- Smart Options Trader

- Posts

- Meta's Shocking $10B Google Deal Reshapes AI Infrastructure

Meta's Shocking $10B Google Deal Reshapes AI Infrastructure

Silicon Valley stunned as tech giants forge unprecedented six-year partnership while building massive data centers. Professional traders dominate options flow with QQQ positioning strategy revealed inside.

Silicon Valley stunned as tech giants forge unprecedented six-year partnership while building massive data centers. Professional traders dominate options flow with QQQ positioning strategy revealed inside.

🕒 Market Overview: Meta commits $10B to Google Cloud over six years, reshaping AI infrastructure competition

🔄 Sector Insight: Heavy call activity in tech as MAG-7 stocks drive NASDAQ to record highs above $570

💰 Today's Trade Idea: Bull Call Spread on QQQ captures broad tech exposure with defined risk parameters

SMART TRADE IDEA

Bull Call Spread on QQQ

Trade Setup: Buy $600 Call / Sell $680 Call, March 20, 2026, expiration

Cost: $21.20 ($2,120 per spread)

Max Profit: $58.80 ($5,880 per spread)

Breakeven: $621.20 on the QQQ on March 20, 2026.

Management Plan: Exit at 50% loss, take profits, or roll up if QQQ’s price reaches $660.

The QQQ $600 and $680 strike prices for the March 20, 2026, expiration have substantial open interest, likely resulting in execution ease on a tight bid/offer spread. Technology has been the place to be over the past years, and AI innovations will likely continue the bullish trend into 2026 and beyond.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

