- Smart Options Trader

- Posts

- Lumber, Tariffs, Interest Rates, and an Opportunity...

Lumber, Tariffs, Interest Rates, and an Opportunity...

With the odds of lower short-term interest rates increasing, this may be an excellent time to put lumber-related assets on your investment and trading radar.

Free VIX Playbook Webinar Later Today! 3:30pm CT

🕒 Market Overview: While trading lumber futures is highly risky, there are stocks and ETFs that are correlated with lumber prices.

📈 Sector Insight: With the odds of lower short-term interest rates increasing, this may be an excellent time to put lumber-related assets on your investment and trading radar.

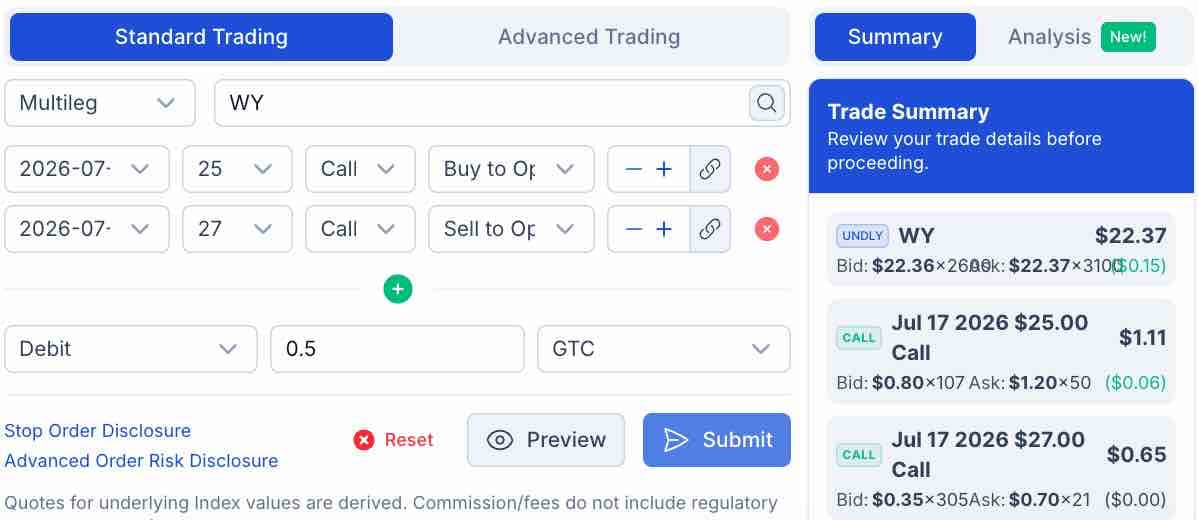

💡 Today's Trade Idea: Bull Call Spread on WY.

SMART TRADE IDEA

Bull Call Spread on WY

Trade Setup: Buy $25 Call / Sell $27 Call, July 17, 2026, expiration.

Cost: $0.50 ($50 per spread)

Max Profit: $1.50 ($150 per spread)

Breakeven: $25.50 on WY shares on July 17, 2026

Risk-reward: 1:3

Management Plan: Roll up, or take profits if WY’s price reaches $27.50 per share before July 17, 2026. Lower interest rates could support lumber demand in 2026 for new home construction. Moreover, the spread provides an eight-month window that includes the peak construction season, where lumber prices tend to reach annual highs.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Smart AnalysisA Wall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

Lumber, Tariffs, Interest Rates, and an Opportunity...

Lumber is a critical industrial commodity, as it is an essential ingredient in the construction of new homes and infrastructure. Lumber futures are traded on the Chicago Mercantile Exchange. However, the lumber futures market is highly illiquid, leading to substantial price volatility.

Lumber prices reached an all-time high in May 2021, and a lower but substantial peak in March 2022, when U.S. short-term interest rates were near zero, and longer-term mortgage rates fell below the 3% level. As inflationary pressures rose, the U.S. Federal Reserve hiked rates, with long-term rates following suit, pushing lumber prices substantially lower.

The CME sought to increase volume and open interest in the lumber futures market by replacing the previous random-length futures with more flexible physical futures. However, liquidity remains challenging in August 2025.

In late 2025, nearby lumber futures are trading below $540 per 1,000 board feet, well below the 2021 and 2022 highs. While trading lumber futures is highly risky, there are stocks and ETFs that are correlated with lumber prices. With the odds of lower short-term interest rates increasing, this may be an excellent time to put lumber-related assets on your investment and trading radar.

