- Smart Options Trader

- Posts

- Presidential Fed Visit Triggers Massive Volatility Spike in Markets

Presidential Fed Visit Triggers Massive Volatility Spike in Markets

Trump's surprise Fed headquarters visit doubles VIX options volume while traders position for policy chaos ahead.

Political theater meets monetary policy as Fed independence faces unprecedented challenge from White House pressure.

🕒 Market Overview: Trump's surprise Fed visit triggers VIX reversal and doubles options volume

🔄 Sector Insight: Regional banks spike on rate cut speculation while homebuilders surge

💰 Today's Trade Idea: Gold bull call spread capitalizes on safe-haven demand amid Fed uncertainty

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

Presidential politics collided with monetary policy yesterday as Trump made an unprecedented visit to Federal Reserve headquarters. This marks only the fourth time in modern history a sitting president has entered the central bank, creating immediate market disruption. Fed funds futures pushed September rate cut probabilities significantly higher while the VIX snapped its multi-session decline.

The timing amplifies existing tensions over inflation policy. Powell has maintained his "higher-for-longer" stance citing persistent inflation above the Fed's target. However, this physical incursion into Fed territory carries symbolic weight that extends beyond typical political pressure. VIX options volume exploded to nearly double typical daily activity, with heavy call buying indicating traders are specifically hedging political risk rather than economic fundamentals.

Sector and Stock Watch – Identifying Key Movers

Regional bank options experienced substantial volatility spikes as traders positioned for potential rate cuts that would reshape financial sector profit margins. This represents a bearish signal for bank earnings as lower rates compress net interest margins.

Homebuilder options surged on prospects that mortgage rates might decline, creating a bullish sentiment for housing-related plays. The sector rotation reflects direct rate sensitivity as these industries stand to benefit most from any dovish Fed pivot.

Trading Strategy in Focus – How to Play the Market

Political catalysts create sharp but often short-lived volatility spikes, making tactical hedging essential while avoiding overpaying for protection. The current environment favors strategies that benefit from uncertainty itself rather than directional bets.

VIX call skew remains elevated despite modest index readings, suggesting sophisticated money is pricing political risk premiums. This creates opportunities for theta management strategies that capitalize on time decay while maintaining protective positioning.

SMART TRADE IDEA

Bull Call Spread on GLD

Trade Setup: Buy $330 Call / Sell $350 Call, January 16, 2026 expiration.

Cost: $4.55 ($455 per spread)

Max Profit: $15.45 ($1,545 per spread)

Breakevens: $334.55

Risk-reward: 1:3.4

Management Plan: Exit at 50 percent loss, roll up or take profits if GLD’s price reaches $340 before the end of 2025.

