- Smart Options Trader

- Posts

- Intel Implodes as CEO Announces Emergency Restructuring Plan

Intel Implodes as CEO Announces Emergency Restructuring Plan

Semiconductor leader's catastrophic earnings miss triggers extreme volatility as traders position for potential recovery.

Semiconductor leader's catastrophic earnings miss triggers extreme volatility as traders position for potential recovery.

🕒 Market Overview: Intel reports historic loss, triggering sector-wide volatility reassessment

🔄 Sector Insight: AI transition accelerates traditional semiconductor company struggles

💰 Today's Trade Idea: Bull Call Spread on INTC targets potential restructuring recovery

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

The semiconductor landscape faces its most significant structural shift since the PC-to-mobile transition. Intel's catastrophic Q2 results—posting a $0.10 per share loss against expected $0.01 profit—highlight the existential challenges facing traditional chip manufacturers in an AI-dominated market. The company's $800 million in non-cash impairment charges and plans to eliminate 15,000 jobs signal emergency restructuring measures.

While Intel struggles with basic profitability, Google's increased AI infrastructure spending to $85 billion demonstrates where capital allocation priorities lie. The VIX remains subdued at 15.39, suggesting markets view Intel's crisis as company-specific rather than systemic, creating a selective risk environment that rewards discriminating technology investors.

Sector and Stock Watch – Identifying Key Movers

Intel's implied volatility explosion to 160% represents one of the most extreme volatility environments in semiconductors this year—nearly double the stock's normal 52-week range. The pre-earnings call-to-put ratio of 1.3:1 indicates traders were positioned for upside, making the 9% premarket drop to $20.60 particularly painful for call holders.

The volatility contagion extends beyond Intel, with AMD and ON Semiconductor showing elevated implied volatility as markets reassess sector-wide risks. This creates a bifurcated environment where AI-specialized companies command premium valuations while traditional processors face mounting pressure.

