- Smart Options Trader

- Posts

- Lithium Stock Surges as Uncle Sam Becomes Partner

Lithium Stock Surges as Uncle Sam Becomes Partner

A restructured government deal gave taxpayers equity in Lithium Americas, sparking massive call volume. The playbook for strategic sectors just changed.

A restructured government deal gave taxpayers equity in Lithium Americas, sparking massive call volume. The playbook for strategic sectors just changed.

🕒 Market Overview: Washington took a 5% stake in Lithium Americas, sparking after-hours gains and record call volume across critical minerals.

🔄 Sector Insight: Traders now view government partnerships as validation rather than interference, repricing risk across defense, energy, and materials sectors.

💰 Today's Trade Idea: Bull Call Spread on XOM targets government partnership potential with defined risk exposure through March 2026.

SMART TRADE IDEA

Bull Call Spread on XOM

Trade Setup: Buy $115 Call / Sell $130 Call, March 20, 2026 expiration.

Cost: $4.15 ($415 per spread)

Max Profit: $10.85 ($1,085 per spread)

Breakeven: $119.15.

Management Plan: Exit at 50% loss, roll up, or take profits if XOM’s price reaches $125 before March 20, 2026.

While selecting the next target sector for the administration’s partnership model, energy could be in the crosshairs. Meanwhile, XOM is already in a bullish trend with U.S. energy policy supporting higher earnings for the leading integrated oil company.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

The Trump administration is rewriting industrial policy by taking direct equity positions in strategic sectors. This marks a departure from traditional subsidies and loans toward ownership stakes that align government interests with shareholder returns. The Lithium Americas deal—structured as a no-cost warrant package worth 5% of the company—demonstrates Washington's willingness to become an active investor in critical supply chains.

This shift carries broader implications for market volatility and sector rotation. When the government signals strategic importance through equity participation, it reduces regulatory uncertainty and creates a new category of risk-adjusted assets. Traders are responding by repricing companies at the intersection of national security and investment opportunity.

The critical minerals sector experienced immediate impact, with call options volume surging across lithium, rare earth, and battery material producers. Options activity suggests institutional positioning for additional government partnership announcements across energy, agriculture, and defense manufacturing.

Subsection 2: Sector and Stock Watch – Identifying Key Movers

Energy sector dynamics are shifting as administration policies favor domestic production expansion. Traditional energy companies face a unique positioning opportunity as potential candidates for government strategic partnerships, particularly those with scale, operational capacity, and alignment with energy independence objectives.

ExxonMobil sits at the convergence of multiple favorable factors: dominant market position, administration policy support, and a business model aligned with domestic energy security. The company operates as the largest U.S. integrated oil producer with global competitive positioning against state-owned enterprises like Saudi Aramco.

