- Smart Options Trader

- Posts

- Google Antitrust Victory Triggers $200B Rally

Google Antitrust Victory Triggers $200B Rally

Court ruling validates AI disruption theory, creating massive opportunities as tech regulation landscape shifts overnight.

Court ruling validates AI disruption theory, creating massive opportunities as tech regulation landscape shifts overnight.

🕒 Market Overview: GOOG surges following lenient antitrust ruling, adding $200 billion market cap

🔄 Sector Insight: Court accepts technological change as competitive force, setting crucial precedent

💰 Today's Trade Idea: Google-Apple $20 billion search agreement preserved, boosting both stocks

SMART TRADE IDEA

Bull Call Spread on GOOG

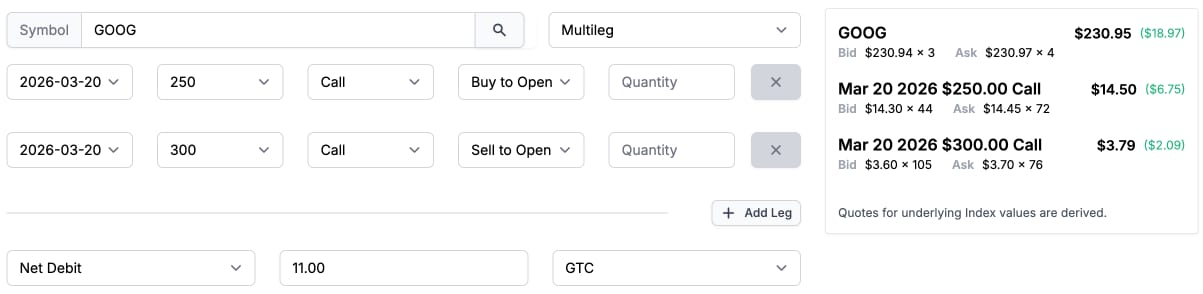

Trade Setup: Buy $250 Call / Sell $300 Call, March 20, 2026, expiration.

Cost: $11 ($1,100 per spread)

Max Profit: $39 ($3,900 per spread)

Breakeven: $261 on GOOG shares

Management Plan: Exit at 50% loss, roll up, or take profits if the GOOG share price reaches $280.

GOOG shares are relatively inexpensive compared to those of other leading technology companies. Catching up could lead to a substantial rally in GOOG shares, and the March expiration provides ample time for GOOG shares to move to the upside.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

The antitrust ruling delivered precisely the regulatory clarity tech markets needed during September's historically weak performance period. Judge Mehta's decision established AI innovation as a legitimate defense against traditional breakup remedies, fundamentally altering how courts may approach tech regulation moving forward.

Volatility indicators reflected the dramatic shift in sentiment. The VIX, which had climbed to 17.17 ahead of the decision, captured heightened anticipation before the explosive after-hours reaction. The ruling provided bullish momentum exactly when markets were navigating Federal Reserve uncertainty and rising bond yields that had been pressuring technology stocks.

The precedent-setting nature of this decision extends beyond Google. By embracing "judicial humility" in rapidly evolving technology markets, the court signaled a less aggressive approach to tech intervention that could benefit the entire sector.

Sector and Stock Watch – Identifying Key Movers

Alphabet shares experienced extraordinary movement, surging as much as 9% in after-hours trading and continuing to climb through the following session. The rally eliminated months of regulatory uncertainty that had kept the stock trading at a discount to tech peers.

Apple captured significant upside momentum, rising 3-4% as investors recognized the preservation of its estimated $20 billion annual revenue stream from Google search placement fees. This partnership validation removed a key risk factor that had been weighing on Services revenue projections.

The broader Technology Select Sector SPDR (XLK) witnessed heavy call buying as the ruling reduced regulatory breakup risks across the entire Big Tech ecosystem. Options chains throughout the sector repriced as traders shifted from defensive hedging to aggressive positioning.

Trading Strategy in Focus – How to Play the Market

The dramatic options market response demonstrates how quickly derivatives reprice when major tail risks are eliminated. Alphabet options witnessed extraordinary volume surges as September contracts that had been priced with modest volatility suddenly became deeply in-the-money positions overnight.

Current market conditions favor strategies that capitalize on continued tech strength while managing downside risk through defined parameters. The regulatory clarity creates an environment where longer-term positioning becomes more attractive, particularly for stocks trading at valuation discounts to sector leaders.

The validation of strategic partnerships suggests that similar high-value tech alliances may deserve premium valuations rather than regulatory discounts moving forward.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

I view the GOOG resolution as highly bullish for the stock.

The chart shows that GOOG is currently fourth in the race for the company with the highest market capitalization. NVDA, the leader, has a P/E ratio of over 38 times earnings. Second-place MSFT is north of 32.5 times earnings. AAPL, the company with the third-leading market capitalization, has a P/E ratio of over 31 times earnings. Meanwhile, GOOG, which has faced a significant legal challenge, has a P/E ratio of under 22 times earnings. The ruling that ignited the shares on September 3 could continue to send GOOG higher over the coming weeks and months to the levels of the top three companies. The bottom line is that, given its current price-to-earnings level, GOOG shares could be vastly undervalued compared to NVDA, MSFT, and AAPL. A longer-term vertical bull call spread on GOOG shares could capitalize on the ruling as GOOG catches up with the value of the other leading technology companies.

The monthly chart highlights GOOG’s rise to a new record high following the ruling.

At just over $231 per share, the March 20, 2026, $250-$300 vertical bull call spread at $11 per spread or lower has at least a risk-reward ratio of greater than 1:3.5.