- Smart Options Trader

- Posts

- Sterling Options Explode as BOE Cuts Rates With Inflation

Sterling Options Explode as BOE Cuts Rates With Inflation

Currency traders pile into GBP volatility plays as Bank of England faces impossible choice between growth and inflation control.

Currency traders pile into GBP volatility plays as Bank of England faces impossible choice between growth and inflation control.

🕒 Market Overview: Sterling volatility spikes as BOE prepares rate cuts amid persistent inflation concerns

🔄 Sector Insight: UK equity strength continues as weaker pound boosts export competitiveness

💰 Today's Trade Idea: EWU long call positions target continued UK stock momentum

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

The Bank of England faces an unprecedented policy dilemma as it prepares to cut rates while inflation remains well above target. With consecutive monthly economic contractions and stubbornly high inflation at 3.6%, the central bank must navigate conflicting signals. The FX British Pound Volatility Index has surged as institutional players position for extended uncertainty through multiple policy cycles.

This easing cycle differs dramatically from historical patterns, with the BOE taking a full year to reduce rates by just 125 basis points – the slowest pace in recent memory. Global trade tensions add complexity, as tariff policies introduce additional uncertainty into currency flows and monetary policy effectiveness.

Sector and Stock Watch – Identifying Key Movers

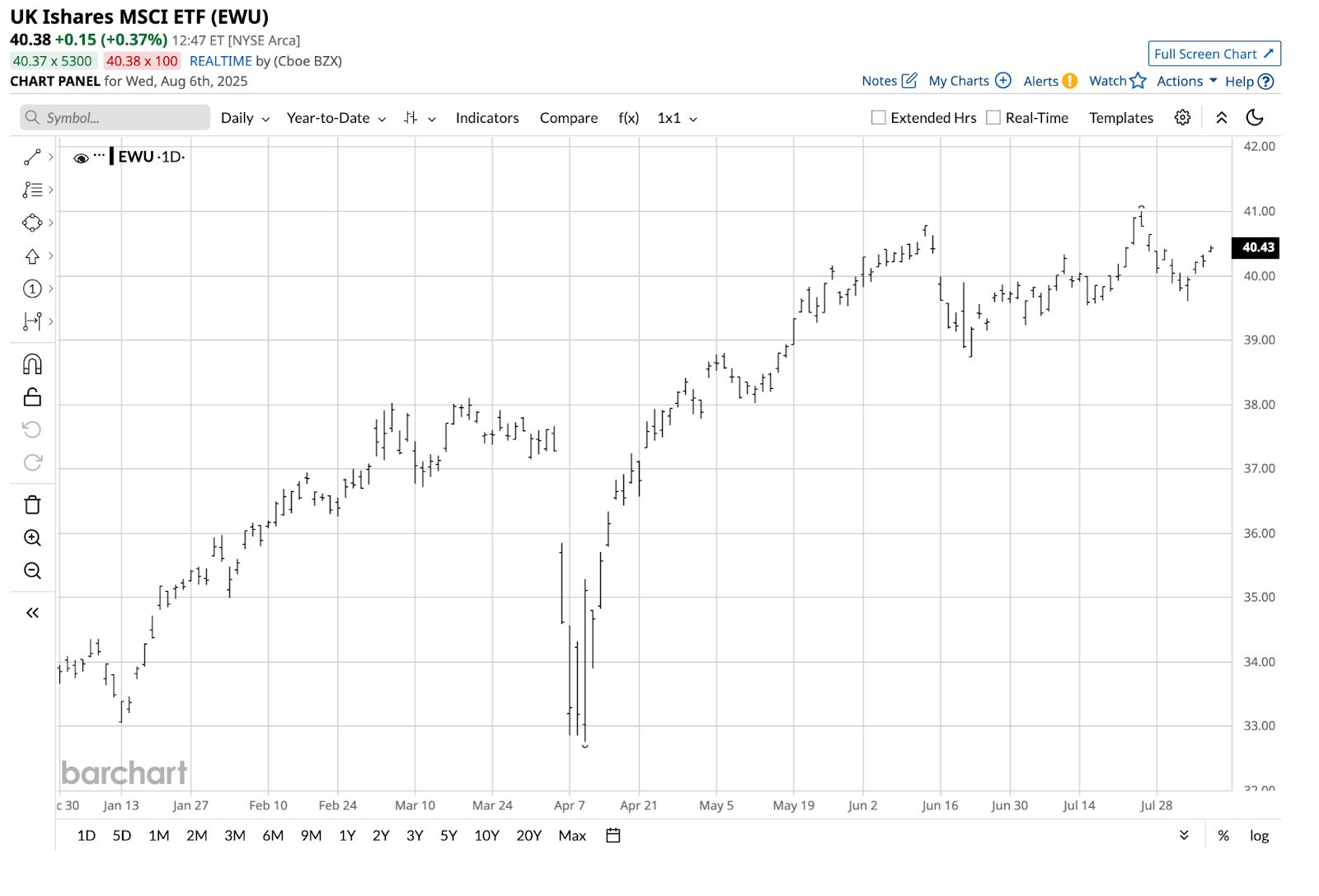

The iShares UK MSCI ETF (EWU) has established a clear bullish trend since April, rallying from lows as trade agreements reduced tariff concerns. Currently trading around the $40 level, the ETF benefits from a weakening pound that makes UK exports more competitive internationally.

GBP/USD has established critical technical levels around the 1.3000-1.3500 range, where options activity has concentrated. The currency pair's recent resilience above 1.3000 indicates underlying demand despite selling pressure near current levels.

Trading Strategy in Focus – How to Play the Market

Options traders are positioning for extended volatility rather than directional moves, recognizing that policy uncertainty extends well beyond immediate rate decisions. Calendar spreads and volatility strategies dominate institutional flow as players target the prolonged adjustment period expected through late 2026.

