- Smart Options Trader

- Posts

- Oil Industry Mass Layoffs Reveal What Wall Street Already Knows

Oil Industry Mass Layoffs Reveal What Wall Street Already Knows

ConocoPhillips slashes 25% of workforce as energy giants prepare for Trump drilling revolution and potential oil price collapse.

ConocoPhillips slashes 25% of workforce as energy giants prepare for Trump drilling revolution and potential oil price collapse.

🕒 Market Overview: ConocoPhillips eliminates up to 3,250 jobs in aggressive restructuring

🔄 Sector Insight: Energy companies prepare for lower oil prices under Trump policies

💰 Today's Trade Idea: Bear put spread on XLE targets falling energy prices

SMART TRADE IDEA

Bull Call Spread on XLE

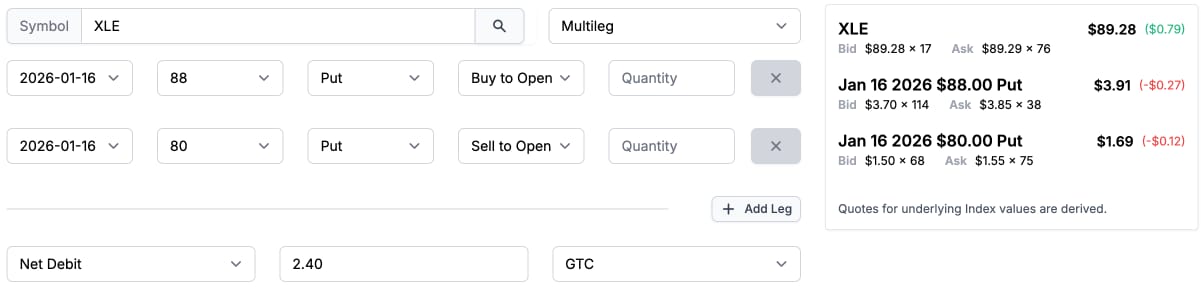

Trade Setup: $88 Put / Sell $80 Put, January 16, 2026, expiration

Cost: $2.40 ($240 per spread)

Max Profit: $5.60 ($560 per spread)

Breakeven: $85.60 on XLE

Management Plan: Exit at 50% loss, roll down, or take profits if XLE’s price reaches $82 per share.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

The energy sector faces a fundamental shift as Trump administration policies prioritize domestic drilling over renewable alternatives. This policy reversal from the Biden era creates downward pressure on oil prices through increased U.S. production capacity.

OPEC+ influence continues to diminish as American output expands, while tariffs and sanctions strengthen U.S. market control. NYMEX crude futures currently trade between $55-$81 per barrel, but industry preparations suggest expectations for prices to drop toward the $40-$50 range.

The combination of expanding supply and policy support for traditional energy extraction creates a deflationary environment for crude oil pricing.

Sector and Stock Watch – Identifying Key Movers

ConocoPhillips leads sector-wide cost reduction initiatives, cutting up to 25% of its workforce as operational costs climbed from $11 to $13 per barrel since 2021. This follows similar moves by Chevron (15-20% cuts) and BP (5% reduction).

The company's stock declined 4.5% to $94.55 following the announcement, outpacing the broader S&P 500 Energy Index drop of 2.6%. This bearish sentiment reflects market concerns about defensive positioning rather than strategic positioning.

Energy companies are transitioning from growth-focused strategies to efficiency-first operations as premier drilling locations become depleted, forcing higher-cost tier-2 and tier-3 development.

Trading Strategy in Focus – How to Play the Market

Bear put spreads present an attractive strategy for traders expecting continued energy sector weakness. The XLE ETF provides diversified exposure to major oil companies including Exxon Mobil, Chevron, and ConocoPhillips with approximately 50% weighting in these three firms.

The current trading range of $74.49 to $98.97 established since September 2022 suggests defined risk parameters. Cost-cutting initiatives across the sector indicate preparation for lower commodity prices, creating bearish catalysts for energy equity valuations.

Options strategies targeting the January 2026 expiration provide sufficient time for fundamental trends to develop while capturing the sector's defensive repositioning.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

The petroleum sector’s restructuring should come as no surprise, as the world’s leading economy, the United States, underwent a dramatic shift in energy policy with the election of President Trump in late 2024. Among the many issues that divided former President Trump from Vice President Harris was the Biden administration’s support for alternative and renewable fuel consumption and production, as opposed to a return to the “drill-baby-drill” and “frack-baby-frack” policies of the first Trump administration. President Trump’s victory has significant ramifications for the international petroleum market. Prices should move lower as U.S. production increases, and OPEC+, the international oil cartel, and Russia will have a decreasing influence in determining crude oil prices. Tariffs and sanctions have only increased the U.S. influence, which looks likely to continue into 2026. Meanwhile, during the Biden administration, the nearby NYMEX crude oil futures continuous contract traded between $47.18 and $130.50 from January 2021 through December 2024. During the first Trump administration, the trading range was briefly below $0 to $76.90 per barrel from January 2017 through December 2020. Meanwhile, since the Trump administration took over in late January 2025, the nearby NYMEX oil futures price has remained between $55.12 and $80.77 per barrel.

The bottom line is that more U.S. production, tariffs, and other factors are likely to keep a cap on oil prices over the coming months and through 2026, with high odds that increasing U.S. output could lead to lower prices between the $40 and $50 per barrel level on the nearby NYMEX crude oil futures contract. Therefore, cost-cutting by ConocoPhillips, Chevron, BP, and the other leading integrated petroleum companies should come as no surprise as they slim down, as the potential for higher U.S. output and lower prices increases. Lowering costs will enable leading companies to survive and thrive, if and when crude oil prices decline. I view the cost-cutting as a sign that the oil industry is preparing for lower prices. Falling oil prices weigh on oil-related stocks. The S&P 500 Energy Sector SPDR (XLE) is a diversified oil-related ETF with a nearly 50% exposure to the three leading U.S. oil companies: Exxon Mobil, Chevron, and ConocoPhillips.

The monthly chart shows that the XLE ETF has been trading in a range of $74.49 to $98.97 since September 2022. As leading oil companies cut costs, it may be due to the anticipation of a significant decline in crude oil prices over the coming months. At around $89 per share, a vertical bear put spread on XLE could capitalize on falling oil prices and declining share prices of oil companies. The $88-$80 vertical bear put spread on XLE, expiring on January 16, 2026, at $2.40 per spread or lower, has a better-than-1:2.3 risk-reward ratio.