- Smart Options Trader

- Posts

- Humana Results Reveal Medicare Advantage Cost Trends

Humana Results Reveal Medicare Advantage Cost Trends

Medical costs are crushing health insurers as government payments fall short. Markets are pricing continued downside volatility across managed care stocks.

Medical costs are crushing health insurers as government payments fall short. Markets are pricing continued downside volatility across managed care stocks.

🕒 Market Overview: Humana beats earnings estimates yet drops over 5% as medical loss ratios climb to unsustainable levels, signaling structural margin compression.

🔄 Sector Insight: Health insurers face accelerating medical costs as Medicare Advantage utilization runs 150-200% higher than projections, creating a fundamental mismatch between revenue and expenses.

💰 Today's Trade Idea: Bear Put Spread on Humana targeting continued downside as the sector transitions from defensive stability to value trap territory.

SMART TRADE IDEA

Bear Put Spread on HUM

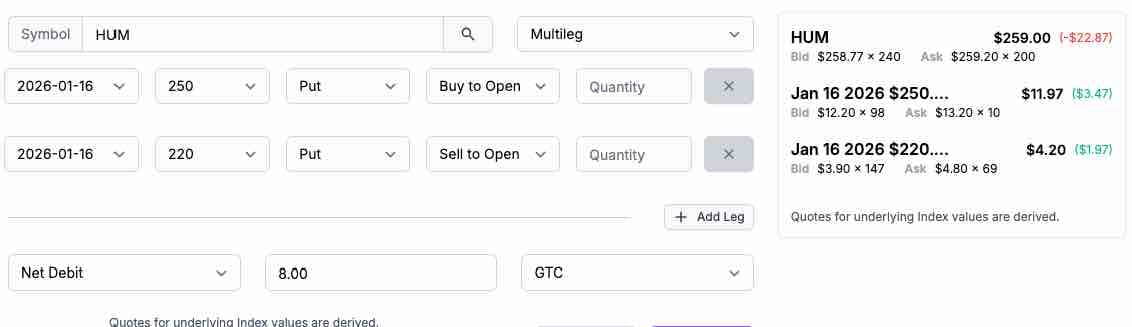

Trade Setup: Buy $250 Put/ Sell $220 Put, January 16, 2026, expiration

Cost: $8.00 ($800 per spread)

Max Profit: $22 ($2,200 per spread)

Breakeven: $242 on HUM shares on January 16, 2026

Management Plan: Exit at 50% loss, roll down, or take profits if HUM’s price reaches $220.

Managed healthcare is a leading issue facing the United States. As costs rise, managed healthcare companies like Humana will see earnings erode, causing them to cut services and coverage. The bearish trend in HUM shares remains firmly intact in early November 2026, and lower lows look likely.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Smart AnalysisA Wall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

The aging of the U.S. population creates stress on Social Security and healthcare. One of the issues at the root of the current government shutdown is funding for healthcare. The shutdown cannot continue indefinitely, and a compromise is likely to be reached over the coming weeks, hopefully not months.

From personal experience, as I turned 65 last year, I found that Medicare Advantage plans can be challenging, as many doctors and specialists do not accept certain plans. Each year is a new adventure, as keeping up with the plans that cover existing medical professionals has become a fast-moving target.

The leading managed care companies are trading at low P/E ratios and have declined significantly from their highs reached in late 2024. UnitedHealthcare (UNH) shares are 48% lower than their November 2024 high. Humana (HUM) has declined 54.5% from its November 2022 record high. These two leading healthcare companies are in bearish trends. The prospects are negative unless the government intervenes and changes the system; however, the disagreement between Democrats and Republicans makes such intervention unlikely, at least until the midterm elections in 2026 and when a new Congress takes office in early 2027. Therefore, the bearish trend is likely to continue.

As the chart shows, technical support for HUM was at the pandemic-inspired March 2020 low of $208.25 per share. In July 2025, the shares fell slightly below that level to $206.87 before recovering. At just below the $260 level, a vertical bear put spread could be optimal. The January 16, 2026 $250-$220 bear put spread at $8.00 has a risk-reward ratio of 1:2.75 with the bottom short strike price above the most recent low.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.