- Smart Options Trader

- Posts

- New Zealand's Rate Cut Triggers Global Currency Chaos

New Zealand's Rate Cut Triggers Global Currency Chaos

The RBNZ just detonated a volatility bomb across currency markets. Here's why your carry trades aren't safe anymore—and how to position for what comes next.

The RBNZ just detonated a volatility bomb across currency markets. Here's why your carry trades aren't safe anymore—and how to position for what comes next.

🕒 Market Overview: RBNZ delivers surprise 50 basis point cut, triggering cross-currency volatility and carry trade unwinding.

🔄 Sector Insight: Gold surpasses $4,000 per ounce as central banks stockpile the precious metal amid declining fiat currency confidence.

💰 Today's Trade Idea: Bull Call Spread on GDX capitalizes on gold mining stocks outperforming bullion by 2.5x this year.

SMART TRADE IDEA

Bull Call Spread on GDX

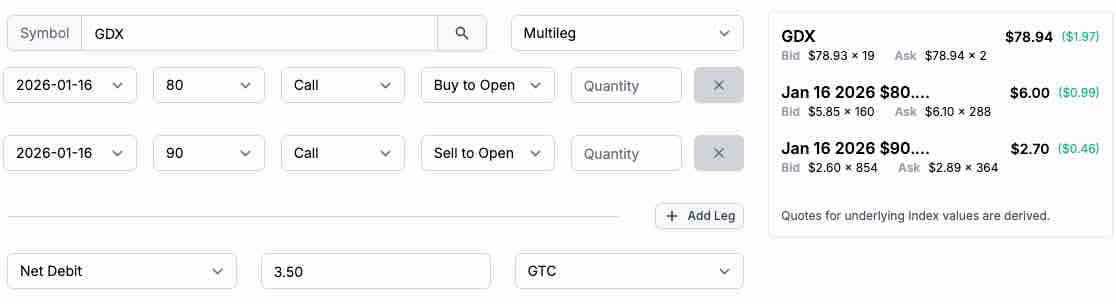

Trade Setup: Buy $80 Call / Sell $90 Call, January 16, 2026, expiration.

Cost: $3.50 ($350 per spread)

Max Profit: $6.50 ($650 per spread)

Breakeven: $83.50 on GDX on January 16, 2026.

Management Plan: Exit at 50% loss, roll up, or take profits if GDX’s price reaches $90.

Gold’s bullish trend shows no sign of any correction. GDX performs like gold on steroids on the upside. A continuation of higher highs will likely cause GDX to continue to outperform gold’s price on a percentage basis.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

The Reserve Bank of New Zealand shattered the illusion of predictable central banking on October 8th, delivering a 50 basis point rate cut when markets expected half that amount. The move drove rates from 3.0% to 2.5% while the New Zealand dollar plummeted to six-month lows. This wasn't an isolated event—it exposed a fundamental shift in how central banks operate under economic pressure.

Currency markets experienced contagion effects that rippled far beyond the kiwi dollar. Two-year interest rate swaps collapsed from 2.62% to 2.52% within minutes as options market makers watched volatility surfaces disintegrate in real-time. The psychological shift from complacency to panic revealed that forward guidance and gradual policy adjustments are no longer reliable frameworks.

Meanwhile, gold breached $4,000 per ounce this week while Bitcoin reached marginal new highs. Central banks and governments are aggressively accumulating gold, pushing the precious metal past the euro to become the world's second-largest reserve currency. This signals declining faith in fiat currencies at the institutional level. With the U.S. government shutdown threatening employment data and stagflationary pressures mounting, the Federal Reserve faces an impossible mandate: stable prices and full employment require opposite policy responses.

