- Smart Options Trader

- Posts

- Markets Ignore July 9 Deadline That Triggered April Selloff

Markets Ignore July 9 Deadline That Triggered April Selloff

The calm before the storm? Trump's tariff deadline approaches while VIX sits unusually low. The setup for massive volatility is building.

The calm before the storm? Trump's tariff deadline approaches while VIX sits unusually low. The setup for massive volatility is building.

🕒 Market Overview: VIX remains subdued despite Trump's tariff deadline approaching in seven days

🔄 Sector Insight: Put/call ratios elevated for index options as institutions buy downside protection.

💰 Today's Trade Idea: Long strangle on TLT targeting post-deadline volatility expansion.

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

Markets face unprecedented uncertainty as Trump's reciprocal tariff "pause" expires July 9. This deadline could trigger the highest U.S. effective tariff rate since 1936, with economic modeling suggesting a permanent GDP reduction of $100 billion annually. The Federal Reserve remains in "wait and see" mode, explicitly stating that tariff uncertainty has prevented rate cuts. This creates a unique environment where fiscal policy through tariffs and monetary policy through Fed rates work at cross purposes.

The current setup mirrors March 2018's pre-tariff announcement calm, but with a critical difference: March 2018 was sector-specific, while July 9 represents universal tariffs affecting virtually every major U.S. trading partner simultaneously. When Trump announced these tariffs in April, they triggered the fifth-worst two-day market decline since World War II.

Sector and Stock Watch – Identifying Key Movers

Sector divergence will likely exceed broad market moves. Automotive faces the most severe potential impact from substantial tariffs on vehicles and components. Technology confronts significant duties on Chinese components despite recent AI-driven strength. Industrial companies already face elevated costs on steel and aluminum inputs.

Defensive sectors including consumer staples, healthcare, and utilities demonstrated resilience during April's volatility. These domestic-focused names carry less supply chain exposure and therefore less tariff risk. The options market reflects this dynamic, with Veeva Systems showing significant call volume on July expiration contracts, while GSK demonstrates defensive put positioning.

Trading Strategy in Focus – How to Play the Market

The setup presents classic binary risk characteristics. If negotiations succeed, volatility could collapse to extremely low levels with risk assets rallying broadly. If negotiations fail, volatility could spike beyond April levels with broad market declines and significant sector divergence.

The asymmetric risk profile suggests structured options strategies may be more appropriate than simple directional equity bets. Long volatility positions targeting the post-deadline period offer the most compelling risk-reward setup, particularly in liquid instruments like TLT that historically exhibit correlated volatility during market stress events.

SMART TRADE IDEA

Long Short-Term Strangle on TLT

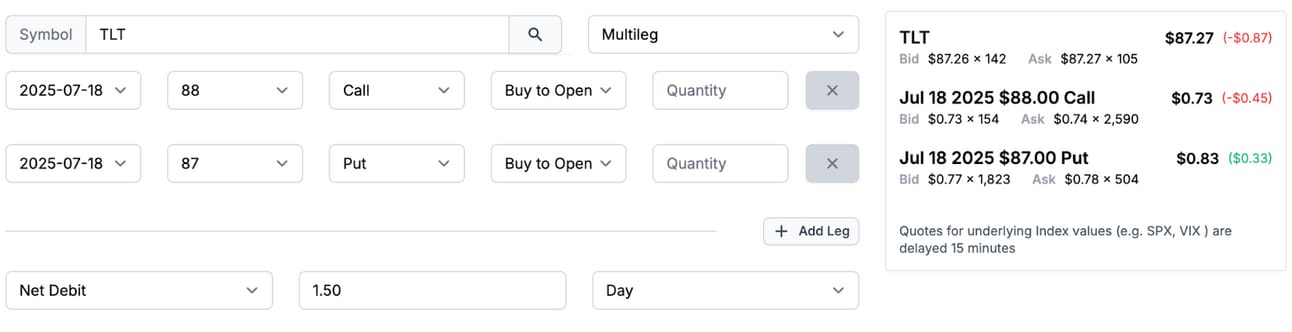

Trade Setup: Buy 88 Call / Buy 87 Put July 18, 2025 expiration

Cost: $1.50 ($150 per spread)

Max Profit: Unlimited

Breakeven: $85.50/$89.50

Management Plan:

Hedge and create vertical Call or put spreads if TLT breaks out to the upside or downside.

Those seeking a long volatility play for the post-July 9 tariff line in the sand could consider a long straddle on the highly liquid TLT ETF, as any significant market move could cause TLT shares to experience similar volatility.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

For now, Wednesday, July 9, marks the U.S. trade policy line in the sand, leading to increased speculation and hedging activity. The impact of the April 2 "Liberation Day" announcement and its subsequent market reaction has not faded from the memories of market participants. The VIX spiked to over 60, and the leading stock market indices fell to their lows on April 7. Traditionally, a significant selloff in stocks leads market participants to the safety of the bond market. Still, U.S. government bonds fell in tandem with the stock market. The TLT ETF reflects the prices of government bonds with maturities of twenty years or longer.