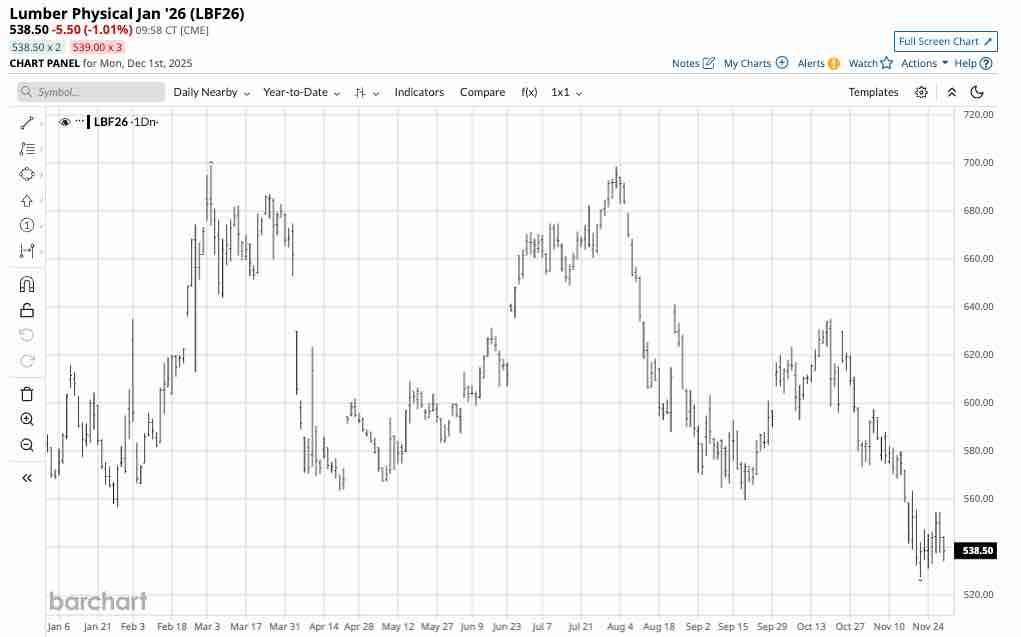

Lumber prices have come down

Source: Barchart

Nearby physical CME lumber futures have traded between $527.50 and $699.00 per 1,000 board feet in 2025.

At $538.50 on December 1, the wood futures for nearby delivery are near the low end of the trading range. The short-term trend since the August 1 slightly lower 2025 high of $698.50 is bearish. Lumber is now in the offseason due to construction projects slowing during winter.

Tariffs could impact availability

Canada is the world’s leading lumber-exporting country, with the United States a major destination for Canadian wood. The United States is the top wood-importing country, with around 45% more wood imports than second-place China.

Tariffs distort prices, creating oversupply in some regions and shortages in others. The ongoing tariff dispute between the United States and Canada could significantly impact U.S. lumber prices over the coming months.

The futures are dangerous

The Chicago Mercantile Exchange delisted the random-length lumber futures contracts in 2022, replacing them with more flexible physical lumber futures. The exchange had hoped that the physical lumber futures with a lower contract size and more flexible delivery specifications would increase hedging and speculative activity.

The open interest, which represents the total number of open long and short positions in the physical lumber futures market, has remained low, with fewer than 9,500 open contracts in early December 2025. Daily trading volume of under 1,000 contracts on most days is far below the level that would encourage critical mass.

The bottom line is that the physical lumber futures remain untradeable, and market participants seeking lumber exposure must seek alternatives.

WY is a lumber-related REIT

Weyerhaeuser Company operates as a real estate investment trust with ownership or control of timberlands in the United States and long-term leases in Canada.

At $22.30 per share, the U.S. company had a market capitalization of $16.01 billion. WY trades an average of over six million shares daily, making it a highly liquid lumber-related equity. WY pays shareholders an annual dividend of $1.04 per share, translating to an attractive 4.66% yield.

WY is a REIT with a call option on lumber attached, as rising lumber prices support the company’s earnings.

Two ETFs that track lumber prices

At $70.17 per share, the iShares Global Timber & Forestry ETF (WOOD) owns a portfolio of lumber-related companies. WOOD is an ETF with over $228 million in assets under management. WOOD trades an average of 10,361 shares daily and charges a 0.40% management fee. WOOD’s $1.09 annual dividend translates to a 1.55% yield.

At $28.82 per share, the Invesco MSCI Global Timber ETF (CUT) also owns a portfolio of lumber-related companies. CUT is an ETF with nearly $42 million in assets under management. CUT trades an average of 15,086 shares daily and charges a 0.60% management fee. CUT’s $0.97 annual dividend translates to a 2.43% yield.

Both CUT and WOOD have exposure to WY.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.