The technical setup in UK equities presents opportunities for traders expecting continued monetary accommodation to support stock prices through currency weakening effects.

SMART TRADE IDEA

Long Call on EWU

Trade Setup: Buy $40 Call, October 17, 2025 expiration.

Cost: $1.35 ($135 per option)

Max Profit: Unlimited

Breakeven: $141.35 on EWU

Management Plan: Consider taking profits or selling the October 17, 2025, $45 EWU call option at $1.35 or higher to create a $40-$45 vertical bull spread at flat or a credit.

UK interest rate cuts could support a rally in UK stocks, as they will make the country's products more competitive on the international market due to a weaker British pound against the US dollar. The EWU is an ETF product that invests in the leading UK multinational companies.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

The rally in the US dollar versus the British pound in 2025 has run out of upside steam.

The daily year-to-date chart shows the nearly 14% rally from $1.21004 on January 13 to the high of $1.37886 on July 1. Since then, the currency relationship has run out of upside steam, with the pound making lower highs and lower lows versus the US dollar, and trading around the $1.3350 level as of August 6. With the UK ready to cut interest rates, the interest rate differential with the US dollar could weaken as rates are a critical factor for the path of one currency versus another. A weaker pound could support UK stocks because it makes their products more competitive abroad.

The iShares UK MSCI ETF (EWU) tracks UK equities. If UK interest rates decline, we could see a continuation of higher highs in the EWU ETF product.

The chart highlights the rally and bullish trend in the EWU ETF since the April 9 low, driven by US tariff news. Since then, the US and UK have agreed on a trade protocol. EWU is trading around the $40 per share level on August 6. A weaker pound could support a continuation of higher highs in the EWU ETF product. Buying a $40 EWU call option for the October 17, 2025, expiration at the $1.35 level, with plans to sell the $45 call for the same expiration at the same or a higher premium, could be optimal in the current environment.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.

LATEST MARKET BREAKDOWN

Watch on Youtube

That's it for today!Before you go we'd love to know what you thought of today's newsletter to help us improve the experience for you. |