- Smart Options Trader

- Posts

- XBI Biotech ETF Breaks Out on Acquisition Wave

XBI Biotech ETF Breaks Out on Acquisition Wave

Novartis drops $12 billion on Avidity, triggering sector-wide repricing. XBI breaks four-month range as Big Pharma's $1.5 trillion war chest targets RNA therapeutics.

Novartis drops $12 billion on Avidity, triggering sector-wide repricing. XBI breaks four-month range as Big Pharma's $1.5 trillion war chest targets RNA therapeutics.

🕒 Market Overview: Novartis pays 46% premium for Avidity, validating RNA therapeutics platform technology.

🔄 Sector Insight: XBI rallies 15% year-to-date, reflecting the return of institutional capital to biotech and pharma.

💰 Today's Trade Idea: Bull Call Spread on XBI targets M&A-driven momentum with defined risk parameters.

SMART TRADE IDEA

Bull Call Spread on XBI

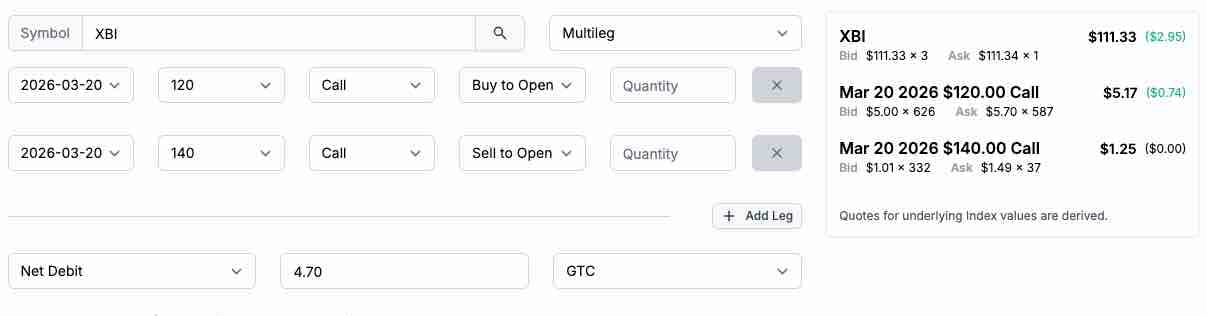

Trade Setup: Buy $120 Call / Sell $140 Call, March 20, 2026 expiration

Cost: $4.70 ($470 per spread)

Max Profit: $15.30 ($1,530 per spread)

Breakeven: $124.70 on XBI

Management Plan: Exit at 50% loss, roll up, or take profits if XBI’s price reaches $140 before March 20, 2026.January 16, 2026.

The short leg of the $120-$140 bull call spread is over $30 below XBI’s record high from 2021. Meanwhile, rising M&A activity in the pharma and biotech sectors supports higher prices for the diversified ETF product over the coming months.

NOTE: Remember, options trading involves substantial risk and is not suitable for all investors. Consider your investment objectives, financial resources, and experience level before implementing this or any options strategy.

DISCLOSURE: Trade recommendations may have changed since publication. Evaluate current market prices and risk/reward before acting. Trading involves significant risk and is not suitable for everyone. This is not personalized investment advice. Past performance doesn't guarantee future results. Publisher and contributors may hold positions in recommended securities. Readers assume full responsibility for their trading decisions. Consult a financial professional before investing.

| Andy Hecht | Smart AnalysisA Wall Street veteran and analyst covering technical and fundamental factors in markets across all asset classes for over four decades. |

The M&A activity in pharma and biotech is clearly picking up, but the potential for oversized rewards comes with commensurate risks. While not exclusively small-cap, the XBI ETF is heavily weighted toward smaller biotechnology companies and provides exposure to the biotech sector as a whole. In the current environment, selecting the next target is a challenge, which is why a diversified approach to the sector could be optimal.

The S&P Biotech SPDR (XBI), at $111.50 per share, has a blended price-to-earnings ratio of 16.40 times earnings, which is below the S&P 500 and the technology-heavy NASDAQ indices. Meanwhile, XBI is a highly liquid ETF with around $6.65 billion in assets under management. XBI trades an average of over ten million shares daily and charges a 0.35% management fee.

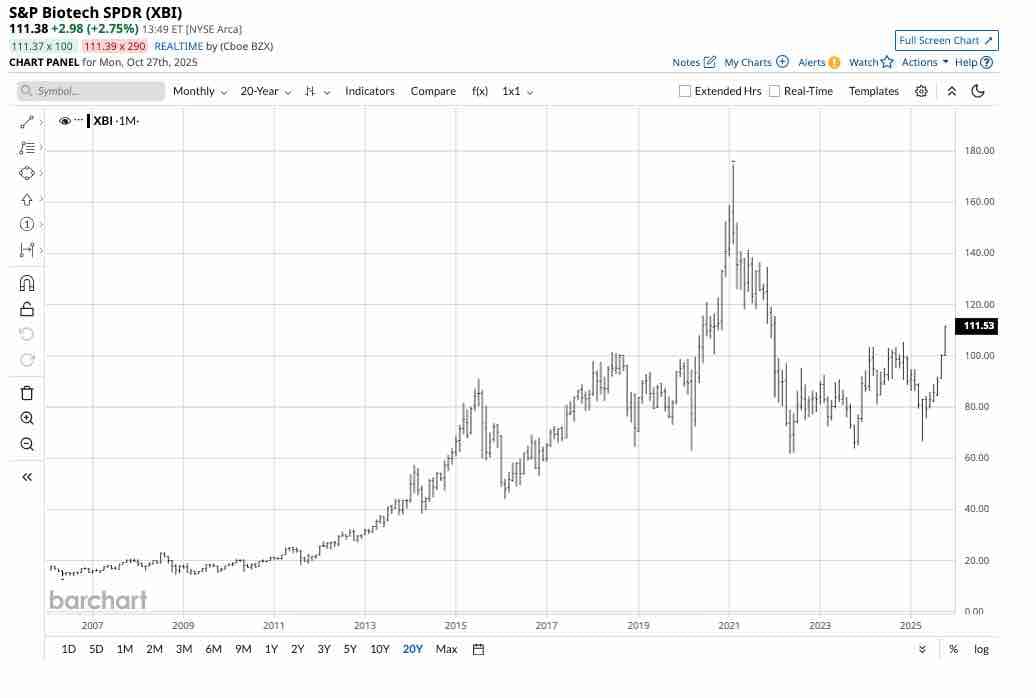

As the chart highlights, XBI is trading over 36% below its record February 2021 high of $174.79 per share. The M&A activity could push the XBI toward a challenge of its all-time peak over the coming months.

The March 20, 2026, $120-$140 vertical bull call spread at $4.70 or lower has a risk-reward ratio of higher than 1:3.25.

TRADE SMARTER WITH TRADIER

A Brokerage Built for Options Traders

Tradier offers fast execution, direct API access, and seamless platform integrations—all with a flat-rate subscription model that eliminates per-contract commissions. Trade on your terms with a brokerage designed for serious traders.