- Smart Options Trader

- Posts

- Panning for Gold in 2026

Panning for Gold in 2026

Gold’s bull market is nine quarters deep — and traders are still finding upside.

Our first 2026 Webinar, Jan 20, 3:30pm CT

Discover how PLAN ETF can be used to identify edge and opportunity in 2026.

Learn how to set up your trade once an edge is identified.

Learn How to manage rolling and exits once your position is on.

🕒 Market Overview: Gold established its ninth consecutive quarterly gain and a new record high in Q4 2025.

📈 Sector Insight: Buying gold on price corrections has been optimal for over a quarter of a century, and I expect that trend to continue.

💡 Today's Trade Idea: Bull Call Spread on IAU.

SMART TRADE IDEA 💡

Bull Call Spread on IAU

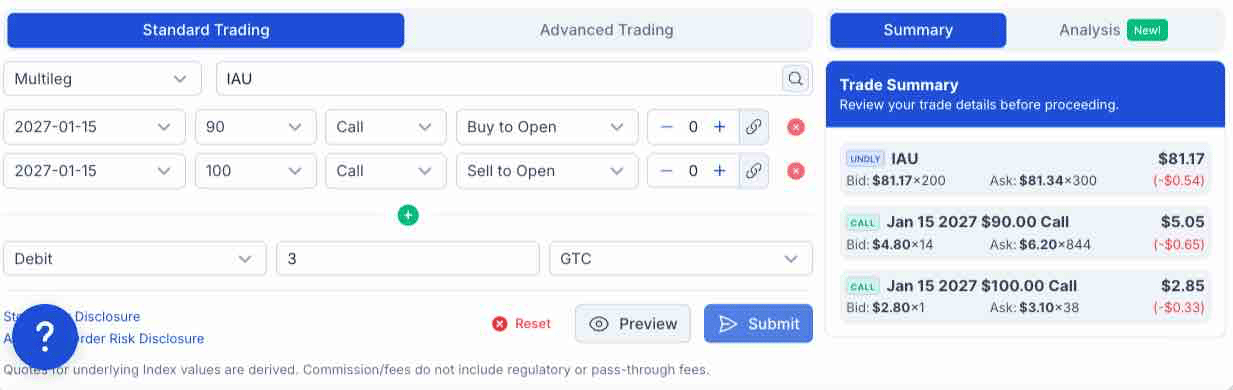

Trade Setup: Buy $90 Call / Sell $100 Call, January 15, 2027, expiration.

Cost: $3 ($300 per spread)

Max Profit: $7 ($700 per spread)

Breakeven: $93 on IAU on January 15, 2027

Risk-reward: 1:2.33

Management Plan: Exit at 50% loss, roll up, or take profits if IAU’s price reaches $97 per share. I remain bullish on gold, but remember, even the most aggressive bull markets rarely move in straight lines. Corrections become more likely as prices rise.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Smart AnalysisA Wall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

Panning for Gold in 2026

Gold established its ninth consecutive quarterly gain and a new record high in Q4 2025. Nearby continuous COMEX gold futures reached a record high in late September, then traded to an even higher record high in early October, before reaching $4,584 in December 26. While gold futures corrected below $4,300, they closed 2025 at a settlement price of $4,341.10 per ounce on the nearby February COMEX futures contract.

Gold’s bull market remains firmly intact in early 2026.

The bullish trend continues

Source: Barchart

The quarterly chart shows that gold prices have reached new record highs over the past nine consecutive quarters. A move of over $4,584 per ounce, the December 2025 high on the February 2026 contract, in Q1 2026, will extend the streak to ten quarters.

At its most recent high of $4,584 per ounce, gold was 73.6% above its closing price at the end of 2024. In 2026, gold is entering the 27th year of its bull market.

The deterioration of fiat currencies

Gold is the world’s oldest means of exchange. While gold had backed some currencies during the previous century, today the legal tender issued by countries worldwide is fiat, deriving its value only from the full faith and credit of the countries and governments that issue currencies. Gold’s ascent reflects the steady decline in the value of fiat currencies. Central banks, governments, and monetary authorities validate gold’s role in the global financial system by holding it as a reserve asset, classifying it as a currency reserve. In 2025, gold replaced the euro as the second-leading reserve asset, behind only the U.S. dollar.

Interest rates in 2026 likely support higher gold prices

Gold is an interest rate-sensitive asset, like stocks and other assets. When real interest rates rise, the opportunity cost of holding gold as an asset increases, since it offers no yield. When rates decline, gold’s price tends to increase. However, rising interest rates due to inflation are another story, as gold has a long history as an inflation indicator. The bottom line is that inflation erodes fiat currencies’ purchasing power, while gold’s limited supply and scarcity maintain its value. While governments can issue currency to their heart’s content, the only way to increase the gold stock is to extract it from the earth’s crust.

Central banks continue to add to reserves

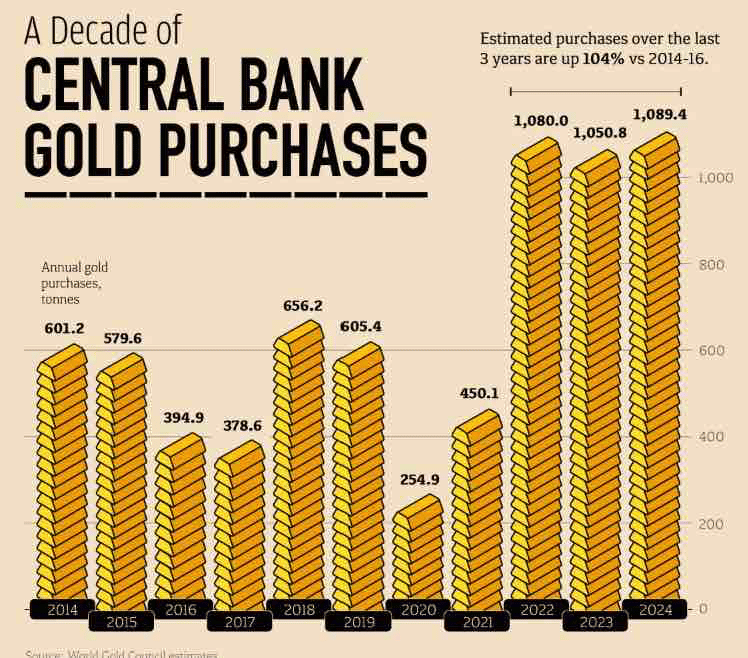

On October 23, 2025, the Visual Capitalist published a chart highlighting the growth in central bank gold purchases over the past decade.

Source: visualcapitalist.com

JP Morgan forecasted that central banks would purchase an additional 900 metric tons for reserves in 2025. Meanwhile, the official data is likely lower than the actual government gold reserve purchases and holdings. According to the World Gold Council, China is the world’s leading gold producer, followed by Russia. China and Russia have been substantial gold buyers over the past few years, and they have likely increased their reserves through domestic production. Since gold and other strategic commodity reserves are national security matters in China and Russia, the increase in their holdings is likely understated.

The iShares Gold Trust is a highly liquid ETF that holds physical gold. At $81.17 per share on December 31, 2025, IAU had $66.892 billion in assets under management. IAU trades an average of nearly 8.2 million shares daily and charges a 0.25% management fee.

AD - TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.