- Smart Options Trader

- Posts

- Trade Truce Triggers Volatility Crush

Trade Truce Triggers Volatility Crush

Markets just experienced a massive volatility collapse as U.S.-EU trade tensions ease. Fed meeting Wednesday could spark the next big move.

Markets just experienced a massive volatility collapse as U.S.-EU trade tensions ease. Fed meeting Wednesday could spark the next big move.

🕒 Market Overview: VIX crashes to 14.9 as surprise U.S.-EU trade agreement removes systemic risk

🔄 Sector Insight: Autos, semiconductors, and pharma benefit most from reduced tariff threats

💰 Today's Trade Idea: MAGS call option positioned for potential Fed surprise rally

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

The volatility landscape shifted dramatically following Sunday's unexpected U.S.-EU trade compromise. President Trump's threatened 30% blanket tariff was reduced to 15%, while Brussels committed to $750 billion in U.S. energy purchases and $600 billion in new investment. This agreement, reached just three days before the August 1st deadline, effectively defused what many considered the market's most immediate tail risk.

The VIX plummeted to 14.9, its lowest level since February, while S&P 500 options now embed only a ±0.6% daily swing expectation. This represents a fundamental shift from systemic policy risk to event-specific catalysts. Fed futures show only a 4% chance of a rate cut Wednesday, but 67% probability by September. The tariff de-escalation reduces arguments for immediate monetary easing, though some Fed members have recently voiced support for cuts.

Sector and Stock Watch – Identifying Key Movers

The market reaction wasn't uniform across sectors. Automobile, semiconductor, and pharmaceutical companies – previously facing triple-digit tariff threats – led the recovery. Auto sector implied volatility compressed from 27% to 21%, while call open interest jumped 12%. Semiconductor equipment volatility decreased from 32% to 26% with flattening call/put skew.

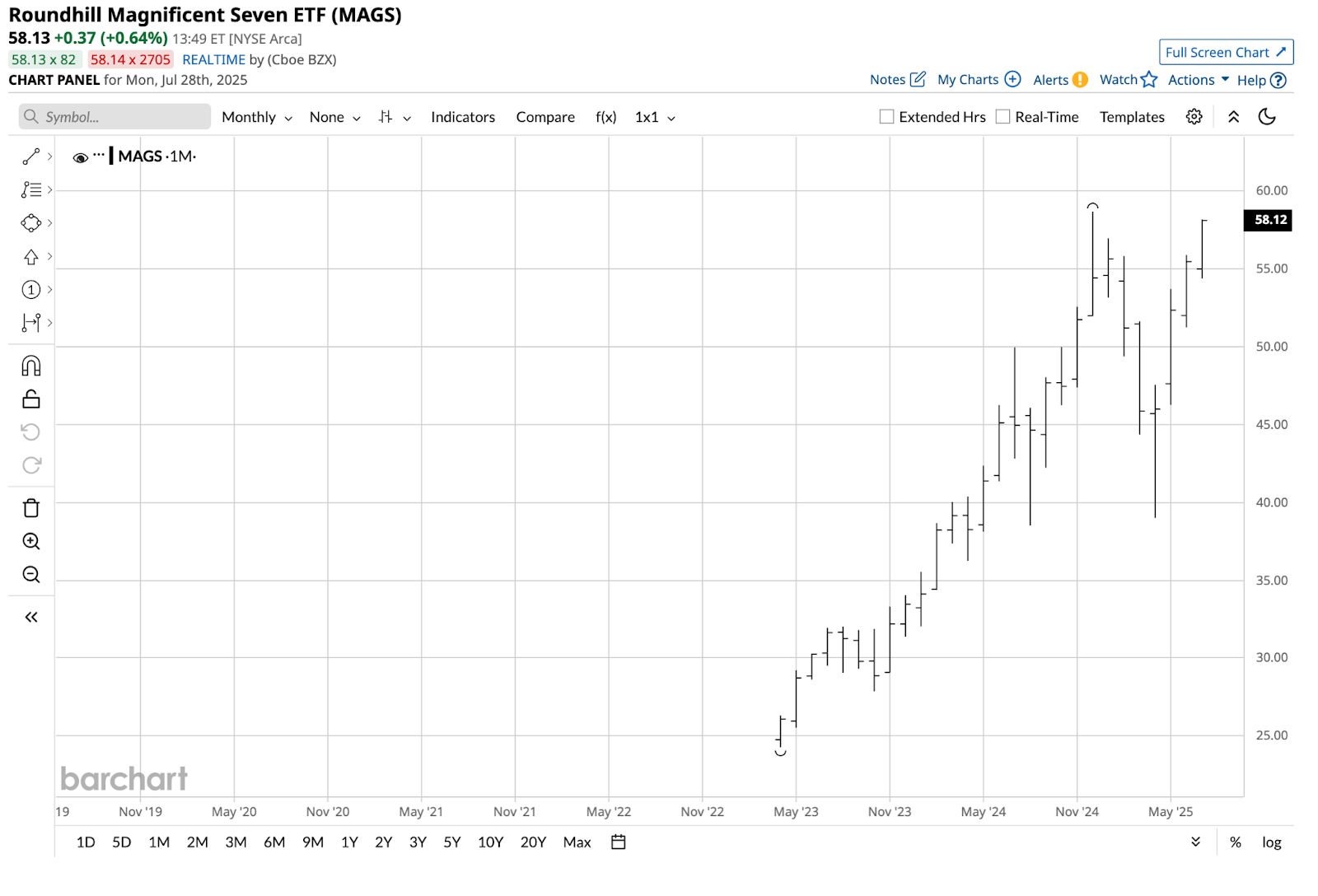

The MAGS ETF, tracking the Magnificent Seven stocks, now trades just below its December 2024 record high of $58.69. Despite the macro volatility crush, individual stock pre-earnings implied moves remain elevated, with Apple at 4.1%, Amazon at 5.3%, Microsoft at 4.2%, and Meta at 6.1%.

