’s $55 billion LBO is a watershed event that has nearly doubled the company’s market cap from the stock’s low of $115.21 in January 2025 to the $210 per share buyout price.

The chart shows the bullish trend over the past years, and the explosive rally caused by the LBO. Those who purchased EA shares, believing in the value of interactive gaming and services, when the share declined and held above critical support levels in early 2025, have received a handsome reward. EA is a leader in the sector.

The EA news made me think of another potential diamond in the rough, a leading company in the sports entertainment and gaming sector. DraftKings (DKNG) is the only U.S.-based vertically integrated sports betting operator. DKNG provides multi-channel sports betting and gaming technologies and is the official partner of the NFL, MLB, and the PGA. It is also an authorized gaming operator of the NBA and MLB, as well as an official betting partner of the PGA Tour. Fantasy sports is a growing business, and DKNG has a dominant position in the sector. Moreover, the value of sport-related franchises has soared. Last week, Robert Kraft sold an 8% stake in the New England Patriots, valuing the team at $9 billion. Sports is a huge and growing business, attracting substantial investment capital. The NFL is currently seeking to renegotiate its media contracts, which would provide owners with significantly more revenue over the coming years. The bottom line is that sport-related gaming and entertainment investment could be another area with massive upside potential. DKNG shares could benefit from the trend.

The chart shows that at under $43 per share, DKNG remains substantially below the March 2021 high of $74.38 and has been making higher lows and higher highs since early 2023, closing in on the first technical resistance at the high of $53.61 from February 2025. DKNG could experience an explosive move on the horizon if investment capital and M&A activity shift their focus to the sector. Therefore, buying an out-of-the-money call option below the record 2021 peak offers a limited risk interest with the potential for explosive returns.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.