Sector and Stock Watch – Identifying Key Movers

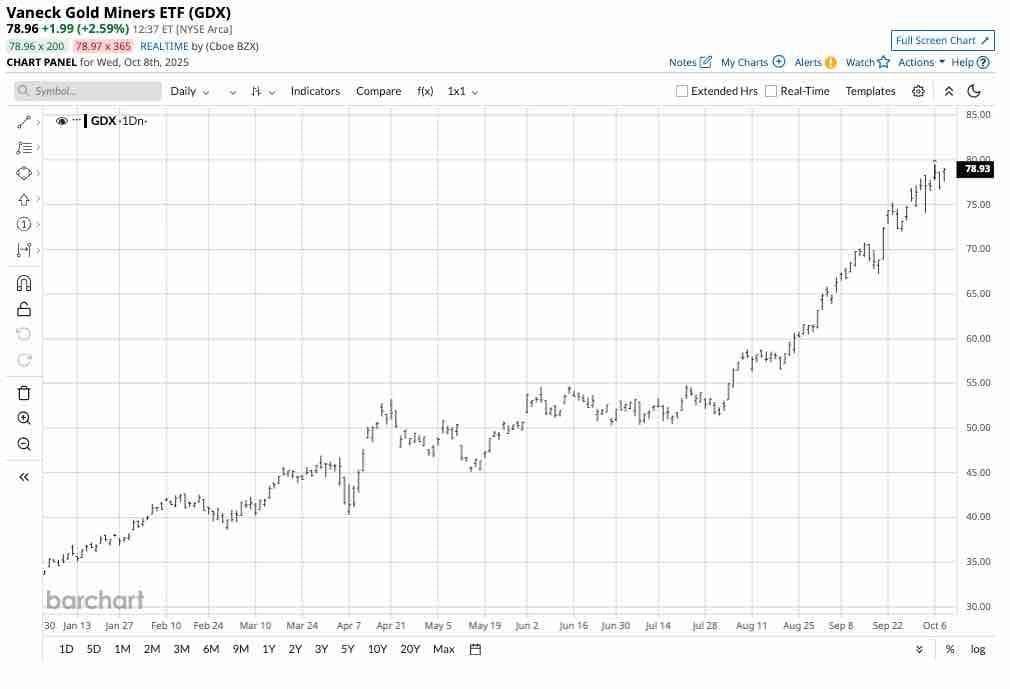

Gold mining equities are delivering outsized leverage to the underlying commodity. The GDX ETF, which holds shares of leading gold mining companies, has surged over 130% in 2025 while gold itself has gained approximately 54%. This performance gap demonstrates how mining equities amplify moves in the underlying metal during sustained bullish trends.

The divergence between gold's price action and mining stock performance creates opportunities for traders seeking leveraged exposure to precious metals. GDX now trades near record highs just below $79 per share, reflecting market positioning that anticipates continued weakness in fiat currencies and sustained central bank gold accumulation.

Currency pairs touching New Zealand experienced violent swings as carry trades unwound. NZD/JPY, NZD/EUR, and NZD/CAD all saw forced liquidation as interest rate differentials compressed unexpectedly. This volatility spread to seemingly unrelated pairs through algorithmic trading systems and correlation trades, exposing how interconnected modern markets have become

Trading Strategy in Focus – How to Play the Market

The current environment favors defined-risk strategies that capitalize on directional trends while limiting downside exposure. Vertical spreads allow traders to participate in strong moves without the unlimited risk profile of outright long positions.

Gold mining equities present a compelling case for bull call spreads given the sustained trend in both gold prices and GDX performance. The strategy offers positive risk-reward ratios while capping maximum loss if the trend reverses. With gold showing no signs of correction and central banks continuing accumulation, mining stocks positioned near record highs may extend gains.

Policy uncertainty across global central banks suggests elevated volatility will persist across currency and commodity markets. Traders should reassess leverage in carry trades and recognize that cross-currency correlations previously considered stable can break down rapidly during surprise policy shifts. The RBNZ event established a precedent that other commodity-dependent economies—Australia, Canada—might deliver similarly aggressive moves.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

Markets are in flux, and the faith in fiat currencies has declined over the past weeks and months at an accelerated pace. We do not have to look further than the price action in gold, which surpassed the $4,000 per ounce milestone this week, and Bitcoin, which rose to a marginal new high. While Bitcoin’s upward price action signals uncertainty and an expanding addressable market, gold’s ascent is far more critical as the leading buyers are central banks, governments, and monetary authorities. As governments buy gold and increase their holdings to a point where the precious metal is now the world’s second-largest reserve currency, surpassing the euro, the world’s nations are expressing declining faith in fiat currencies.

Gold and Bitcoin are not the only assets rallying as stocks are higher; other metal prices are moving to the upside, fueling inflation. Meanwhile, the world’s leading economy, the United States, is mired in a government shutdown, which is likely to lead to increased unemployment. The Fed has been concerned about stagflation, and all signs are that a stagflationary period is underway. The central bank’s mandate is to maintain stable prices and achieve full employment. Prices and unemployment are rising, making the Fed’s job nearly impossible as each requires the opposite monetary policy approach for the Fed Funds Rate. However, short-term rates are likely to drop in 2026 as the U.S. administration has not been shy about its desire for a far lower interest rate environment. The bottom line is that significant market volatility is likely on the horizon.

Gold mining shares tend to provide leverage compared to the gold price. The GDX ETF owns shares of the leading gold mining companies. While gold at $$4,070 is 54.1% higher in 2025, the GDX ETF has rallied 132.8%.

The trend in gold and gold mining stocks remains bullish freight trains. At just below $79 per share, a record high, the January 16, 2026, GDX $80-$90 vertical bull call spread at $3.50 per spread or lower offers a risk-reward ratio of at least 1:1.85.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.