- Smart Options Trader

- Posts

- Healthcare Firm MEDP Delivers Shock Of Earnings Season

Healthcare Firm MEDP Delivers Shock Of Earnings Season

Clinical research firm delivers shocking guidance raise that proves fundamental analysis still generates alpha in today's technical market. Elevated implied volatility presents range-bound trading opportunity with clear profit targets.

Clinical research firm delivers shocking guidance raise that proves fundamental analysis still generates alpha in today's technical market. Elevated implied volatility presents range-bound trading opportunity with clear profit targets.

🕒 Market Overview: Healthcare services sector delivers explosive surprise amid macro uncertainty.

🔄 Sector Insight: Clinical research organizations benefit from demographic trends and regulatory complexity

💰 Today's Trade Idea: Iron butterfly spread captures elevated volatility in post-earnings environment.

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

Fed uncertainty continues as Christopher Waller advocates for rate cuts while Powell speaks today. The VIX hovers around 16.88 as traders position for Tesla and Alphabet earnings, expecting 7.4% and 6.0% implied moves respectively. Rate cut expectations could benefit growth companies with strong cash flows, while healthcare services offer defensive characteristics regardless of monetary policy direction.

Zero-day options now represent over 50% of S&P 500 options volume, with retail traders accounting for 31% of options activity—up from 18% five years ago. These participants increasingly execute complex multi-leg strategies with disciplined risk management, structuring over 95% of zero-day trades as limited-risk positions.

Sector and Stock Watch – Identifying Key Movers

Medpace Holdings (MEDP) delivered a 45% surge following Q2 earnings that crushed estimates with $3.10 per share against $603.3 million in revenue. The clinical research organization raised full-year guidance to $2.42-$2.52 billion, demonstrating growth rates that caught the market off-guard.

This move occurred while market attention focused on mega-cap earnings, highlighting how fundamental analysis can still generate alpha in overlooked sectors. Social media sentiment for MEDP shifted to "extremely bullish" overnight, creating amplification effects in the hyper-connected market environment.

Trading Strategy in Focus – How to Play the Market

The post-earnings volatility spike in MEDP options creates an opportunity for income-generating strategies. With implied volatility elevated after the explosive move and the stock trading near previous technical resistance around $460, range-bound strategies become attractive.

The iron butterfly capitalizes on high implied volatility while defining risk parameters clearly. This approach works when traders expect volatility to decrease and price action to stabilize within a specific range.

SMART TRADE IDEA

Iron Butterfly Spread on MEDP

Trade Setup: Sell 460 Call and Sell 460 Put while simultaneously buying the $410 Put and $500 Call, September 19, 2025, expiration.

Credit: $30 ($3,000 per spread)

Max Profit: $30 ($3,000 per spread) at $460 on the expiration day. Profit zone is above $430, below $490 at expiration.

Breakevens: $430 on the downside, $490 on the upside.

Risk - $20 ($2,000 on the downside at $410 or below); $10 ($1,000 on the upside at $500 or above).

The spike in implied volatility presents an opportunity with the iron butterfly, short at the money $460 straddle versus the long $410-$500 strangle for September 19, 2025, expiration. If volatility shrinks, the strategy will likely yield profits. The risk is limited and is below the maximum reward at the $460 level, which is the previous technical resistance, which has now become MEDP's support.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

There has long been a debate about trading or investing based on technical versus fundamental analysis. Technical advocates argue that the trend is always our best friend, until it bends. Technical analysis can take many forms, but the bottom line is respect and adoration for a bullish or a bearish path of least resistance for stocks or any assets.

Fundamentalists argue that underlying idiosyncratic factors, including earnings, supply, demand, and a complex web of micro and macroeconomic factors, will eventually cause a stock or any asset to move in the direction supported by the underpinnings.

