- Smart Options Trader

- Posts

- Seasonality as the Winter Approaches- Expect Volatility in Natural Gas

Seasonality as the Winter Approaches- Expect Volatility in Natural Gas

As winter approaches, seasonality is hitting the markets as we are heading into the peak demand heating season.

Free Webinar Next Week, Not To Be Missed!

🕒 Market Overview: As winter approaches, seasonality is hitting the markets as we are heading into the peak demand heating season.

📈 Sector Insight: Natural gas prices tend to trend higher at this time of year.

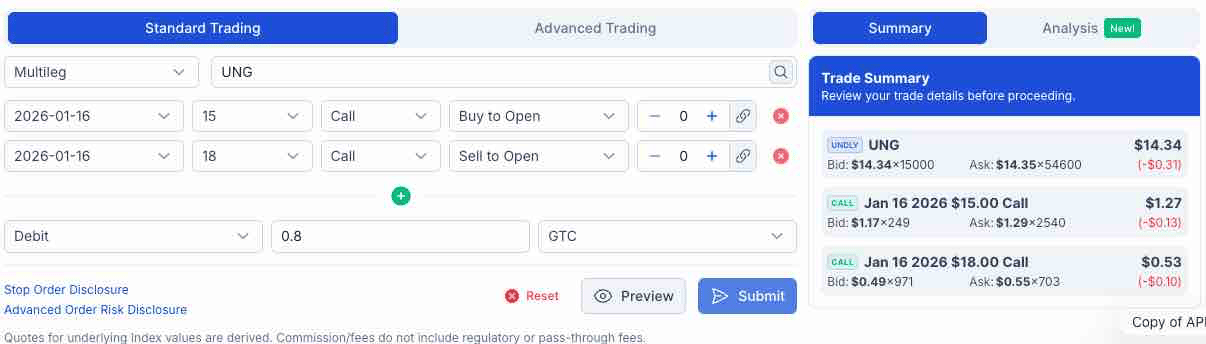

💡 Today's Trade Idea: Bull call spread in the UNG natural gas ETF.

SMART TRADE IDEA

Bull Call Spread on UNG

Trade Setup: $15 Call / Sell $18 Call, January 16, 2026, expiration.

Cost: $0.80 ($80 per spread)

Max Profit: $2.20 ($220 per spread)

Breakeven: $15.80

Risk-reward: 1:2.75

Management Plan: Roll up, or take profits if UNG’s price reaches $18 or higher before January 16 2026 expiration.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Smart AnalysisA Wall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

Seasonality as the Winter Approaches- Expect Volatility in Natural Gas

Seasonality can be a powerful force in the commodities asset class. As markets enter the winter of 2025/2026, futures markets will shift their attention to the supply and demand fundamentals. While animal protein and gasoline prices tend to peak during spring and summer, natural gas and heating oil often reach annual highs as colder weather approaches. Meanwhile, gasoline and meat futures usually hit yearly lows after their peak-demand seasons. Seasonality can lead to significant volatility in commodity futures markets and related ETFs.

Natural Gas could get interesting

Historically, the peak demand season for natural gas futures begins in the late fall as the heating season arrives. U.S. natural gas inventories tend to decline during late fall and winter as demand increases, and then rise during spring and summer when demand decreases. From March through November, natural gas inventories historically increase, and decline from November through March.

Prices tend to rally in October through January, depending on the weather conditions. Colder weather increases demand for natural gas-based heating.

The U.S. natural gas market has undergone significant changes over the past few years. Natural gas flows are no longer limited to the U.S. and North American pipeline network, as LNG (liquefied natural gas) now travels the world by ocean vessels. Natural gas has shifted from a domestic to an international market.

Natural gas prices were elevated in 2025 because of European demand and the war in Ukraine

Nearby natural gas futures prices reached a high of $4.908 per MMBtu in March 2025. The 2025 peak was 16.8% higher than the December 2024 high of $4.201 per MMBtu.

Increasing demand for U.S. liquefied natural gas from Europe and other regions drove up natural gas prices. The ongoing war in Ukraine, sanctions on Russia, and trade agreements between Europe and Asian countries are increasing the demand for U.S. LNG.

