- Smart Options Trader

- Posts

- Interest Rates - What may be coming

Interest Rates - What may be coming

Lower Interest Rates Could Be on the Horizon. Read on to get Andy's take on this.

🕒 Market Overview: While the Fed lowered the short-term rate in the Fed Funds Rate as inflation data has declined to around the 3% level, the administration believes that the Fed is moving far too slowly.

🔄 Sector Insight: A recovery in the bond market, would send interest rates lower.

💰 Today's Trade Idea: Bull Call Spread on TLT.

SMART TRADE IDEA

Bull Call Spread on TLT

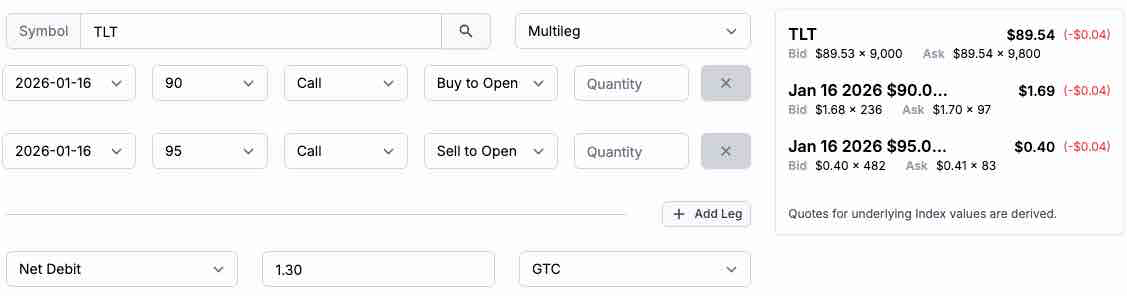

Trade Setup: Buy $90 Call / Sell $95 Call, January 16, 2026, expiration

Cost: $1.30 ($130 per spread)

Max Profit: $3.70 ($370 per spread)

Breakeven: $91.30 on January 16, 2026

Management Roll up or take profits if TLT’s price reaches $95.00 per share January 2026.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Smart AnalysisA Wall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

A Battle Between the Central Bank and White House

The ongoing Battle Royale between President Trump and Fed Chairman Jerome Powell has an end date, which is May 2026, when the Chairman’s term ends, and the President will appoint a successor. President Trump has not been shy about his desire for a lower Fed Funds Rate, stating it should be 2% lower than the current 3.875% midpoint. Chairman Powell and the FOMC have only lowered the short-term interest rate by 50 basis points in 2025, initially citing the potential for tariff-related stagflation and uncertainty about inflationary pressures. While the Fed lowered the short-term rate in the Fed Funds Rate as inflation data has declined to around the 3% level, the administration believes that the Fed is moving far too slowly.

Victories and Funding the U.S. Debt

The administration had been chalking up victories over the past few months, with the latest win being the passage of the Big Beautiful Bill. President Trump believes that the BBB will ignite an economic boom, while opponents worry that the price tag will increase the U.S. debt to an even higher, unsustainable level. Meanwhile, funding the over $38.17 trillion debt costs nearly $1.48 trillion annually, and lower rates would reduce the cost.

Stubborn Inflation- Bonds in a Range

Inflation has declined toward the central bank’s 2% target, but the impacts of tariffs continue to filter through the economy. In November 2025, the odds favor lower rates, as the Trump administration is likely to use its influence to push monetary policy in its desired direction.

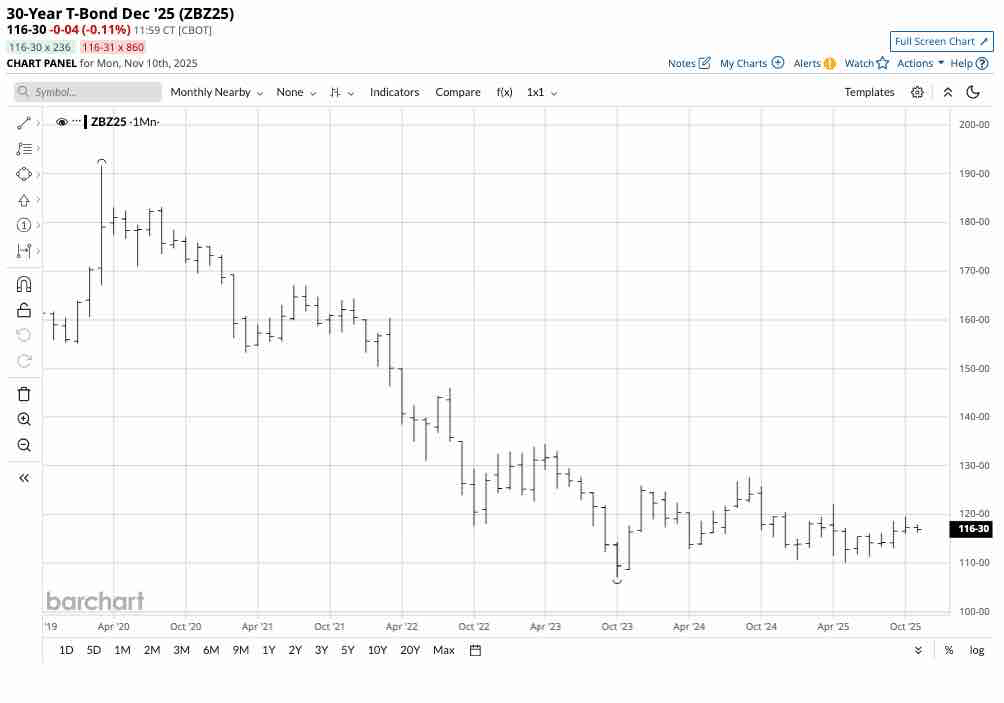

Source: Barchart

The monthly chart highlights the bearish trend that took the long bond futures from the 2020 high to the October 2023 low of 107-04. Since December 2024, the long bond futures have traded in a 110-01 to 127-22 range. At the 116-29 level in November 2025, the long bond futures trend has a bearish bias, with the futures below the midpoint of the trading range after trading at the bottom in May.

