- Smart Options Trader

- Posts

- Mag 7 Earnings Gauntlet Begins

Mag 7 Earnings Gauntlet Begins

Four trillion-dollar tech giants report within 48 hours as options signal unprecedented volatility divergence between index calm and single-stock tension.

Four trillion-dollar tech giants report within 48 hours as options signal unprecedented volatility divergence between index calm and single-stock tension.

🕒 Market Overview: VIX hits five-year July low while Mag 7 options price extreme volatility

🔄 Sector Insight: Tech earnings convergence creates systemic risk as four companies control half of S&P gains

💰 Today's Trade Idea: Bear Put Spread on MSFT targets post-earnings correction from all-time highs

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

The Federal Reserve meeting coincides with the most consequential tech earnings week of the summer, creating a volatile cocktail of policy uncertainty and corporate fundamentals. Fed Funds futures price just a 2.6% chance of July rate cuts after robust economic data, while Trump's August 1 tariff implementation looms over Apple and Tesla supply chains. The VIX closed at 15.03 – its lowest July reading in five years – yet individual tech names are pricing in dramatic post-earnings moves.

This volatility paradox reflects a market betting that positive Big Tech news can sustain the broader rally even as macro headwinds intensify. The challenge lies in threading the needle between AI spending concerns, margin compression from tariffs, and a still-hawkish Federal Reserve that could reprice growth stock valuations overnight.

Sector and Stock Watch – Identifying Key Movers

Microsoft enters earnings at all-time highs with options implying a 4% two-day range, while Apple's straddle suggests a 4.2% swing – nearly triple its typical realized volatility. Meta has seen call open interest surge to 1.1 million contracts after overnight positioning, indicating traders expect upside surprises from improved ad spending trends.

The most telling signal comes from Nvidia, whose expected move balloons above 9% despite reporting four weeks away. This premium expansion across the AI ecosystem signals that traders view these earnings as potential inflection points for the entire artificial intelligence narrative, not just individual company results.

Trading Strategy in Focus – How to Play the Market

The elevated put skew in Magnificent 7 names creates opportunities for defined-risk bearish strategies, particularly in stocks trading near technical resistance. With three of four companies declining last quarter despite beating estimates, the market has learned to price in "positive prints, negative reactions" scenarios.

Bear put spreads offer attractive risk-reward profiles in this environment, allowing traders to capitalize on post-earnings corrections while maintaining defined maximum loss parameters. The strategy becomes particularly compelling when targeting stocks at or near all-time highs with limited technical support below current levels.

SMART TRADE IDEA

Bear Put Spread on MSFT

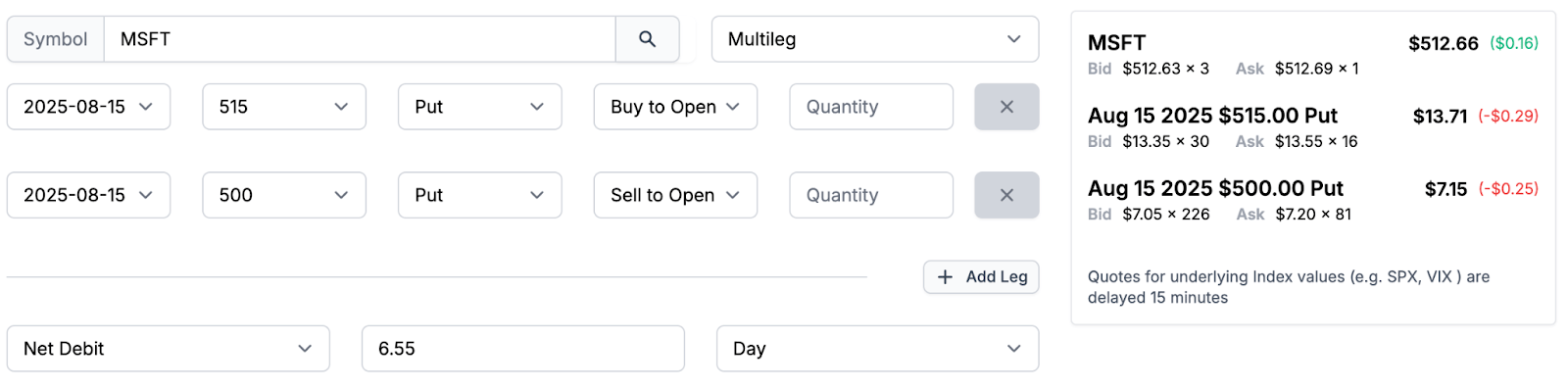

Trade Setup: Buy $515 Put / Sell $500 Put, August 15, 2025, expiration.

Cost: $6.55 ($655 per spread)

Max Profit: $8.45 ($845 per spread)

Breakeven: $508.45

Management Plan – Example: Exit at 50 percent loss, roll down, or take profits if MSFT shares reach $500 or lower.

The vertical put spread on MSFT is a contrarian trade in the current environment. If earnings are in line or below expectations, the shares could experience a downdraft. Taking profits or rolling the risk lower is critical following earnings if selling descends on MSFT following the earnings report, as the vertical bear put spread is a short-term risk position expiring on August 15.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

Comparing the VIX to the MAG seven stocks is an apples-to-oranges exercise. The VIX measures the implied volatility on the S&P 500 stock options, while the MAG seven trade on the NASDAQ. Meanwhile, the MAG seven stocks attract the most investment and speculative interest, creating a bifurcation of risk expectation levels.