Trading Strategy in Focus – How to Play the Market

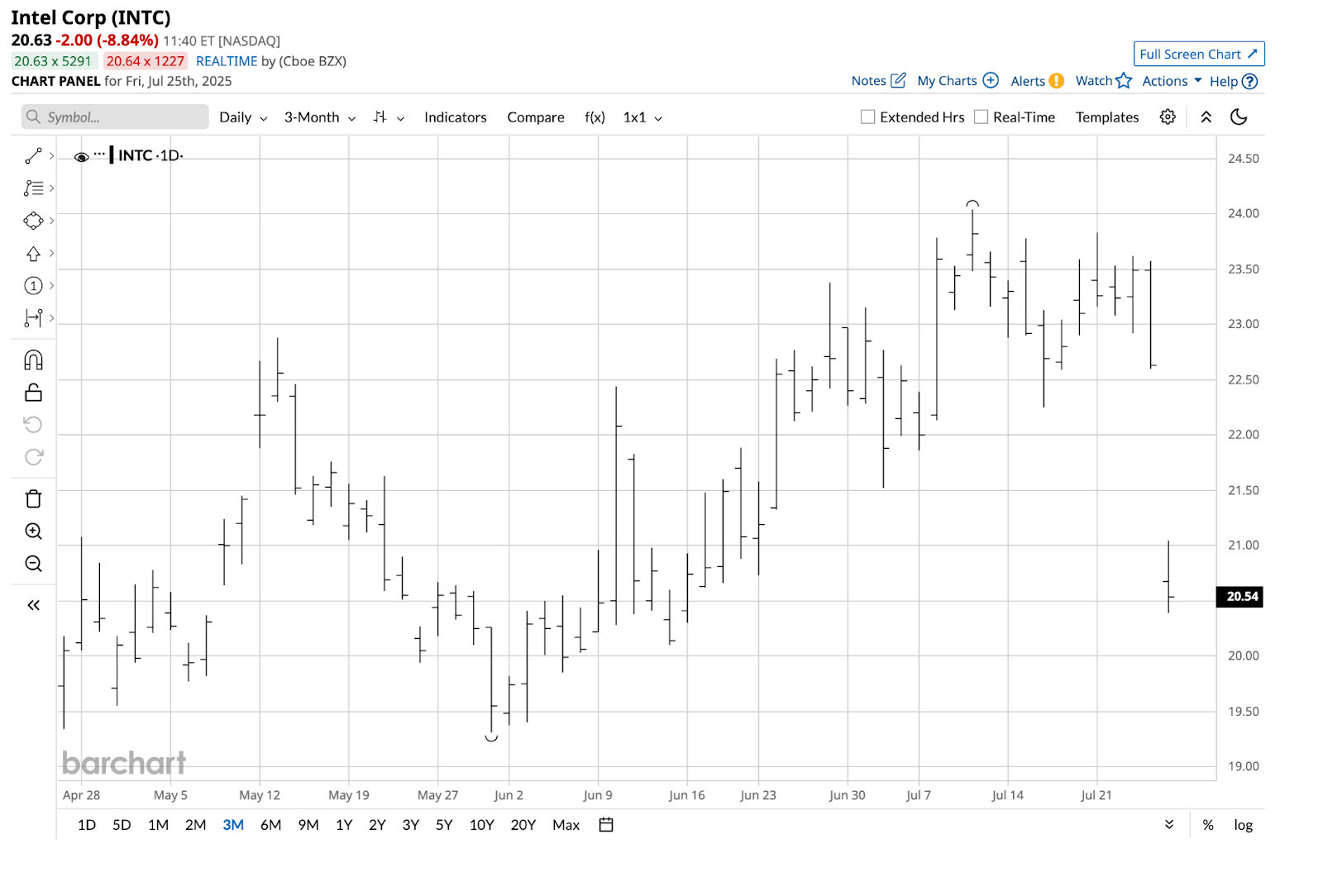

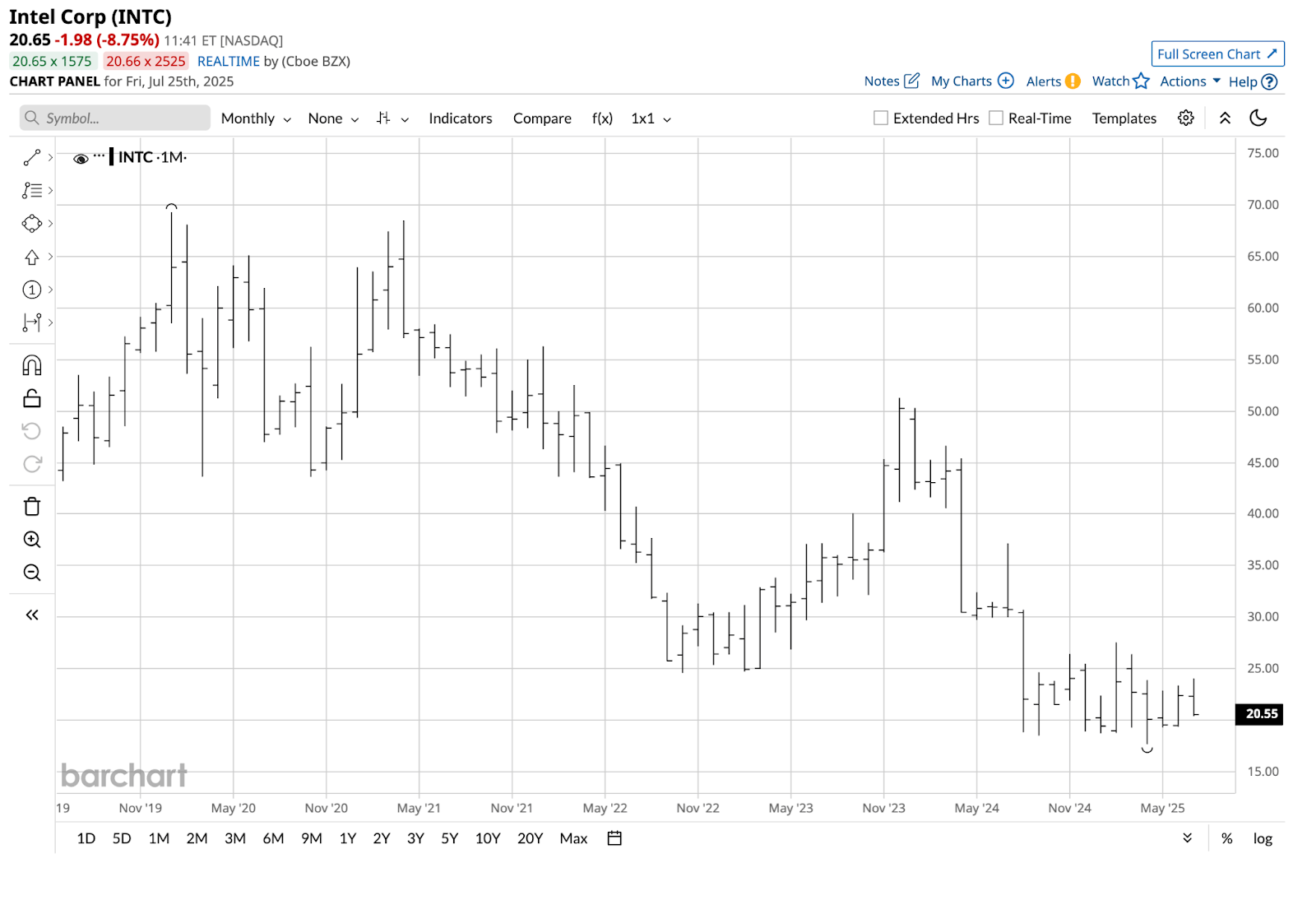

The extreme divergence between individual stock volatility and compressed index volatility creates opportunities for traders who can exploit these spreads. Intel's current positioning near the bottom of its trading range between $17.67 and $27.55, combined with new CEO leadership implementing aggressive cost-cutting measures, presents a contrarian setup for patient traders.

The January 2026 expiration window allows sufficient time for restructuring initiatives to impact financial results, while the call spread structure limits downside risk in a volatile environment. Technical support levels at $20.10 and $19.31 provide reference points for risk management.

SMART TRADE IDEA

Bull Call Spread on INTC

Trade Setup: Buy $21 Call / Sell $26 Call, January 16, 2026 expiration.

Cost: $1.50 ($150 per spread)

Max Profit: $3.50 ($350 per spread)

Breakeven: $22.50

Management Plan – Example: Exit at 50 percent loss, roll up, or take profits if INTC's share price reaches $26.

After the latest earnings disappointment, the INTC vertical bull call spread is a contrarian trade in the chip company. The January 2026 expiration allows the CEO time to make changes that can impact the bottom line by the end of this year. Moreover, the call spread takes advantage of the short-term gap that sent INTC shares from a low of $22.60 on July 24 to a high of $21.05 on July 25.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