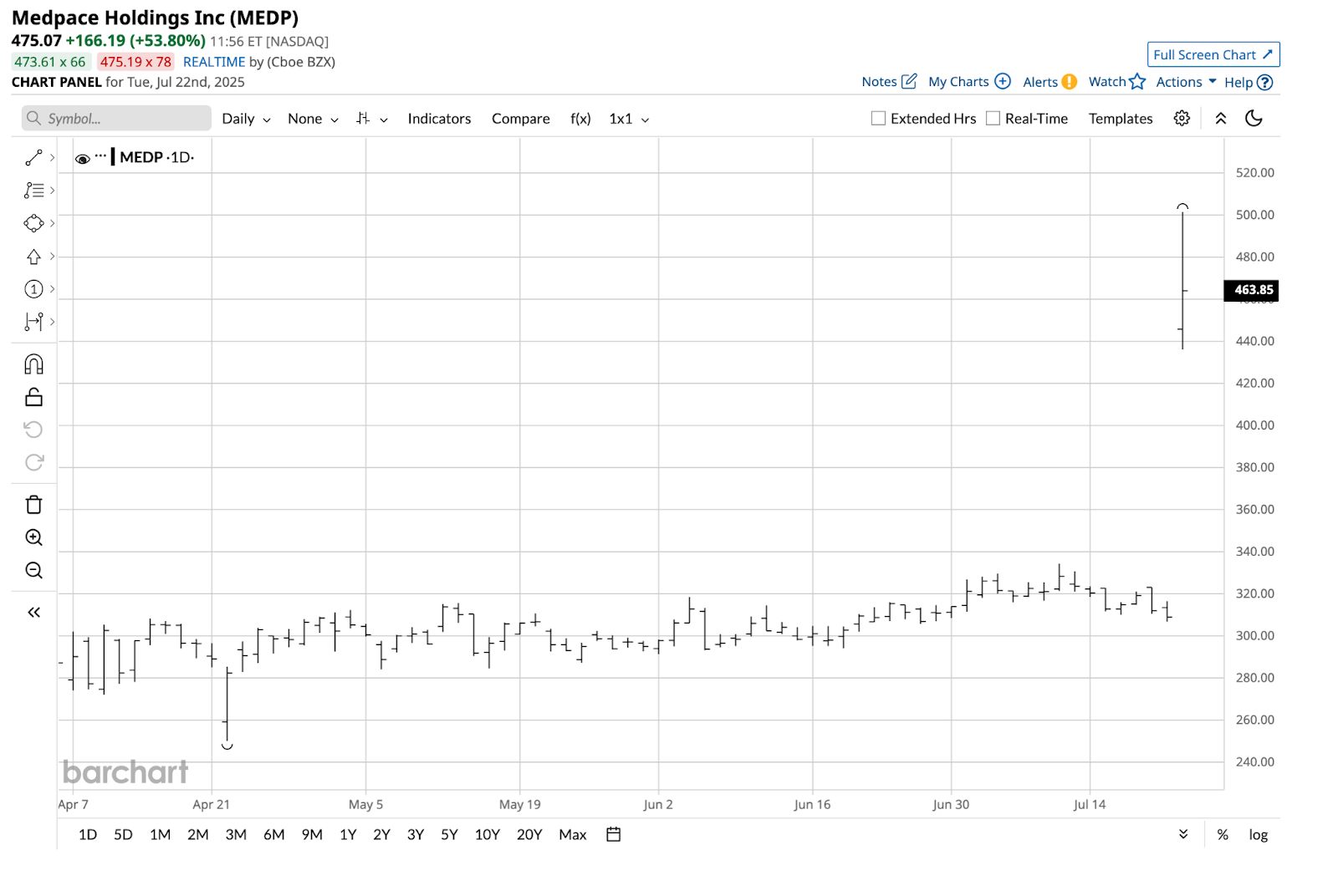

Medpack's (MEDP) daily chart highlights the fundamental approach following the earnings, which delivered on the basic signals that had been flashing. MEDP shares surged to over $500 at the July 22 high, blowing through the previous Q3 2024 record high of $459.77 like a hot knife through butter. MEDP quickly backtracked, but the stock was trading near the previous 2024 high, which is now a critical technical support level.

A pure technical or fundamental approach can lead to success, but a combination of the two disciplines often yields the best results. Once fundamentals kick in, as in MEDP's case, the technical approach can yield significant clues about the price path.

