- Smart Options Trader

- Posts

- Oil Tests Critical Floor While OPEC Reverses Course

Oil Tests Critical Floor While OPEC Reverses Course

October 2024's Middle East missile crisis sent oil soaring to $72. One year later, crude sits at $61 with technical support just $6 away. The energy landscape has shifted dramatically.

October 2024's Middle East missile crisis sent oil soaring to $72. One year later, crude sits at $61 with technical support just $6 away. The energy landscape has shifted dramatically.

🕒 Market Overview: Crude oil trades under pressure at $61 after falling from crisis-driven highs near $72.

🔄 Sector Insight: OPEC+ production increases and U.S. policy shifts create headwinds for energy prices.

💰 Today's Trade Idea: Bull Call Spread on SCO for defined risk exposure to potential crude oil decline.

SMART TRADE IDEA

Bull Call Spread on SCO

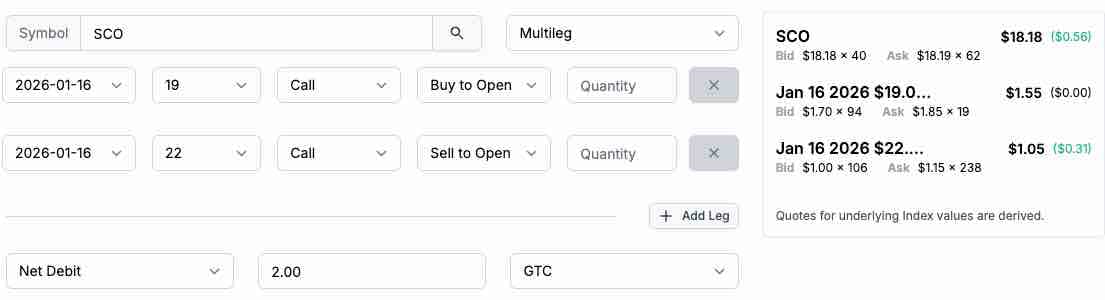

Trade Setup: Buy $19 Call / Sell $22 Call, January 16, 2026, expiration.

Cost: $0.90 ($90 per spread)

Max Profit: $2.10 ($210 per spread)

Breakeven: $19.90 on SCO on expiration.

Management Plan: Roll up, or take profits if SCO’s price reaches $22 per share.

SCO is a leveraged ETF product that moves higher when oil prices decline. At $18.20 per share on October 2, 2025, the $19-$22 bull call spread presents an attractive risk-reward profile for market participants who anticipate crude oil prices will decline.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

One year ago, Iran's ballistic missile barrage sent oil markets into crisis mode. Today, the landscape has transformed entirely. OPEC+ has opened production taps, adding supply to a market already adjusting to shifting demand patterns. The Trump administration's energy policy favors domestic fossil fuel production and consumption, creating additional pressure on global prices.

