- Smart Options Trader

- Posts

- JPM Profits as Pharma Obesity Bidding Wars Escalate

JPM Profits as Pharma Obesity Bidding Wars Escalate

Novo hijacks Pfizer's obesity biotech deal as Lilly dominates the $150B GLP-1 market. One sector profits no matter who wins.

Novo hijacks Pfizer's obesity biotech deal as Lilly dominates the $150B GLP-1 market. One sector profits no matter who wins.

🕒 Market Overview: Novo Nordisk launches $8.5B unsolicited bid for Metsera, triggering pharmaceutical bidding war.

🔄 Sector Insight: Eli Lilly's tirzepatide franchise generates $10.1B quarterly revenue, cementing GLP-1 market leadership.

💰 Today's Trade Idea: Bull Call Spread on JPM captures investment banking fee surge from accelerating M&A activity.

SMART TRADE IDEA

Bull Call Spread on JPM

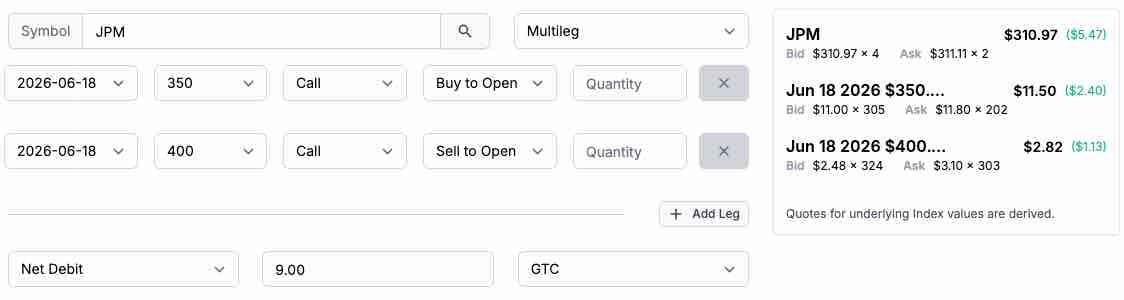

Trade Setup: Buy $350 Call / Sell $400 Call, June 18, 2026, expiration.

Cost: $9.00 ($900 per spread)

Max Profit: $41 ($4,100 per spread)

Breakeven: $359 on June 18, 2026

Management Plan: Exit at 50% loss, roll up, or take profits if JPM’s share price reaches $385 or higher.

A bidding war in big pharma and booming M&A activity will cause investment banking fees to soar. Jamie Dimon, JPM’s CEO, is in the same position as Randolph and Mortimer Duke; regardless of whether JPM’s clients make money or lose money, JPM will receive its investment banking fees.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Smart AnalysisA Wall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

There is no doubt that the current regulatory and other U.S. government policies support increasing M&A activity over the coming months and until at least the 2026 mid-term elections, if not longer. Moreover, falling interest rates support mergers and acquisitions (M&A). The stronger cash-rich companies will likely compete for the best opportunities, but bidding wars could be on the horizon.

Meanwhile, the critical question for big pharma and other sectors, where merger and acquisition activity is expected to continue increasing, is whether these transactions will be accretive, adding value, or dilutive, subtracting value for the competing companies. While picking the winners can be highly lucrative, the potential for rewards comes with commensurate risks. As shares in companies like Metsera soar, the eventual acquirer could suffer indigestion and losses if they pay too much for a deal.

From my perspective, there is one sector that benefits from increased M&A activity, even if the deals ultimately prove costly to the acquirer. In the classic movie, Trading Places, Randolph and Mortimer Duke explain their business to Billy Ray Valentine (Eddie Murphy), "The good part, William, is that, no matter whether our clients make money or lose money, Duke & Duke get the commissions." In the world of M&A, financial institutions with the strongest investment banking presence make their fees, whether their clients make or lose money.

JP Morgan (JPM) is a leading player in the pharma and biotech sector, based on deal volume and value.

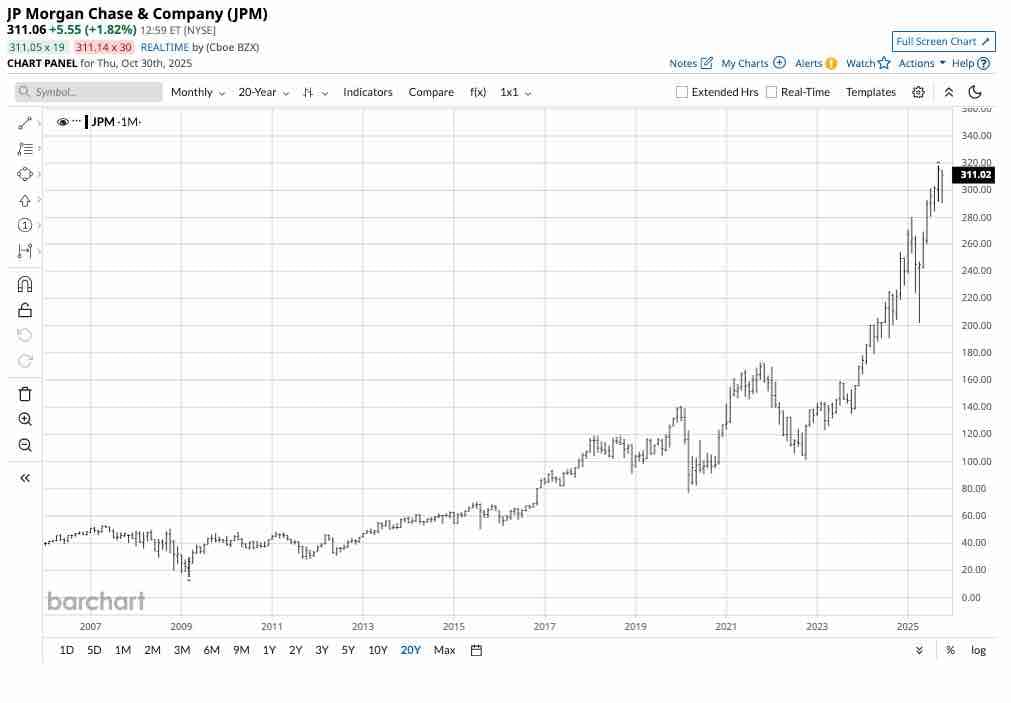

The monthly chart highlights the bullish trend in JPM shares. At the $311 level, JPM trades at an attractive P/E ratio of less than 16 times earnings.

The June 18, 2026, $350-$400 vertical bull call spread on JPM at $9 or lower has a risk-reward ratio of better than 1:4.5.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.