- Smart Options Trader

- Posts

- Opportunities in Nuclear Energy

Opportunities in Nuclear Energy

Expect investment capital to flood the energy sector over the coming months and years.

**New weekly Tradier HUB LIVE show**

The Power Hour: Turn Market Chaos Into Options Clarity

Step into The Power Hour, the new live show where 30-year options veteran Robert Roy dissects the S&P 500, breaks down market-moving news, and delivers no-fluff, real-time analysis on your own trade setups.

If you’re ready for sharper insights, smarter decisions, and a weekly jolt of high-impact strategy — show up to level up, your portfolio will thank you!

🕒 Market Overview: Given the rising power requirements, I expect the leading cash-rich technology and chip manufacturing companies to battle to secure power sources through strategic investments and acquisitions.

📈 Sector Insight: The NLR ETF is the most liquid diversified approach to the nuclear power sector. NLR is an ETF that owns shares in the leading energy companies, uranium miners, and nuclear energy companies that stand to benefit from the growing power demand driven by technology.

💡 Today's Trade Idea: Bull Call Spread on NLR.

SMART TRADE IDEA 💡

Bull Call Spread on NLR

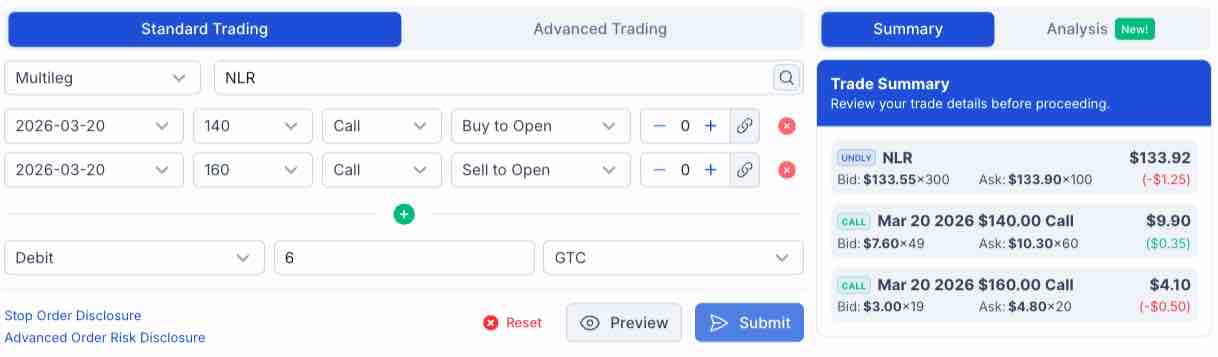

Trade Setup: Buy $140 Call / Sell $160 Call, March 20, 2026, expiration.

Cost: $6.00 or lower ($600 per spread)

Max Profit: $14.00 ($1,400 per spread)

Breakeven: $146.00

Risk-reward: 1:2.3

Management Plan: Exit at 50% loss, roll up, or take profits if NLR’s price reaches $160. At $6 or lower, the $140-$160 vertical call spread for March 20, 2026, expiration has at least an attractive 1:2.33 risk-reward ratio. Meanwhile, the spread’s top short strike price of $160 is below the NLR ETF’s October 2025 record high of $168.12 per share.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Smart AnalysisA Wall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

Opportunities in Nuclear Energy

The development of nuclear energy projects dramatically declined following the Chernobyl and Fukushima disasters. Climate change and nuclear accidents increased the use of alternative and renewable energy sources, as petroleum, natural gas, coal, and nuclear energy took a back seat to biofuels, solar, wind, and other renewable and clean energy alternatives.

In 2025, the world changed. The United States elected Donald Trump, the forty-fifth President, the forty-seventh President, on a platform including energy independence and lower inflation through a “drill-baby-drill” and “frack-baby-frack” policy encouraging fossil fuel production and consumption. Moreover, policy initiatives include more friendly regulation and the encouragement of the development and expansion of nuclear power projects.

Energy demand is growing by leaps and bounds, driven by the AI revolution. Cash-rich technology companies may be poised to make substantial energy investments to support their AI portfolios. Energy is critical for technology, and nuclear power utilities could have explosive investment potential over the coming months and years.

AI turbocharges power demand

· AI energy demand is growing, straining power grids.

· The demand could triple by 2028. According to Goldman Sachs, global data center power demand could increase by 165% by 2030.

· Aside from AI, cryptocurrency mining is also putting substantial strains on the power grid.

M&A activity is exploding

· Cash-rich technology companies are making substantial investments in AI.

· Amazon (AMZN), Alphabet (GOOG), Microsoft (MSFT), and Meta (META) are making significant AI investments.

· NVIDIA (NVDA), Advanced Micro Devices (AMD), and Broadcom (AVGO) are chipmakers investing in AI.

· These companies have substantial energy requirements over the coming years.

The companies that could benefit

· Utilities stand to benefit from rising power demand.

· Nuclear energy companies could soar as alternative energy sources become more attractive.

· Technology and chip manufacturers, sitting on piles of cash, will likely seek to own power generation, igniting an acquisition frenzy.

· Nuclear power companies could experience the most interest.

ETFs that are positioned for the energy revolution

· VanEck Uranium and Nuclear ETF (NLR): At $134.00 per share, NLR had over $3.557 billion in assets under management. NLR trades an average of over 582,000 shares daily and charges a 0.60% management fee.

· Range Nuclear Renaissance Index ETF (NUKZ): At $66.10 per share, NUKZ had over $745 million in assets under management. NUKZ trades an average of over 153,000 shares daily and charges a 0.85% management fee.

· First Trust Bloomberg Nuclear Power ETF (RCTR): At $33.00 per share, RCTR had over $10 million in assets under management. RCTR trades an average of nearly 5,300 shares daily and charges a 0.70% management fee.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.