- Smart Options Trader

- Posts

- Trade War Brinkmanship Sparks Institutional Hedging Wave

Trade War Brinkmanship Sparks Institutional Hedging Wave

Commerce Secretary's hard August 1st deadline sent options markets into defensive positioning. Key sector play inside.

Commerce Secretary's hard August 1st deadline sent options markets into defensive positioning. Key sector play inside.

🕒 Market Overview: Commerce Secretary confirms uncompromising August 1st deadline for EU tariffs, pushing VIX above 16.

🔄 Sector Insight: Industrial sector sees put-call ratios spike as institutions hedge tariff exposure defensively.

💰 Today's Trade Idea: Bear Put Spread on XLI offers asymmetric risk-reward as volatility reprices policy uncertainty.

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

Commerce Secretary Howard Lutnick's weekend confirmation of an August 1st deadline for 30% EU tariffs fundamentally shifted how traders are pricing geopolitical risk. The VIX jumped to 16.94 as implied volatility in tariff-sensitive sectors hit multi-week highs. This wasn't typical news-driven volatility—institutional money began sophisticated, layered hedging strategies suggesting the deadline carries real weight.

Currency markets responded with dollar strength against the euro while cross-asset macro funds positioned for potential economic disruption through risk reversals. The pattern mirrors the 2018 steel and aluminum tariff episode when similar escalation drove the VIX from 11 to 17, though current positioning remains more measured.

Sector and Stock Watch – Identifying Key Movers

The Industrial Select Sector SPDR (XLI) became ground zero for defensive positioning. Options volume reached 2.5 times the 30-day average with simultaneous spikes in both puts and calls, indicating traders were building straddles and strangles to capture volatility rather than direction.

Auto manufacturers showed the clearest defensive signals. Stellantis saw 30-day implied volatility rocket from 44% to 49%, with put buyers overwhelming calls at a 2.8-to-1 ratio. Toyota's put-to-call ratio hit 5.3-to-1, suggesting institutions specifically hedged Japanese auto exposure ahead of potential collateral damage.

Market makers widened bid-ask spreads across industrial names—a clear sign of real-time risk repricing. Institutional hedgers parked over $300 million in large SPY block hedges while systematically reducing short-volatility exposure.

Trading Strategy in Focus – How to Play the Market

With eight trading sessions until the August 1st deadline, traders face binary event risk with a known timeline. The options market is pricing three scenarios: last-minute compromise (40% probability), phased implementation (45% probability), or full escalation (15% probability).