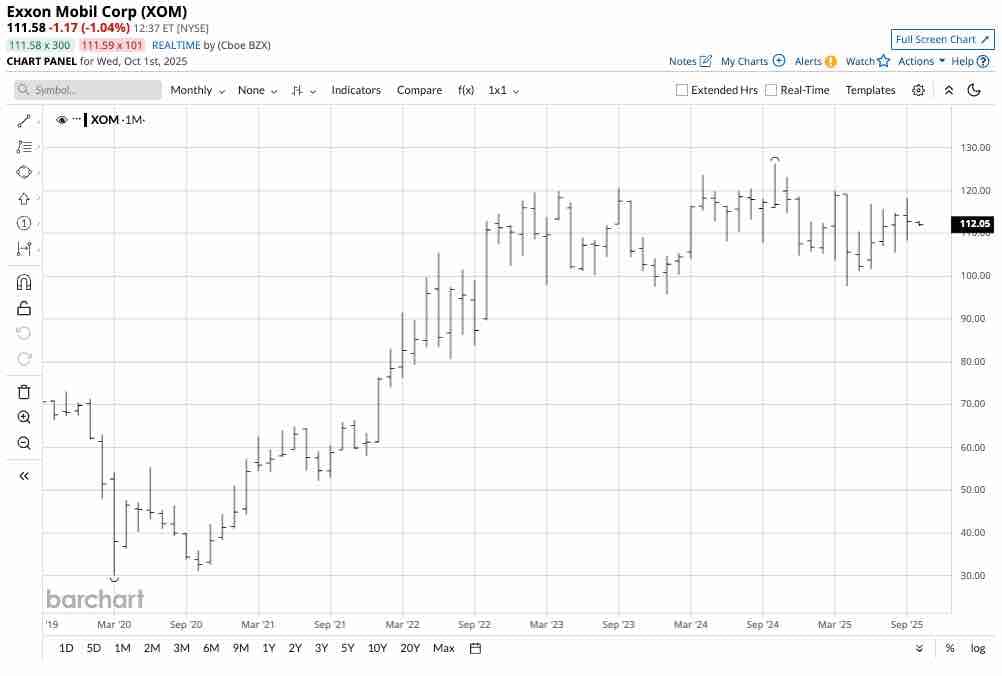

Technical patterns show XOM consolidating within a defined range after establishing support above key levels. The stock maintains strong dividend characteristics while demonstrating resilience during periods of commodity price volatility. Institutional interest in energy names has increased as policy clarity around domestic production incentives solidifies.

Subsection 3: Trading Strategy in Focus – How to Play the Market

Current market conditions favor defined-risk strategies that capture potential upside from government partnership announcements while limiting downside exposure. Bull call spreads provide asymmetric risk-reward profiles suited to scenarios where catalysts may materialize over extended timeframes.

The vertical spread structure caps maximum loss while maintaining participation in directional moves. This approach proves effective when trading policy-driven narratives where timing remains uncertain but directional bias appears favorable. Longer-dated expirations accommodate the extended timeframes typical of government partnership negotiations and announcements.

Position sizing becomes critical when trading policy speculation. The defined-risk nature of vertical spreads allows traders to allocate capital proportionally to conviction level without exposure to unlimited downside scenarios.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

Lithium through Lithium Americas, rare earths with MP Materials, and chips through Intel are more than test cases; they are the first of many companies the U.S. government will partner with to support the Trump administration’s Made-in-America strategy. In considering the other strategic sectors, the administration may use the recent partnerships as a model; energy and agriculture are potential candidates. The shift in U.S. energy policy to supporting the production and consumption of fossil fuels to address inflation, achieve energy independence, and increase revenues by exporting oil and gas could be ripe for deals. Meanwhile, agricultural companies and processors are among the candidates, as the United States is a leading exporter of corn, soybeans, wheat, and other agricultural products. Energy prices are currently under control, as oil and gas prices have declined substantially from their highs over the past few years. Agricultural prices, specifically those of grains and oilseeds, have plummeted from their highs in 2022. However, energy and agricultural commodities have long and volatile price histories that reflect the cyclical nature of commodity markets. Prices tend to rise to levels where production increases, inventories grow, consumers seek substitutes or forgo purchases, and prices reach highs and turn lower. Conversely, prices tend to decline to levels where production decreases, inventories decline, and consumers increase their purchases, leading to prices reaching lows and then turning higher. The strategic position of energy and agricultural commodities for the United States means that the government could seek similar deals that will support these industries and their leading companies when prices decline, ensuring production aligns with the model.

Given the administration’s support for traditional energy production and its “drill-baby-drill” and “frack-baby-frack” policies that favor the leading U.S. integrated oil companies, ExxonMobil (XOM) could be a candidate for one of these deals with Uncle Sam in the currrent environment. At $112.25 per share, XOM has a market capitalization of over $480 billion. XOM trades an average of over 16.3 million shares daily and currently pays an attractive dividend yield of over 3.5%. XOM has two key advantages: it is the leading U.S. integrated traditional energy company, and it enjoys the administration’s support from a regulatory and policy standpoint. Moreover, government support in the form of a partnership could only serve to enhance the company’s influence when competing with Saudi Aramco, the world’s leading energy company.

The lithium, rare earth, and even semiconductor partnerships would be small potatoes compared to a U.S. government deal with XOM. It is no secret that President Trump loves to go big with everything he does, and a deal with the leading U.S. oil company would be the biggest, given XOM’s stature.

As the chart highlights, XOM rose from its pandemic-inspired low of $30.11 per share in March 2020 to the most recent high of $126.34 in October 2024. XOM shares have been trading in a range of approximately $100 to $120 over the past three years.

Even if the U.S. government does not pursue a strategic and investment partnership with XOM, the administration’s policies favor the upside when the current consolidation period comes to an end.

The March 20, 2026, XOM $115-$130 vertical bull call spread at $4.15 per spread or lower has at least a better than 1:2.6 risk-reward ratio.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.