- Smart Options Trader

- Posts

- The Semiconductor Bankruptcy That Exploded 1,700% in One Day

The Semiconductor Bankruptcy That Exploded 1,700% in One Day

A semiconductor stock exploded 1,700% post-bankruptcy while wiping out 95% of shareholder equity. Here's what options traders missed—and why volatility spikes demand defensive strategies.

A semiconductor stock exploded 1,700% post-bankruptcy while wiping out 95% of shareholder equity. Here's what options traders missed—and why volatility spikes demand defensive strategies.

🕒 Market Overview: Wolfspeed surged 1,700% while diluting legacy shareholders to 3-5% ownership.

🔄 Sector Insight: Options implied volatility hit 400%, revealing complete market uncertainty about valuation.

💰 Today's Trade Idea: SPY Bear Put Spread provides asymmetric downside protection during low-VIX complacency.

SMART TRADE IDEA

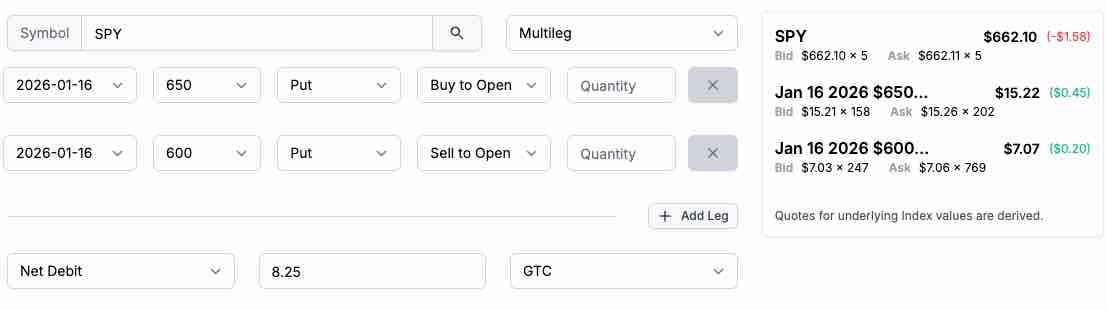

Bear Put Spread on SPY

Trade Setup: Buy $650 Put / Sell $600 Put, January 16, 2026, expiration.

Cost: $8.25 ($825 per spread)

Max Profit: $41.75 ($4,175 per spread)

Breakeven: $641.75

Management Plan: Exit at 50% loss, roll down, or take profits if SPY’s price reaches $620 or lower.

The many issues facing markets on the economic and geopolitical landscapes increase the odds of a surprise over the coming weeks and before the end of 2025. The SPY $650-$600 bear put spread for January 16, 2026, expiration will benefit from any shocks to the system that could trigger an overdue correction. Moreover, the spread is attractive, as the long $650 put is priced at approximately a five-volatility point discount to the $600 put option for the same expiration, resulting in the above 1:5 risk-reward ratio.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

Markets remain near record highs as September closes, with SPY trading within striking distance of all-time peaks. The VIX hovers below 17—a level that historically signals complacency rather than caution. This environment creates a dangerous disconnect: investors are pricing in stability while systemic risks accumulate across economic and geopolitical landscapes.

The Wolfspeed situation serves as a stark reminder that microeconomic shocks can materialize without warning. From the 1987 crash to the 2020 pandemic, history demonstrates that calm surfaces often precede violent disruptions. Current low volatility readings translate to inexpensive option premiums, presenting an opportunity to establish protective positions before uncertainty reprices.

Federal policy uncertainty, geopolitical tensions, and stretched valuations all contribute to an environment where unexpected events can trigger rapid repricing. The VIX trading near its 2025 lows suggests the market is underestimating tail risk.

Sector and Stock Watch – Identifying Key Movers

Wolfspeed's bankruptcy emergence exposed the mechanics of extreme corporate restructuring. The company slashed debt from $6.5 billion to $2 billion through a reorganization that cancelled existing shares at an exchange ratio of 0.008352 new shares per old share. Creditors became majority owners while legacy shareholders retained minimal equity.