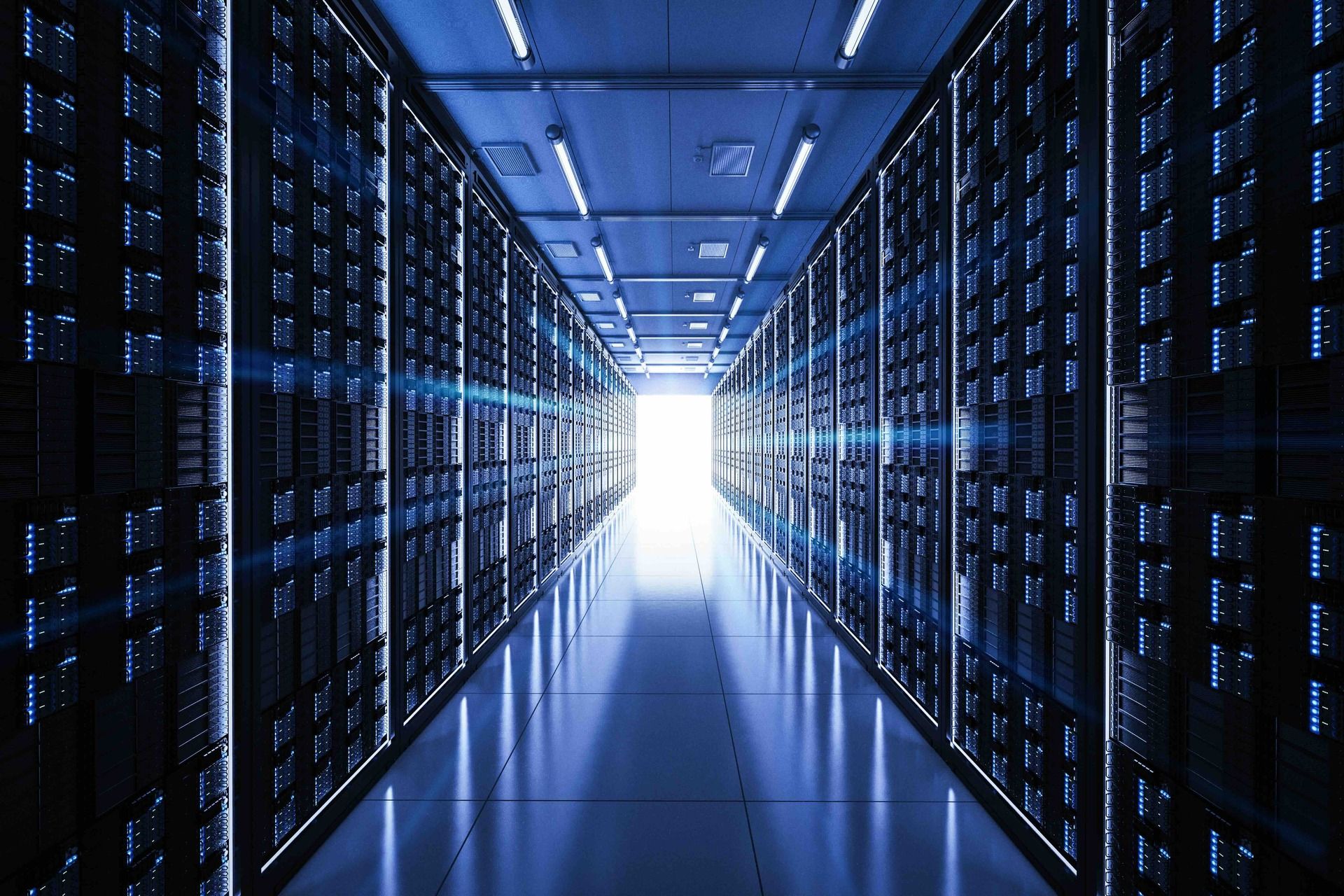

The AI infrastructure spending boom has reached a critical inflection point. With global AI infrastructure markets projected to hit $223.45 billion by 2030 at a 30.4% compound annual growth rate, corporate capital allocation toward computing power has become the defining investment theme of this cycle.

Powell's final Jackson Hole appearance has increased September rate cut odds, providing a supportive backdrop for tech valuations. The VIX remains contained in the 14-22 range despite elevated implied volatility across cloud computing names, suggesting markets are pricing in sector-specific uncertainty rather than broad risk-off sentiment.

The Magnificent Seven stocks continue to dominate market capitalization rankings, with combined valuations exceeding $20 trillion. These companies possess the financial resources to sustain massive AI infrastructure investments, creating a self-reinforcing cycle of technological advancement and market leadership.

Sector and Stock Watch: Identifying Key Movers

Meta's designation of Google as a primary cloud vendor represents a seismic shift in enterprise partnerships. For the first time, Meta has moved beyond treating Google as a supplementary provider to AWS and Microsoft Azure. This strategic pivot addresses Meta's immediate computing needs while their Prometheus and Hyperion facilities remain under construction until 2026 and 2030.

Options markets reflected this significance immediately. Meta's August $800 call strike saw 59,368 contracts trade, representing nearly 14% of total options volume. Professional traders dominated the flow at 65% of activity, signaling institutional positioning rather than retail speculation.

Google Cloud's competitive positioning strengthens considerably from this partnership. The technical validation of securing Meta as a primary vendor could accelerate enterprise client acquisition, potentially creating a virtuous cycle against AWS and Azure market share.

Trading Strategy in Focus: How to Play the Market

The tech-heavy NASDAQ's surge to record levels above $570 creates compelling opportunities for systematic exposure rather than single-stock selection. The QQQ ETF provides diversified access to the Magnificent Seven while reducing individual company risk.

Current market dynamics favor long-term positioning in technology infrastructure plays. The combination of Fed policy support, massive corporate AI investments, and sustained innovation cycles supports extended bull market conditions in tech-heavy indices.

Bull call spreads offer defined risk exposure to continued NASDAQ strength while capping maximum loss potential. The March 2026 expiration provides sufficient time for AI infrastructure investments to translate into earnings growth across the technology sector.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

There is no doubt that AI investments are on the rise, and the companies leading the market in value are driving the advancement of the technology. Meta’s $10 billion deal with Google Cloud is likely the first of many deals, mergers, and acquisitions (M&A) activities, as well as breakthroughs in high-performance computing. Meanwhile, the most valuable companies will continue to be at the cutting edge of AI.

As the charge shows, the top ten companies by market cap include the Magnificent Seven stocks, including NVDA, MSFT, AAPL, GOOG, AMZN, META, and TSLA. All have plenty to invest in AI, as TSLA, with the smallest market cap, is still worth over $1 trillion. NVDA’s value is above $4.32 trillion, MSFT and AAPL are worth more than $3.30 trillion, GOOG and AMZN are worth over $2.40 billion, and META’s value is just shy of $1.9 trillion. The MAG-7 are earnings machines with plenty to invest in AI, which all believe will improve their future earnings flow and cause their valuations to continue to rise. All Mag 7 stocks are traded on the NASDAQ, and the QQQ ETF tracks the price action of the NASDAQ Composite.

While today’s news from Jackson Hole will likely drive the short-term path of least resistance for the stock market and the tech-heavy NASDAQ, AI and innovations will continue to drive the long-term trend, which remains bullish as of late August 2025. Chairman Powell’s speech ignited a bullish fuse as the odds of a September rate cut have increased.

I believe the most effective and diversified approach to capturing technology growth is through a tech-heavy index, rather than selecting individual winners. The QQQ is an excellent investment choice, trading at a record high of over $ 570 per share. The March 20, 2026, QQQ $600-$680 vertical bull call spread, priced at $21.20 per spread or lower, has at least an over 1:2.75 risk-reward ratio.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.

LATEST MARKET BREAKDOWN

Watch on Youtube

That's it for today!Before you go we'd love to know what you thought of today's newsletter to help us improve the experience for you. |