- Smart Options Trader

- Posts

- VIX Spikes as Inflation Fears Collide with Policy Chaos

VIX Spikes as Inflation Fears Collide with Policy Chaos

Markets face perfect storm conditions as inflation jumps and trade policy shifts overnight. VIXY positioning for summer volatility surge.

Markets face perfect storm conditions as inflation jumps and trade policy shifts overnight. VIXY positioning for summer volatility surge.

🕒 Market Overview: VIX jumps 5% as June inflation hits highest level since February

🔄 Sector Insight:Tesla sees massive institutional put buying with 100,000+ contracts purchased

💰 Today's Trade Idea: Long VIXY call positions for summer volatility surge

MARKET BREAKDOWN

Macro Lens – Big Picture Market Forces

The market delivered a perfect storm scenario as June inflation data exceeded expectations, marking the highest reading since February and providing the first concrete evidence of tariff-driven price pressures materializing in the economy. The Federal Reserve faces an impossible position, with FOMC minutes showing members split on rate cuts while inflation data complicates their decision-making process.

Adding to the complexity, Nvidia announced it will resume selling AI chips to China with Washington's approval, creating policy whiplash that highlights the unpredictable nature of current trade dynamics. This intersection of monetary policy uncertainty and trade policy volatility pushed the VIX nearly 5% higher, signaling that sophisticated options traders recognize multi-dimensional uncertainty as a profitable environment.

Treasury markets reflected deeper concerns as yields rose meaningfully, with traders positioning for potential Fed hawkishness. Fixed-income derivatives experienced elevated volume as institutions hedged against duration risk in a rising rate environment, creating cross-asset volatility opportunities.

Sector and Stock Watch – Identifying Key Movers

Tesla emerged as the focal point of institutional options activity, with massive put positioning exceeding 100,000 contracts on near-term strikes. This wasn't retail sentiment but institutional-sized hedging ahead of potential market volatility, suggesting smart money is preparing for broader market corrections rather than company-specific concerns.

Banking stocks presented an interesting paradox, delivering earnings beats while experiencing elevated options activity. Straddles on major banks were priced for significant moves despite positive earnings results, indicating that even fundamental strength cannot overcome broader uncertainty plaguing markets.

The options market revealed sector rotation patterns, with technology stocks commanding elevated volatility premiums following trade policy news, while energy and commodity-related options showed increased activity as traders positioned for potential tariff impacts on global supply chains.

Trading Strategy in Focus – How to Play the Market

The current environment favors volatility strategies over directional positioning. When markets face perfect storms combining inflation concerns, trade policy uncertainty, and earnings season dynamics, successful options trading requires positioning for volatility around policy outcomes rather than attempting to predict specific directions.