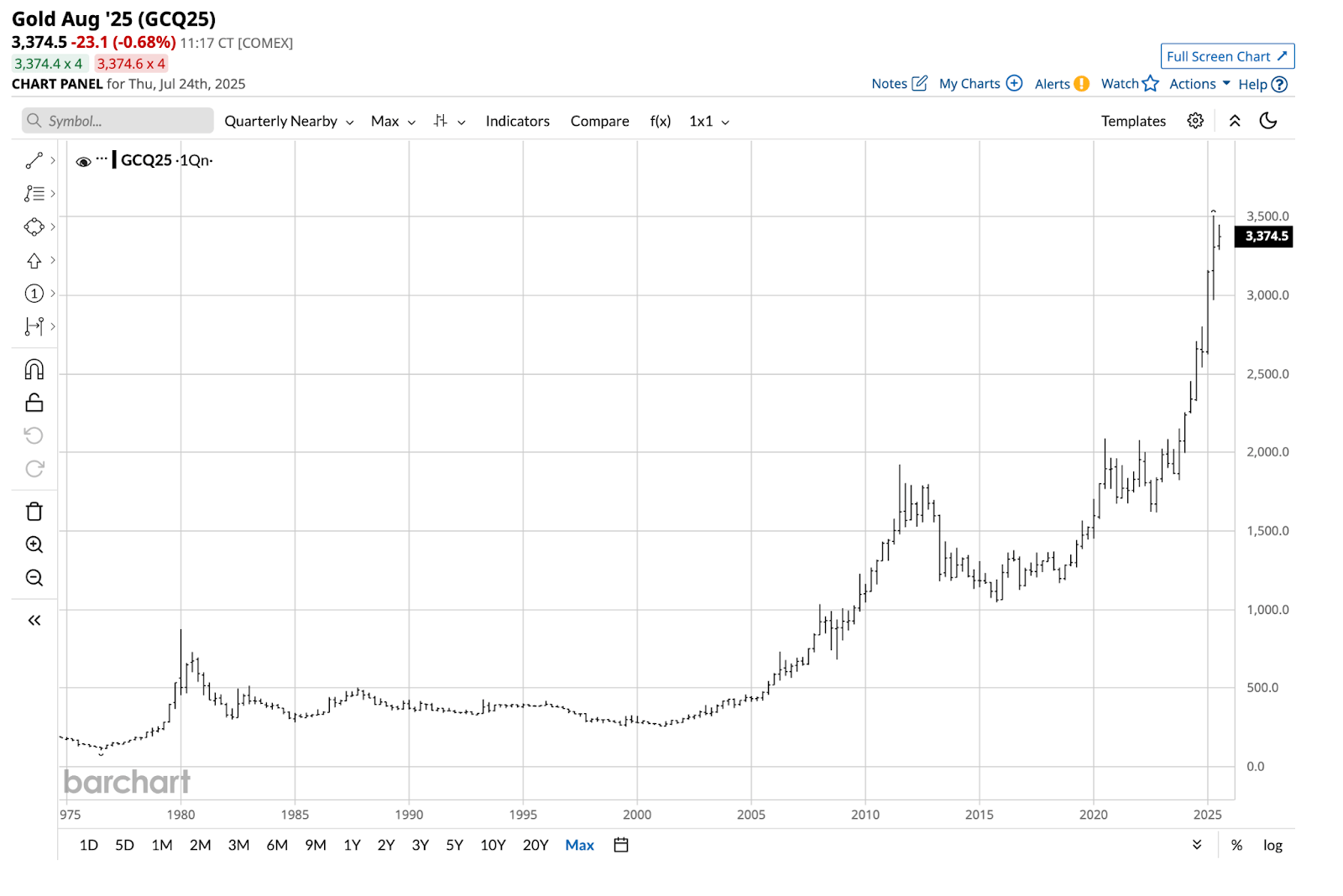

GLD is a highly liquid ETF product. Gold has been in a bullish trend for the past two and a half decades. A falling dollar and lower U.S. interest rates typically support higher gold prices. Increased volatility in markets causes traders and investors to seek safe-haven assets. And, central banks and governments continue to expand their gold reserves, causing gold to surpass the euro as the world's second-leading reserve currency. Central banks validate the role of gold in the global financial system.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

While the jury is out on whether Chairman Powell and the FOMC will back down in the face of President Trump's pressure to slash interest rates, markets will find out next week when the committee gathers for its July meeting. Former Chairman Alan Greenspan once said that the Fed's ideal position is when the markets have no clue whether the Fed will raise, lower, or keep rates unchanged at an upcoming meeting. Meanwhile, market expectations are for a continuation of the monetary policy pause with the short-term Fed Funds Rate remaining at a midpoint of 4.375%. However, recent statements from a voting member suggest that there could be some dissent in favor of a rate cut.

There are compelling arguments on both sides. As U.S. trade policies have not filtered through the economy, the potential for increasing inflation remains a threat. The most recent CPI, PPI, and PCE data have shown that the economic condition remains above the central bank's 2% target. On the other hand, inflation is under 3%. The recent trade deal with Japan and the potential for an agreement between the U.S. and the European Union have diminished the inflationary and stagflationary potential that the Fed has cited as its reasoning for pausing rate cuts. If the tariff situation continues to improve and the administration moves the needle toward a more level trade playing field, economic growth could follow without significant inflationary ramifications, justifying a much lower Fed Funds Rate. Moreover, in the current environment, the latest data and progress on trade agreements mean that the 4.375% Fed Funds Rate is too high, perhaps substantially elevated as the administration has argued.

As tensions between the President and the Fed Chairman continue, traders and investors must keep a critical factor in mind. President Trump has three and one-half years left in his term, while Chairman Powell's term ends in early 2026. Moreover, the President will appoint his successor. Therefore, the President holds most of the cards. So long as President Trump does not act to reduce or eliminate the Fed's independence, the Republican majority in the House and Senate will likely support his decisions.

While we may see short-term spikes in the VIX and bouts of increased price variance in markets across all asset classes, the dollar index, which has been in a bearish trend since the start of 2025, is likely to continue hitting new lows. Short-term interest rate differentials are a crucial factor for the path of one currency versus others. Despite the tension between the administration and the central bank, most agree that the next move in the Fed Funds Rate is likely to be lower. While many see a continuation of the pause, there are no indications that the Fed Funds Rate will increase in the foreseeable future. A lower dollar and the potential for lower interest rates are bullish for a market that has been rallying since the turn of this century.

The quarterly chart indicates that gold has consistently formed higher lows and higher highs since 1999. Moreover, gold prices have risen to new record highs for seven consecutive quarters. Buying gold on pullbacks has been optimal for twenty-six years, and that trend is likely to continue.

The most recent high in gold futures pushed the GLD ETF to a peak of $317.63. If gold is heading for its eighth consecutive quarter of new record highs, the GLD January 16, 2026 $330-$350 vertical bull spread at $4.55 or better offers a risk-reward profile of approximately 1:3.4.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.

LATEST MARKET BREAKDOWN

Watch on Youtube

That's it for today!Before you go we'd love to know what you thought of today's newsletter to help us improve the experience for you. |