Markets gravitate to where the action is, and these days, it is all about technology and AI. The bottom line is that the VIX is probably too low, and the implied volatilities of Mag 7 and technology stocks are probably too high in the current environment.

The Fed meets tomorrow, and while the odds of a Fed Funds Rate cut are low, trade deals, inflation data below 3%, and other factors suggest that a 4.375% Fed Funds Rate is likely too high. Markets reflect market sentiment, which is a function of the wisdom of crowds. In this case, the crowd is the investment and trading constituencies. Moreover, the markets are in the middle of summer, the vacation season, where liquidity can decline, leading to elevated price variance. Therefore, careful attention to risk-reward dynamics is critical as knee-jerk reactions to earnings or events can lead to explosive or implosive moves before mean reversion factors cause realignments.

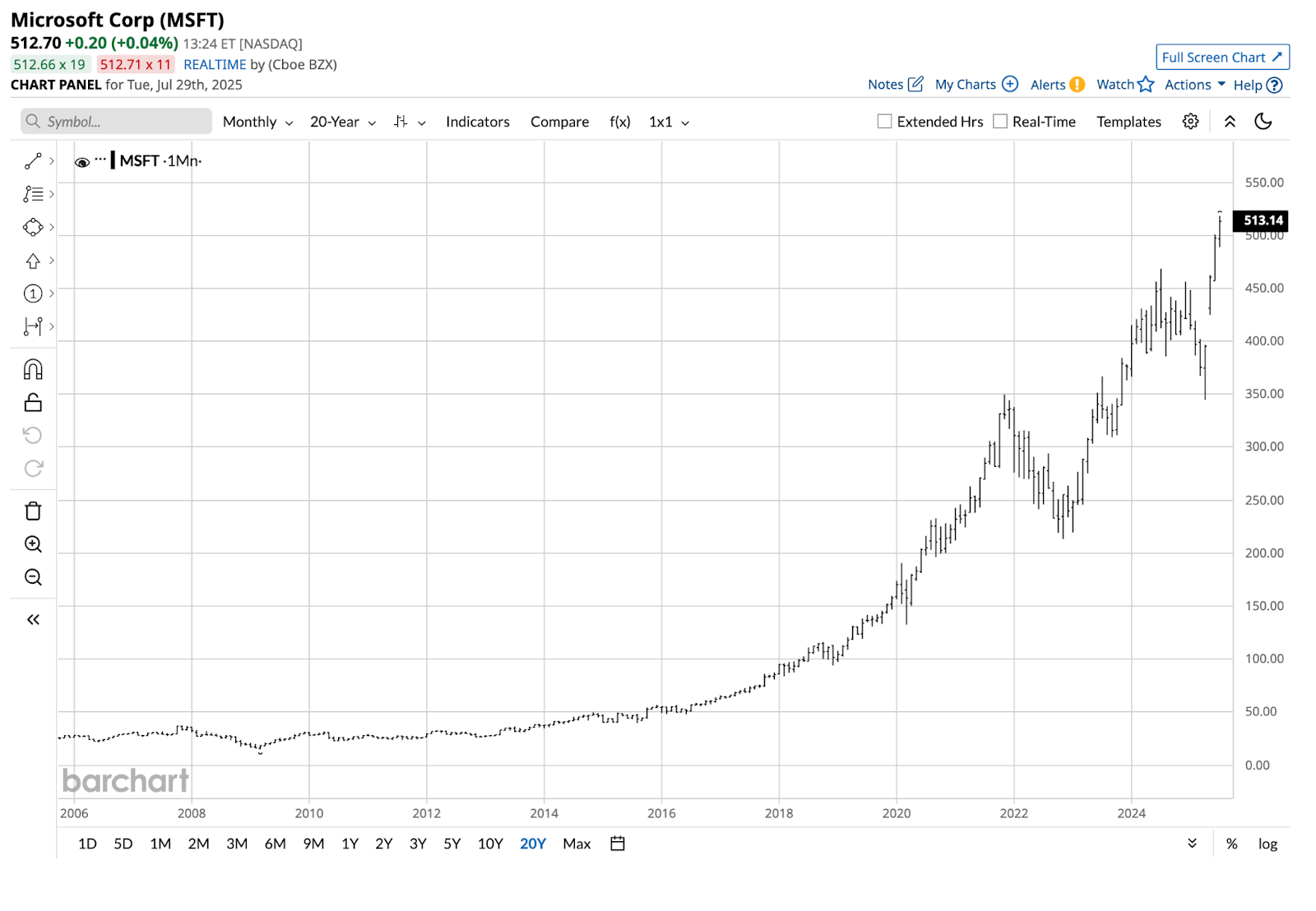

Microsoft (MSFT) is going into earnings with the stock near its all-time high.

The August 15, 2025, $515 - $500 vertical bear put spread at $6.35 could offer value and an attractive 1:1.36 risk-reward profile with a slightly positive implied volatility skew. to read The August 15, 2025, $515 - $500 vertical bear put spread at $6.55 could offer value and an attractive 1:1.29 risk-reward profile with a slightly positive implied volatility skew.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.

LATEST MARKET BREAKDOWN

Watch on Youtube

That's it for today!Before you go we'd love to know what you thought of today's newsletter to help us improve the experience for you. |