Despite brutal dilution, the stock surged due to a compressed float—shrinking from 156 million to 25.8 million shares—combined with speculative buying pressure. The silicon carbide semiconductor market positioning remains intact, with Wolfspeed controlling 60-65% of the EV silicon carbide segment. The underlying technology is viable; the capital structure was unsustainable.

The psychology reveals a critical divide: retail traders chased momentum without understanding the equity reset, while institutional desks struggled to model a security with no relevant price history. Options markets reflected this confusion, with IV reaching the 100th percentile of historical readings.

Trading Strategy in Focus – How to Play the Market

Extreme volatility events like Wolfspeed validate the necessity of defensive positioning during periods of apparent calm. When the VIX trades below 17 while systemic risks persist, vertical spreads offer asymmetric protection without requiring significant capital allocation.

Bear put spreads become particularly attractive when front-month volatility sits at multi-year lows. The current environment—SPY near record highs with compressed volatility—mirrors conditions that preceded historical corrections. Allocating a small percentage of capital to structured downside protection can offset portfolio losses if market sentiment shifts rapidly.

The strategy acknowledges that timing market tops is impossible, but establishing predefined risk parameters allows traders to benefit from inevitable volatility expansion. When uncertainty reprices, option premiums surge—but only positions established beforehand capture that value.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

Risk management is critical for trading and investing, and the price action in Wolfspeed (WOLF) shares is another in a long series of lessons for those who refuse to accept that anything can happen in the blink of an eye on markets. I first learned this lesson in 1987 when the stock market crashed on a Monday. I was reminded of this lesson again during the tech wreck in early 2000, the housing and mortgage-backed security debacle, the European sovereign debt crisis in 2008, and most recently, the 2020 global pandemic and the 2022 Russian invasion of Ukraine. These were macro events that caused panic and substantial price moves in markets across all asset classes. Of course, there have been the micro events that were more similar to the WOLF situation.

In the commodities market, the price of tin collapsed in 1985 when the tin buffer stock manager ran out of capital. In 2022, a squeeze in the nickel market sent the price soaring to over $100,000 per ton. The 1980 Hunt Brothers attempt to corner the silver market by pyramiding futures contracts caused the price to plunge from over $50 to just over $10 in a matter of weeks. There are many other examples in the volatile commodities markets. In the stock market, the 2001 Enron failure was a notable example of microeconomic failure, as were WorldCom, Theranos, and others. In the cryptocurrency world, Mount Gox and FTX are glaring examples. Currencies and bonds have also suffered from sudden events that caused wild price volatility.

The bottom line is that situations like WOLF remind us that expecting and accounting for the unexpected, using tools such as options —essentially, price insurance instruments — aid in protecting capital. And, protecting capital is the only way to ensure that a trader or investor will be around to participate in the next golden and profitable opportunity.

Markets are calm at the end of September 2025, with the S&P 500, the most diversified U.S. stock market index, trading just near its record high. The SPY is a highly liquid ETF that tracks the S&P 500.

The ten-year chart shows that at over $662 per share, the SPY is only approximately $5 below its record high. The VIX index reflects the implied volatility of options on S&P 500 stocks. The VIX has traded in a 14.12 to 60.13 range in 2025. Below 17 on September 30, the volatility index reflects the market’s overall bullish sentiment and complacency. The low level for the VIX translates to inexpensive SPY option prices.

The most significant market volatility stems from unexpected events, as we recently witnessed in the WOLF situation, and has been seen repeatedly over the past few decades. During this period of complacency, the best approach may be to allocate a small amount of capital for protection via a vertical bear put spread that could pay off if a stock market correction occurs before the end of 2025.

The SPY $650-$600 January 16, 2026, vertical bear put spread, priced at $8.25 per spread or lower, has a better-than-1:5 risk-reward ratio.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.