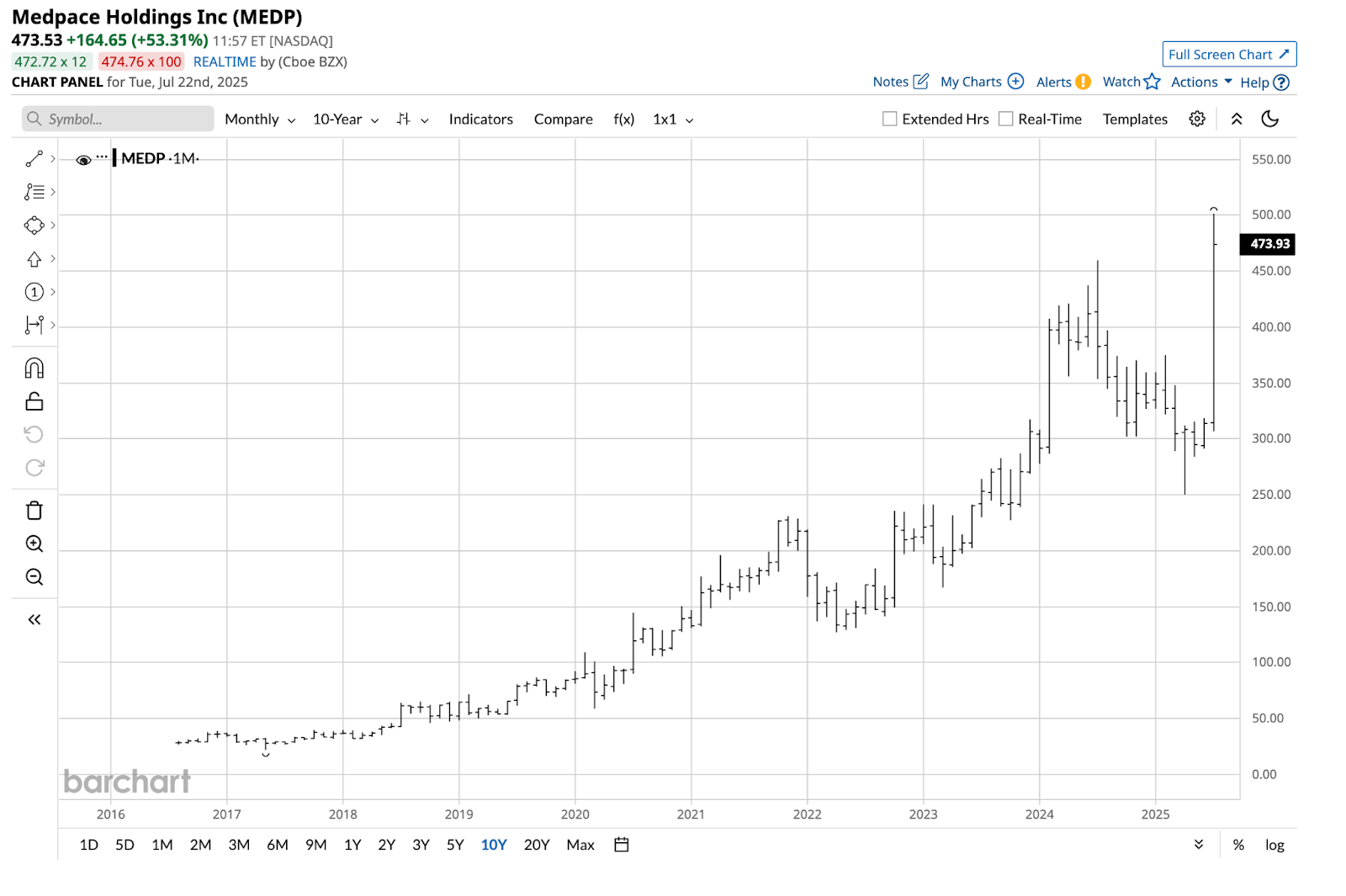

While there is a substantial gap on MEDP's daily chart, the quarterly chart displays no price gap. Meanwhile, the long-term chart shows a pattern of higher lows and higher highs. Given the spike in MEDP options implied volatility after the explosive move, an iron butterfly strategy could provide significant rewards if the stock settles into a trading range near the previous record high around the $460 level.

The short $460 straddle versus the long $410-$500 strangle, with a credit of around $30 for the September 19, 2025, expiration, will yield a maximum profit of $30 or $3,000 per spread at $460 on expiration. The risk is a loss of $10 or $1,000 per spread at a price above $500, or a loss of $20 or $2,000 per spread at a price below $410. The iron butterfly with the short straddle and long strangle takes advantage of the high implied volatility of MEDP options after the July 22 explosive move.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.

LATEST MARKET BREAKDOWN

Watch on Youtube

That's it for today!Before you go we'd love to know what you thought of today's newsletter to help us improve the experience for you. |