- Smart Options Trader

- Posts

- Goldman Sachs Banking Fees Rise on Pharma Consolidation

Goldman Sachs Banking Fees Rise on Pharma Consolidation

Big Pharma's acquisition frenzy creates a clear winner beyond the drug makers. Here's the financial play positioned to collect fees regardless of which deals succeed.

Big Pharma's acquisition frenzy creates a clear winner beyond the drug makers. Here's the financial play positioned to collect fees regardless of which deals succeed.

🕒 Market Overview: Pharmaceutical giants face patent cliff, triggering acquisition wave to secure future revenue streams.

🔄 Sector Insight: Metabolic disease assets command premium valuations as oncology franchises face biosimilar competition erosion.

💰 Today's Trade Idea: Bull Call Spread on Goldman Sachs capitalizes on M&A fee revenue surge.

SMART TRADE IDEA

Bull Call Spread on GS

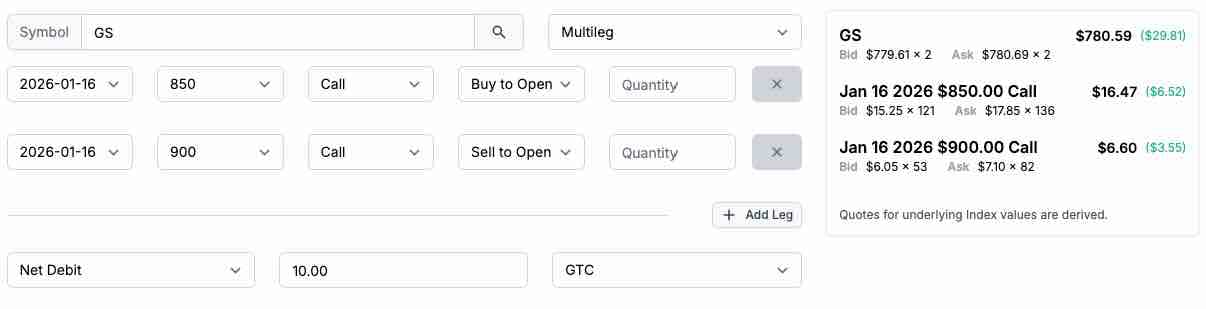

Trade Setup: Buy $850 Call / Sell $900 Call, January 16, 2026, expiration

Cost: 10.00 ($1,000 per spread)

Max Profit: $40.00 ($4,000 per spread)

Breakeven: $860 on GS shares on January 16, 2026

Management Plan: Exit at 50% loss, roll up, or take profits if GS’s price reaches $880 per share or higher before January 16, 2026.

Picking winners in M&A, whether in pharma or any sector, is challenging. However, one thing is for sure: Goldman Sachs will make lots of money if M&A activity increases, which is a high-odds play in the current environment.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Smart AnalysisWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

I agree that M&A activity will continue, that pharma is fertile ground, and that it is challenging to pick the winners. However, one group of nearly guaranteed winners on the back of increasing M&A in pharma and across other sectors and industries is the financial institutions that collect the juicy fees. Leading that pack is Goldman Sachs, investment banking royalty on Wall Street. Deals equal fees, and the prospect for lower interest rates will only accelerate the activity.

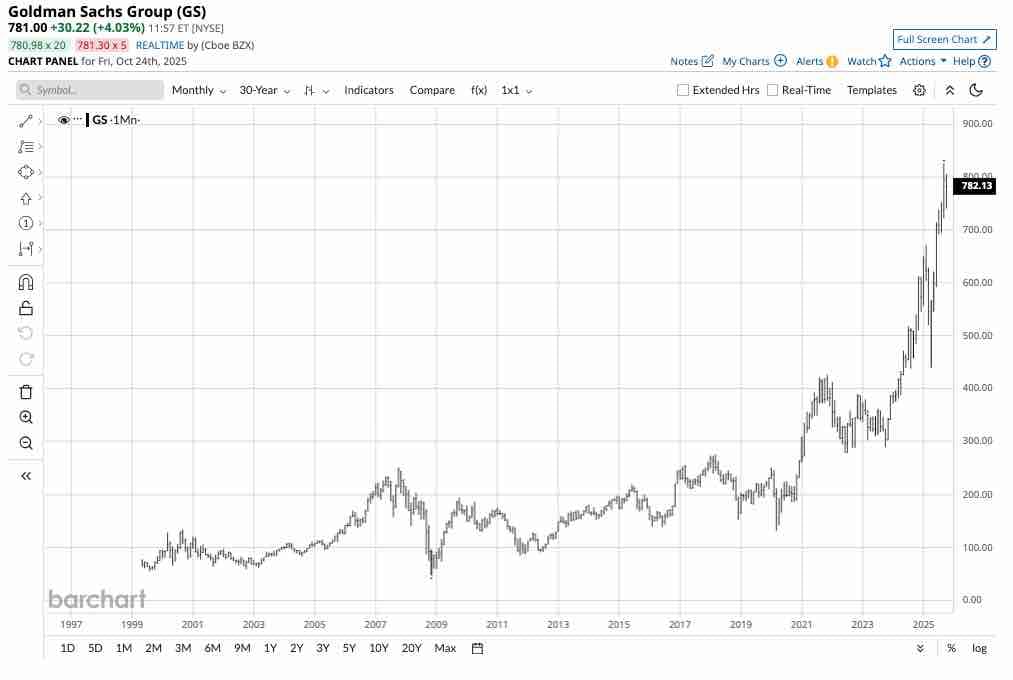

At $781 per share, GS trades at an attractive P/E ratio below 15.50 times earnings, below the average P/E ratios of the S&P 500 and NASDAQ. The bottom line is that one of the best ways to position for more mergers and acquisitions in pharma and other industries is to take a bullish long position in GS shares. While there will be winners and losers, Goldman Sachs typically winds up a winner in most market situations. Trading, banking, and M&A revenues over the years, along with the trajectory of the shares, demonstrate GS’s unique position.

As the chart highlights, GS traded to a record high of over $825 per share in September 2025. At the $781 level, the stock is $44 below its high, with prospects for M&A revenue growth. The January 16, 2026, $850-$900 GS vertical bull call spread at $10 or lower has a risk-reward ratio of at least 1:4.00.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.