The price action in its shares highlighted how INTC's earnings shocked market participants. The stock gapped lower, moving toward two short-term technical support levels.

As the daily three-month chart highlights, support levels are at the June 13, 2025, low of $20.10 and the May 30, 2025, low of $19.31 per share.

The long-term monthly chart highlights critical technical support at the April 2025 low of $17.67, with INTC in a bearish trend since the late 2023 high of $51.28. However, the stock has been range trading between $17.67 and $27.55 since September 2024. At the $20.50 level, INTC shares are closer to the bottom end of the trading range than the top.

INTC's new CEO bluntly reacted to the latest earnings, saying "No more blank checks," as the company had "invested too much, too soon, without adequate demand." Layoffs are on the horizon, as the company plans to reduce bureaucracy, cancel some pending projects, and consolidate other business lines. The reorganization could translate into improved bottom-line results.

A January 16, 2026, $21 - $26 vertical bull call spread on INTC will benefit from the company's streamlining plans if they translate to a bottom-line improvement by the end of this year. The top end of the call spread is below $27.55 technical resistance level. The call spread offers a better than 1:2.3 risk-reward ratio.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.

LATEST MARKET BREAKDOWN

Watch on Youtube

That's it for today!Before you go we'd love to know what you thought of today's newsletter to help us improve the experience for you. |