The case for lower rates

The Trump administration wants interest rates to fall, criticizing the Federal Reserve and its Chairman, Jerome Powell, for not reducing the short-term Fed Funds Rate too slowly.

Inflation has moved towards the Fed’s 2% target. The latest PCE data is steady at just below the 3% level on the core reading. The government shutdown had the central bank operating in the dark. The employment data have been weak, providing support for lower short-term rates. Meanwhile, President Trump will appoint Chairman Powell’s successor when his term ends in May 2026 or sooner. The appointee and any FOMC appointees could give the President a majority and will likely favor lower short-term interest rates through monetary policy easing. Technically, the long bond futures have remained above the long-term technical support levels at the May 2025 low of 110-01 and the October 2023 low of 107-04.

The case for higher rates

The U.S. debt exceeds $38 trillion and is rising, which weighs on bond demand and prices. The President’s economic package allows for a substantial increase in debt.

Moody’s downgraded U.S. sovereign debt in 2025, which weighed on bonds and increased long-term interest rates. U.S. tariff policy could deter foreign buyers from the U.S. government bond market, putting upward pressure on long-term interest rates. The bifurcation of the world’s nuclear powers and U.S. sanctions could inhibit the demand for U.S. sovereign debt securities.

At the August Jackson Hole gathering, the Fed signaled that its restrictive monetary policy may not be appropriate in the current environment. The central bank cut rates by 25 points in September and again in late October. Meanwhile, a lower Fed Funds Rate does not guarantee lower long-term U.S. government interest rates.

After falling for over five years, the long-term U.S. government bonds have settled into a trading range since late 2023. In a flight to quality scenario, or if the administration continues to achieve economic success, the long bonds could potentially trade to the top end of the trading range, which is around the 127 level. A break above the September 2024 127-22 high could lead to a technical rally.

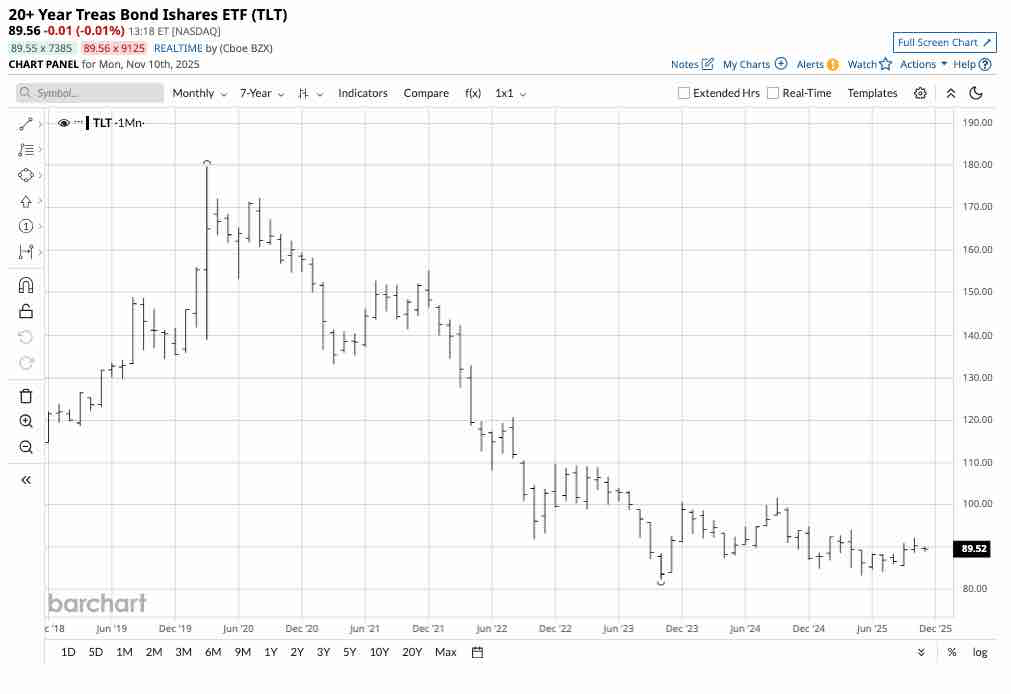

The iShares 20+ Year Treasury Bond ETF (TLT) tracks U.S. long-term bond prices. TLT moves lower when interest rates rise and higher when they decline. At $89.56 per share, TLT had over $49 billion in assets under management. TLT trades an average of nearly 32 million shares daily and charges a 0.15% management fee. TLT is a highly liquid ETF product.

Source: Barchart

The monthly chart highlights TLT’s trading range of $83.30 to $101.64 since late 2023. A recovery in the bond market, which would send interest rates lower, could cause TLT to rally towards the $100 per share level. At $89.56, the TLT $90-$95 vertical bull call spread, priced at $1.30 or lower per spread for January 16, 2026, expiration, has an attractive risk-reward ratio of better than 1:2.85.

The long-term U.S. government bond futures and TLT ETF remain near the bottom of a tight trading range. The risk-reward on the January 16, 2026, $90-$95 call spread is an attractive and low-risk spread that will benefit from rising long-term U.S. bond prices and lower interest rates. Appointments to the Fed will likely put pressure on the central bank to lower short-term rates, which could filter through the yield curve.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.