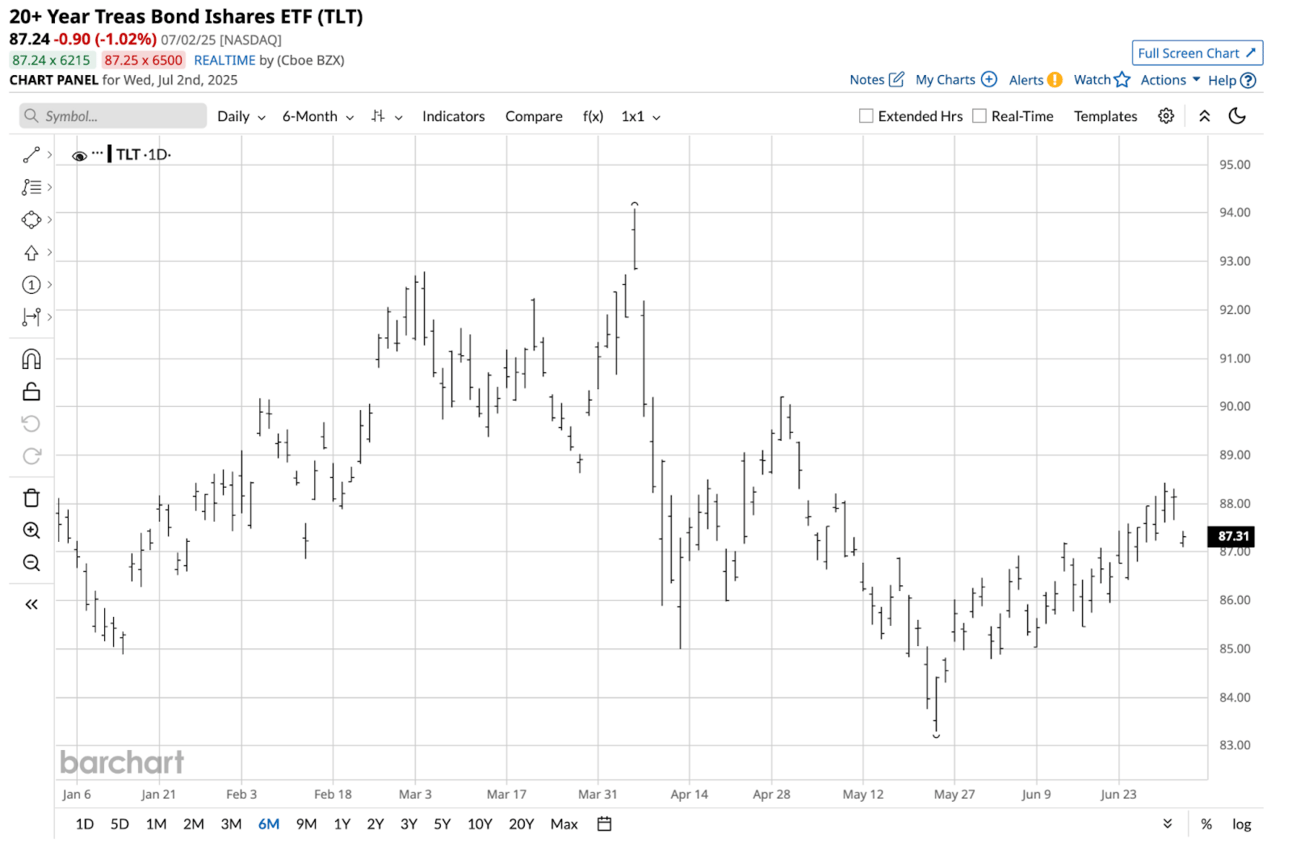

The chart shows that TLT fell to a low of $85.00 on April 11 and a lower low of $83.30 on May 22. TLT's short-term technical support is at the May 22 low of $83.30, with technical resistance at the April 29 high of $90.21 per share. At around $87.30, TLT is just above the midpoint of the technical levels.

The success or failure of the President's economic package, his Big Beautiful Bill, and the July 9 tariff deadline could have a significant impact on the stock and bond markets. Moreover, reduced liquidity during the summer could exacerbate market volatility if any surprises arise.

A short-term long volatility position in TLT could yield a significant return if high price variance returns to markets after the July 9 tariff deadline.

At $87.30 on TLT, the short-term, July 18, 2025, $87 Put-$88 Call strangle, priced at around $1.50 per share, could offer value if substantial market volatility is on the horizon. The breakevens are $89.50 on the upside, below the technical resistance, and $85.50 on the downside, above the technical support level. Implied volatility around 13% is attractive in the current uncertain environment, and the options are highly liquid with substantial open interest at both strike prices.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.

LATEST MARKET BREAKDOWN

Watch on Youtube

That's it for today!Before you go we'd love to know what you thought of today's newsletter to help us improve the experience for you. |