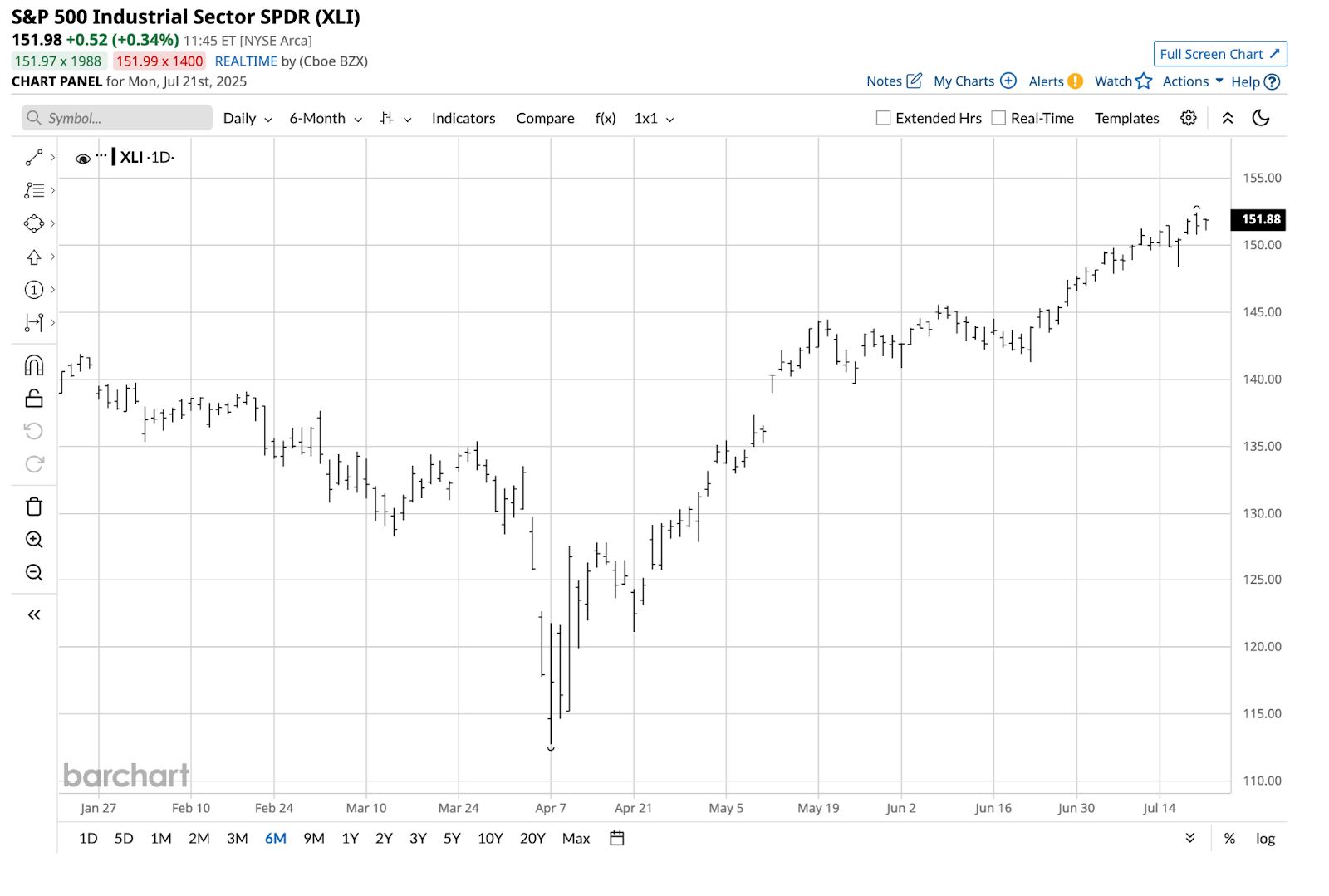

The industrial sector's 35.2% rally from April lows to July highs at $152.47 creates technical vulnerability as tariff uncertainty overlays fundamental positioning. At current elevated levels, defined-risk strategies offer better risk-reward profiles than outright directional bets.

Bear put spreads in sector ETFs provide exposure to potential policy-driven corrections while limiting maximum loss through the short put component. The strategy benefits from elevated implied volatility without requiring precise timing of policy announcements.

SMART TRADE IDEA

Bear Put Spread on XLI

Trade Setup: Buy $145 Put/ Sell $140 Put, September 19, 2025 expiration.

Cost: $0.65 ($65 per spread)

Max Profit: $4.35 ($435 per spread)

Breakeven: $144.35 per share on XLI

Management Plan:

Take profits or roll down if XLI's price reaches $144 or lower.

The trade issue is likely to continue causing periodic market volatility. At a record high, with thinner trading conditions during the summer, a vertical put spread in XLI, offering a better-than-1:6 risk-reward ratio, could be a profitable approach.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

Six months into the Trump administration, markets have learned that statements from 1600 Pennsylvania Avenue can have teeth or be floated out into the public domain to gauge a response. The latest example was the rumors that President Trump was preparing to fire Fed Chairman Powell. The adverse market reaction prompted the President to walk back the rumors, restoring stability to the stock and bond markets. On the tariff front, there have been numerous pivots since the April 2 Liberation Day announcement, which caused extreme market volatility, sending the VIX to over the 60 level for the fifth time in the volatility index's history.

President Trump is seeking to move the needle on trade, and any even slight improvement in the trade balance will be a victory. Expect him to continue pushing trade partners for the best possible deal, but also expect that he will not go so far as to destroy markets. However, the administration's strategy will likely cause periodic bouts of fear to descend on markets, only to reveal itself as another in a long series of buying opportunities. In the current environment, selling rallies and buying dips with a plan could be optimal. The XLI ETF is the S&P 500 Industrial Sector SPDR ETF.

Source: Barchart

As shown in the monthly chart, XLI rallied 35.2% from the early April 2025 low of $112.75 to the July high of $152.47 per share. While the trend is your friend and it is bullish, the volatility trade issue and other factors could cause a swift correction. Moreover, the higher XLI rises, the greater the odds of another selloff. Technical support is at the June 23, 2025, low of $141.28 per share

At around the $152.00 level, the September 19, 2025, $145-$140 vertical bear put spread, priced at $0.65 per spread, has a nearly 1:6.7 risk-reward ratio.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.

LATEST MARKET BREAKDOWN

Watch on Youtube

That's it for today!Before you go we'd love to know what you thought of today's newsletter to help us improve the experience for you. |