Trading Strategy in Focus – How to Play the Market

Current market conditions favor defined-risk strategies that capitalize on the volatility collapse while maintaining exposure to potential event-driven moves. The combination of reduced systemic risk and upcoming Fed decision creates an asymmetric opportunity structure.

Traders should focus on sectors most benefiting from tariff relief while maintaining some gamma exposure through Wednesday's FOMC meeting. The August VIX future still trades 2.5 points above spot, suggesting calendar spread opportunities. Historical precedent shows similar trade détentes often create temporary calm before volatility returns.

SMART TRADE IDEA

Long Call Option on MAGS

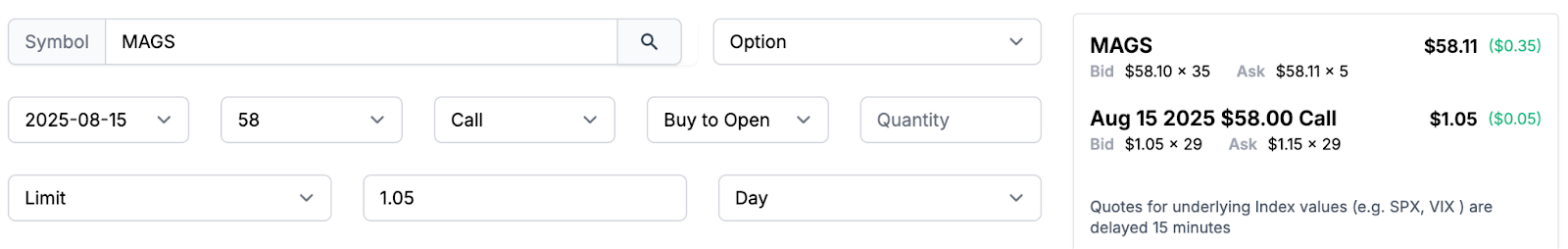

Trade Setup: Buy $58 Call, August 15, 2025 expiration.

Cost: $1.05

Max Profit: Unlimited

Breakeven: $59.05

Management Plan – Example: Sell the August 15, 2025, expiration MAGS $60 Call option at $1.20 or higher. Exit the MAGS $58 call if the Fed does not cut the Fed Funds Rate on Wednesday, July 30, for a small loss.

While the market expects the Fed to leave rates unchanged at the July 30 FOMC meeting, a surprise rate cut could ignite a bullish fuse under the MAG 7 stocks, which tend to attract the most interest. A $58 call at $1.05 for the August 15, 2025, expiration, with plans to sell the $60 call at the same premium or higher, could create an attractive bull spread in the current environment. The risk is limited to the $1.05 premium, and there will be two weeks until expiration if the Fed leaves rates unchanged on Wednesday, creating the opportunity to liquidate the long $58 call option for a slight loss.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

The prospects of U.S. tariffs on worldwide trading partners after the April 2 "Liberation Day" announcement sent markets reeling. However, nearly three months later, it appears that the administration's bluster was a negotiating tactic aimed at moving the needle on global trade by improving the U.S. position. The bottom line is that even a slight shift in the trade needle is a victory for President Trump.

Since the April 2 announcement, the administration has passed its Big Beautiful Bill economic packages and secured the agreement of NATO countries to increase their defense spending dramatically. Moreover, the administration has established new trade frameworks with many of the U.S.'s leading trading partners.

Markets reflect the economic and geopolitical landscapes. While the war in Ukraine continues and the Middle East remains a tinderbox of potential problems and conflicts, markets have discounted these risks, with the price action mostly projecting favorable outcomes over the coming months.

Therefore, the volatility contraction reflects the environment. The next significant event is this Wednesday's Fed meeting, and while the market does not expect the central bank to cut the Fed Funds Rate, the odds of a cut are slightly higher after the most recent EU trade deal. The Fed committee members cited tariff impacts as the reason for leaving the short-term rate unchanged over the past months, but those risks have declined. A rate cut on Wednesday will be a surprise, and lower volatility across markets sets up a low-risk opportunity if the U.S. central bank decides to cut the Fed Funds Rate by 25 basis points, or more. Meanwhile, some committee members have recently voiced support for a rate cut in the current environment. Even if the Fed does not cut rates, a dovish statement for comments from Chairman Powell could light a bullish fuse under the stock and bond markets. The MAG Seven stocks tend to receive the most attention these days, and the MAGS ETF is not far below its all-time peak.

As the chart shows, at just over the $58 level on July 28, the MAGS ETF is approaching a challenge to the December 2024 record high of $58.69 per share.

The slightly in-the-money MAGS $58 call option for August 15, 2025, expiration is trading around the $1.05 level. I consider this an inexpensive call option and would consider a long position with plans to sell the $60 MAGS August 15, 2025, call option on a rally when the premium reaches $1.20 or higher, creating a $58-$60 vertical bull call spread for small credit. The risk-reward ratio of this suggested approach is approximately 1:2. If the Fed surprises the market with a July 30 rate cut, we could see the MAG Seven stocks rally sharply. If the central bank continues to leave rates unchanged, the long $58 call option for August 15 could be liquidated for a small loss.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.

LATEST MARKET BREAKDOWN

Watch on Youtube

That's it for today!Before you go we'd love to know what you thought of today's newsletter to help us improve the experience for you. |