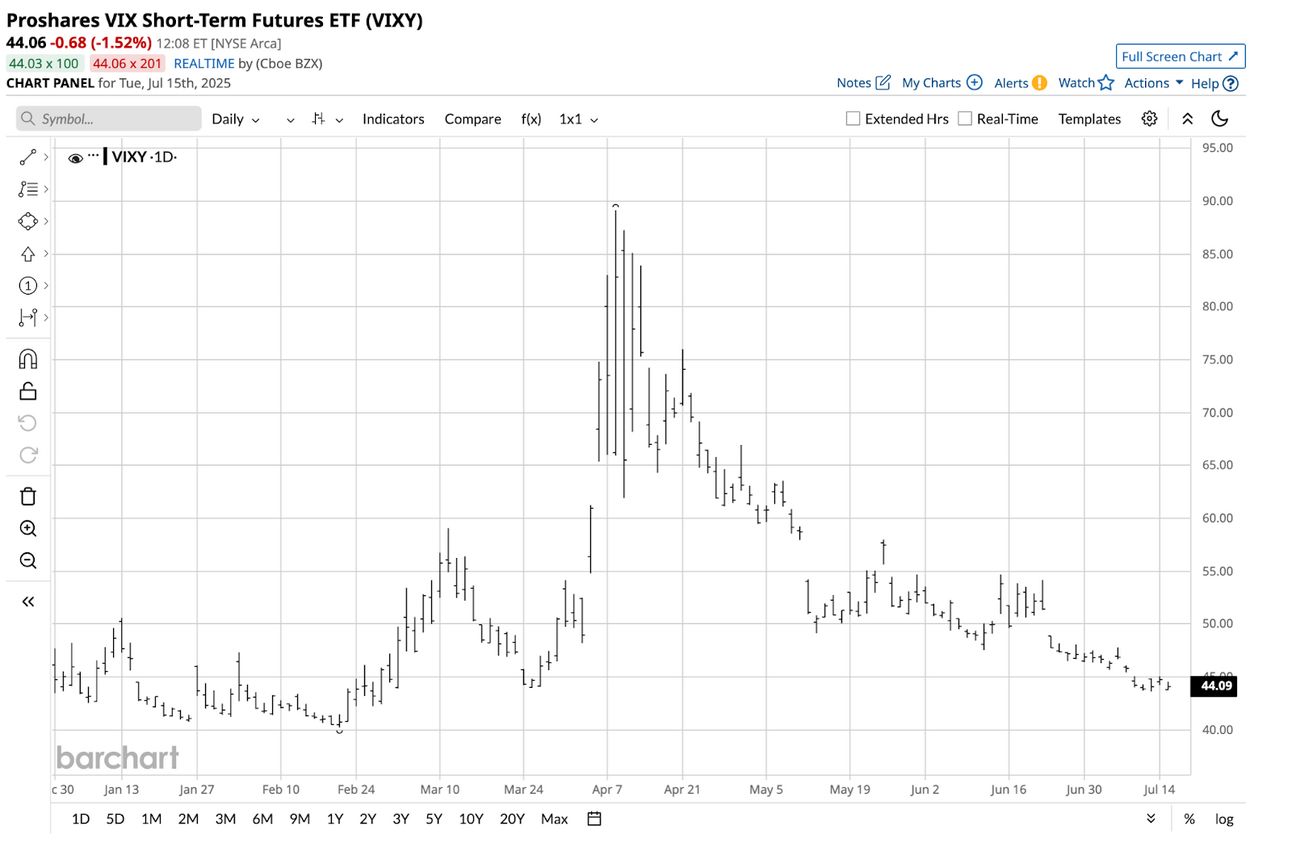

The ProShares VIX Short-Term Futures ETF (VIXY) presents a compelling opportunity, trading near 2025 lows at the $44 level within a $40.22 to $89.14 range. Given the numerous factors that can trigger volatility and reduced summer liquidity that can exacerbate price variance, VIXY positioning offers flexibility to profit from sudden market moves.

Historical patterns suggest that when institutions hedge aggressively while retail sentiment remains bullish, markets often experience sharp reversals. The bifurcation between institutional defensive positioning and retail optimism creates the setup for volatility expansion.

SMART TRADE IDEA

Bull Call Spread on VIXY

Trade Setup: Buy $44 Call, August 15, 2025 expiration.

Cost: Cost: $3.30 or lower ($330 per contract)

Max Profit: Unlimited

Breakeven: $47.30 on VIXY

Management Plan:

Exit at 50 percent loss, take profits, or sell the $50 call at $3.30 or higher to create a bull call spread if VIXY's price reaches $50 per share.

Given the numerous issues facing markets and lower liquidity during the summer, the VIX and VIXY ETFs may provide significant value. A long call on VIXY expiring on August 15, 2025, at $3.30 or lower, provides the flexibility to profit or spread if events trigger sudden and violent market moves over the next month.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Second TakeWall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

Volatility caused by uncertainty creates trading opportunities for flexible traders who are attuned to the market's pulse. In the current environment, the pulse of underlying factors has been erratic, and that is likely to continue. The administration's tariffs policy can change or shift at a moment's notice. The geopolitical landscape remains highly volatile with the bifurcation of the world's nuclear powers. The situation in the Middle East is fragile, the war in Ukraine has escalated, and China's leadership remains committed to reunification with Taiwan. The U.S. Federal Reserve's monetary policy has been unchanged in 2025, but the administration is gaining support for lower rates and a change in leadership at the central bank. Any of these issues, or all of them, could cause immediate and violent price action in markets across all asset classes. Moreover, in the heart of summer, less liquidity can exacerbate price variance.

The chart shows that the ProShares VIX Short-Term Futures ETF has traded in a $40.22 to $89.14 range in 2025. Near the $44 level, VIXY is not far from its 2025 lows. The numerous factors that can trigger volatility make the VIXY highly attractive at its current level.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.

LATEST MARKET BREAKDOWN

Watch on Youtube

That's it for today!Before you go we'd love to know what you thought of today's newsletter to help us improve the experience for you. |