- Smart Options Trader

- Posts

- Microsoft's Massive IREN Deal Exposes AI Power Crisis

Microsoft's Massive IREN Deal Exposes AI Power Crisis

A $9.7 billion partnership reveals why power infrastructure now matters more than code. IREN surged 480% by controlling what hyperscalers desperately need.

A $9.7 billion partnership reveals why power infrastructure now matters more than code. IREN surged 480% by controlling what hyperscalers desperately need.

🕒 Market Overview: Microsoft commits $9.7 billion to secure AI infrastructure capacity, exposing critical power bottlenecks across the cloud sector.

🔄 Sector Insight: IREN's transformation from crypto miner to AI infrastructure provider validates power as the binding constraint in the AI economy.

💰 Today's Trade Idea: Bull Call Spread on VPU targets utilities as potential M&A candidates for cash-rich technology companies seeking power control.

SMART TRADE IDEA

Bull Call Spread on VPU

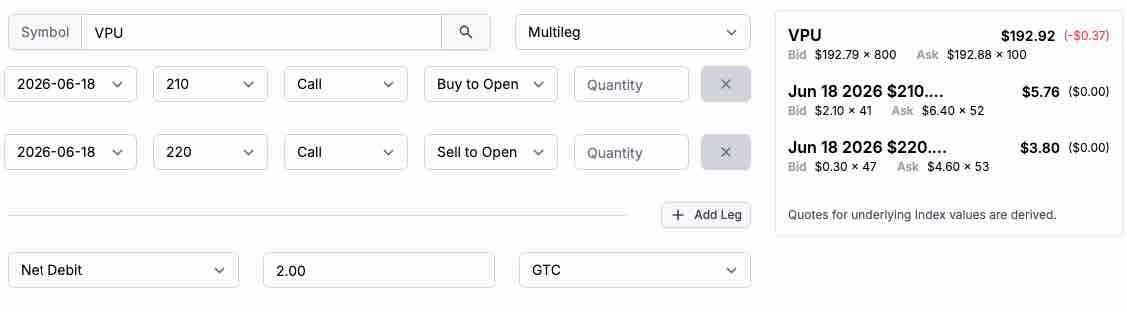

Trade Setup: Buy $210 Call / Sell $220 Call, June 18, 2026, expiration

Cost: $2.00 ($200 per spread)

Max Profit: $8.00 ($800 per spread)

Breakeven: $212 on VPU

Management Plan: Exit at 50% loss, roll up, or take profits if VPU’s price reaches $220 or higher.

Power is power in the current market. The potential for technology companies to pay up to secure the primary ingredient in crypto mining and AI development is high. Utilities, a typically safe and stable sector offering yield, could become fertile ground for capital growth in the current environment as cash-rich tech companies seek to lock down access and even control of power generation.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Smart AnalysisA Wall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

Cryptocurrency mining and artificial intelligence share a significant factor in common: they both have substantial energy requirements. In the current market, power is power, and this will remain the case for the foreseeable future. Traditionally, utilities have been stable investments, with many portfolios seeking exposure for yield. However, with power demand growing rapidly and cash-rich technology companies seeking accretive acquisitions, power generation could offer significant capital growth potential, in addition to attractive dividend yields.

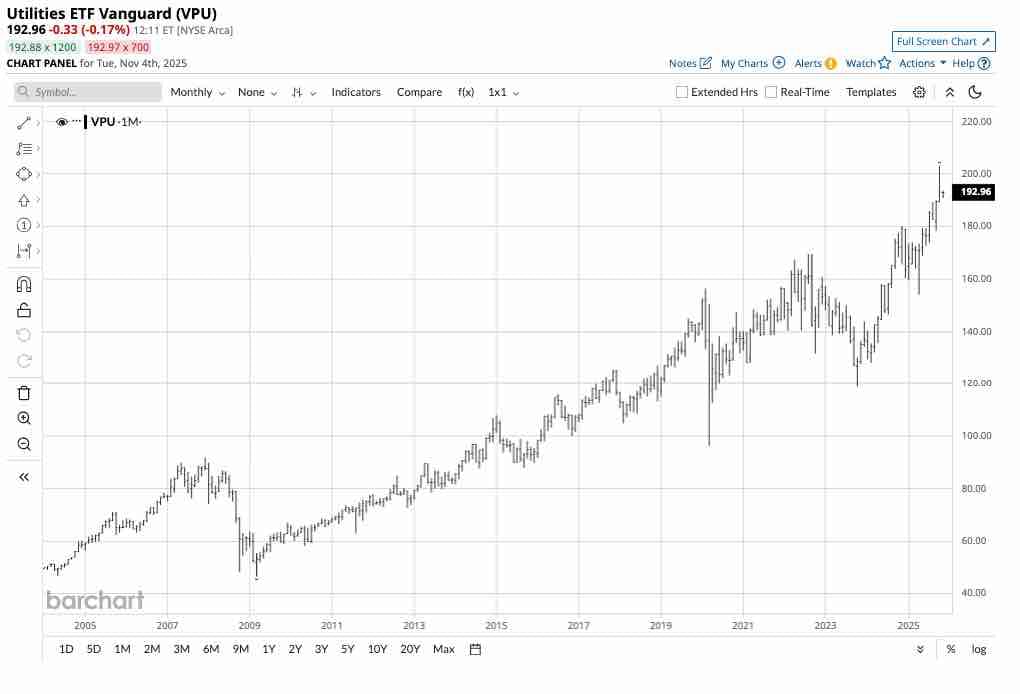

The Vanguard Utilities ETF (VPU) holds shares of the leading utilities that generate power. At around $193 per share, VPU is just below the record October 2025 high of $203.15. VPU pays shareholders an attractive annual dividend of $4.95, translating to a 2.56% yield. VPU is a highly liquid ETF with over $7.89 billion in assets under management, and nearly 177,000 shares changing hands daily. VPU charges a nominal 0.09% management fee.

A diversified approach to technology’s power grab could be exposure to the companies that provide the power. It may only be a matter of time before increasing M&A activity from cash-rich technology companies targets those that generate electricity to fuel technological advances.

The monthly chart highlights VPU’s bullish trend. Acquisitions and strategic investments in these companies could turbocharge the bullish trend over the coming months.

The June 18, 2026, VPU $210-$220 vertical bull call spread at $2 or lower has a risk-reward ratio of at least 1:4 with plenty of time until expiration.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.