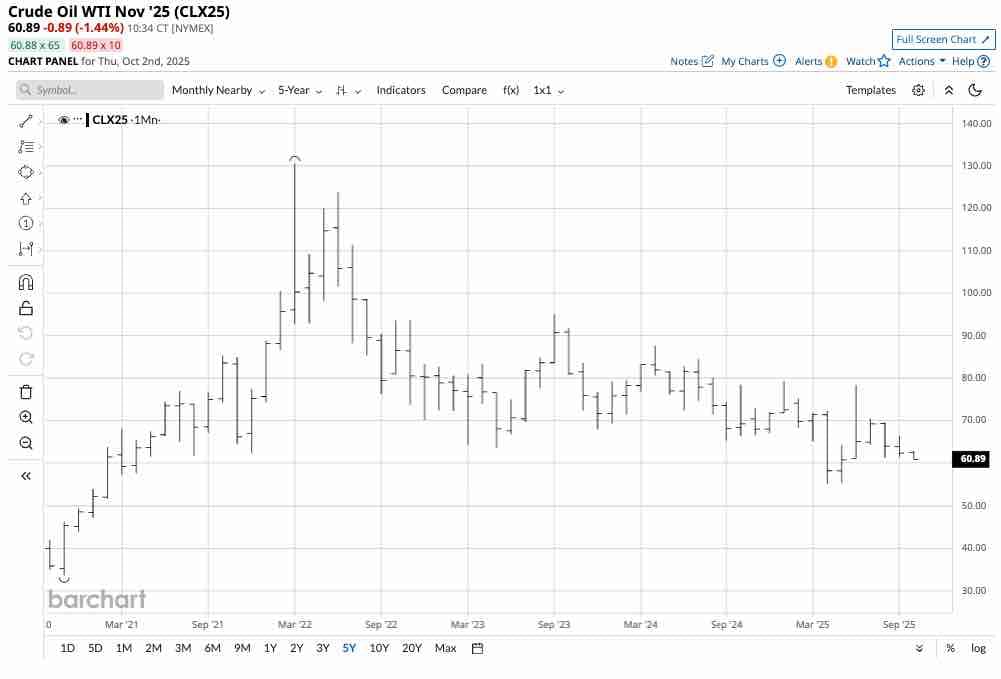

The technical picture reinforces this bearish narrative. Since 2022, crude oil has established a pattern of lower highs and lower lows—a classic downtrend structure. Support sits at $55.12 per barrel from April 2025, less than $6 below current levels. Seasonality typically works against crude during winter months, adding another headwind to the commodity.

A potential Gaza peace agreement awaits Hamas' response, which could remove a significant geopolitical risk premium from energy markets. The same crisis dynamics that pushed prices higher in 2024 may now facilitate downside acceleration as tensions ease.

Sector and Stock Watch – Identifying Key Movers

The Ultrashort Bloomberg Crude Oil -2X ETF (SCO) provides inverse leveraged exposure to crude oil price movements. Trading at $18.20 per share, this instrument moves higher as oil prices decline—offering a direct method to capitalize on bearish energy positioning.

Leveraged ETF products carry inherent complexity and time decay considerations. SCO doubles the inverse daily performance of its underlying index, meaning that while it amplifies gains during downtrends, it also magnifies losses during reversals. The structure favors directional traders with specific price targets rather than long-term holders.

Trading Strategy in Focus – How to Play the Market

When market structure suggests directional momentum, vertical spreads offer defined risk parameters with asymmetric reward potential. Bull call spreads on inverse products like SCO create bullish exposure to bearish oil movements—essentially betting on continued energy weakness through a structured options position.

The current environment combines technical breakdown, fundamental supply increases, and potential geopolitical de-escalation. This confluence creates a setup where defined-risk strategies allow participation in potential downside price action while capping maximum loss exposure.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

Let’s be extremely clear, this article reflects the events that transpired on October 1, 2024, not October 1, 2025. While the October 2024 missile barrage sent crude oil prices to $72 per barrel on October 2, 2024, one year later, the price was approximately $11 per barrel lower at the $61 level on the nearby NYMEX crude oil futures contract. While there is always a chance of sudden hostilities in the Middle East that cause upside price spikes in petroleum prices, the current environment may be more susceptible to a price plunge for the following reasons:

OPEC+ has been increasing crude oil output.

U.S. energy policy under the Trump administration favors the production and consumption of fossil fuels.

A Middle East peace plan that ends the war in Gaza is on the table, awaiting Hamas’ agreement.

Seasonality tends to favor the downside in crude oil prices during the winter months.

The monthly continuous NYMEX crude oil futures chart highlights the bearish trend of lower highs and lower lows since 2022. Technical support is at a low of $55.12 per barrel in April 2025. The current price is under $6, above that level.

The Ultrashort Bloomberg Crude Oil -2X ETF (SCO) moves higher when NYMEX crude oil prices decline. The January 16, 2026, $19-$22 vertical bull call spread has a risk-reward ratio of 1:2.3 or higher at $0.90 or lower.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.