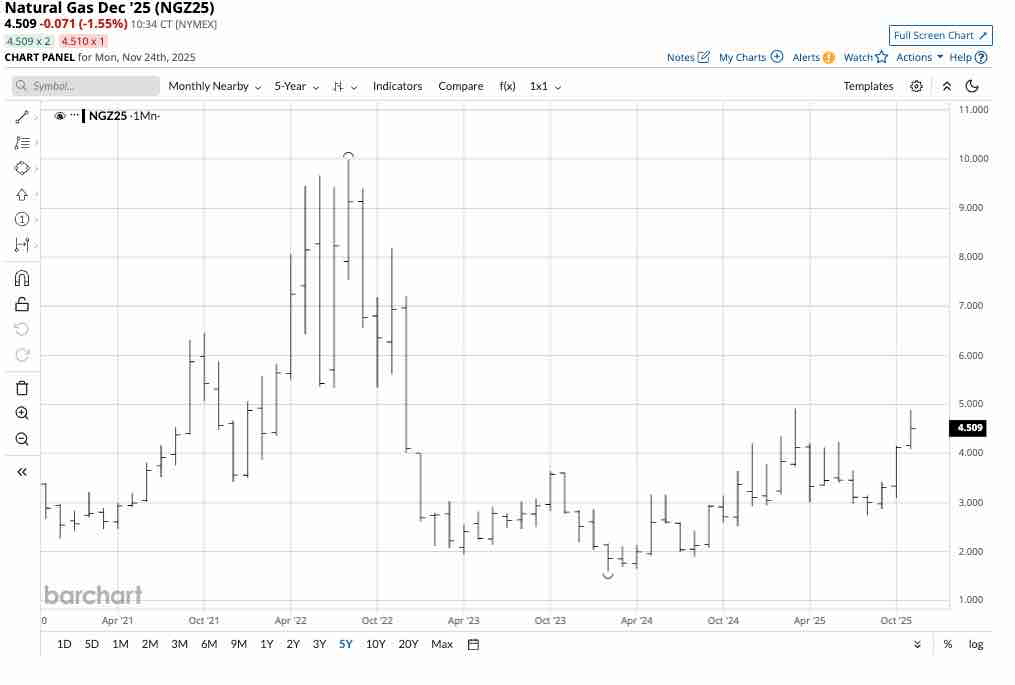

A bullish trend since the March 2024 low

Source: Barchart

The monthly NYMEX continuous contract natural gas futures chart shows that prices fell from the August 2022 high of nearly $10 per MMBtu to a low of $1.60 per MMBtu in February 2024. Natural gas futures have made higher lows and higher highs since the February 2024 low.

In November 2025, natural gas traded in a $4.087 to $4.881 range. In November 2024, the trading range was substantially lower, from $2.514 to $3.639 per MMBtu.

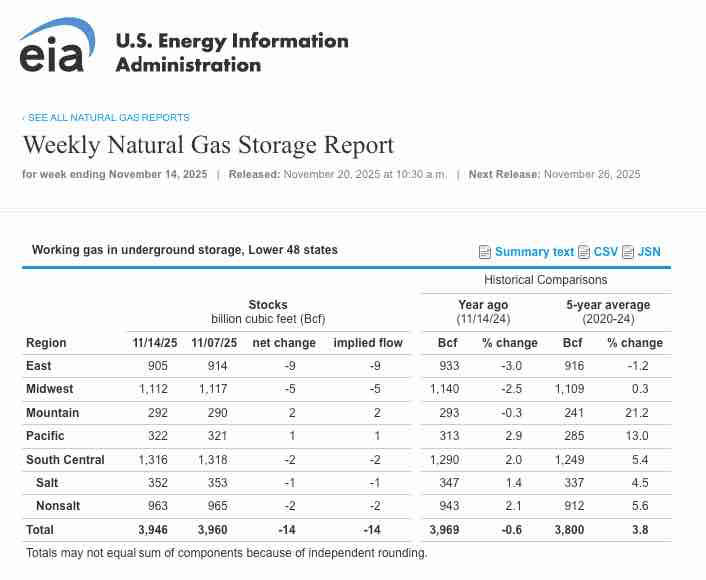

Inventories are lower than the previous year, going into the peak season

Source: EIA

In late November 2025, natural gas inventories across the United States were 3.946 trillion cubic feet. The stockpiles were 0.6% below the level at the same time in 2024. The stocks were 3.8% over the five-year average for late July. Lower year-over-year natural gas inventories could reflect rising demand for U.S. LNG exports. U.S. natural gas stocks peaked at 3.960 trillion cubic feet for the week ending on November 7. While another injection is possible, the withdrawal season has commenced and will run through March 2026.

The leveraged and unleveraged ETF products in the U.S. natural gas market

The most direct route for a risk position in the natural gas futures market is the NYMEX futures and futures options market. The United States Natural Gas Fund (UNG) is a liquid unleveraged ETF product that tracks nearby natural gas futures prices.

The Ultra Bloomberg Natural Gas 2X ETF (BOIL) is a leveraged product that magnifies natural gas futures performance on the upside. The Ultrashort Bloomberg Natural Gas -2X ETF (KOLD) is a leveraged product that magnifies the performance of natural gas futures on the downside.

Leveraged ETF products require both time and price stops as they suffer from time decay.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.